Former employees of Brisbane-based electric vehicle (EV) charger manufacturer Tritium have shared their experiences working at the company, shedding light on its mismanagement and the quality of its products.

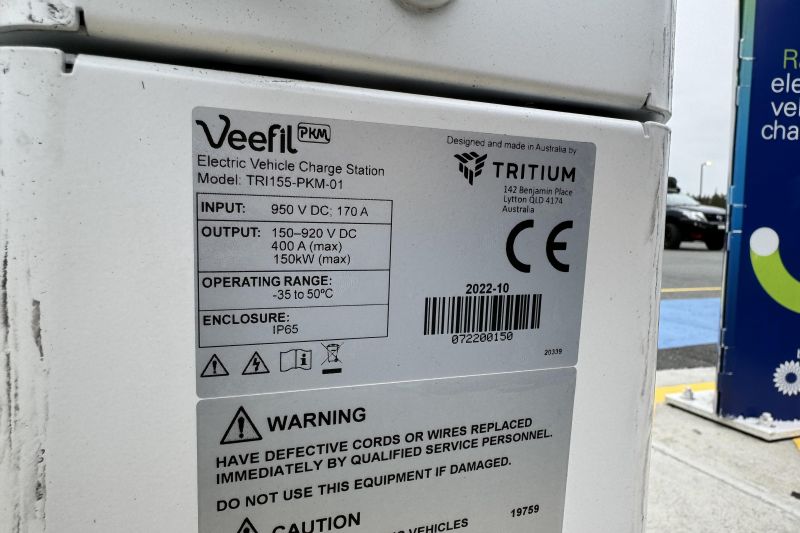

For those who have arrived at a public electric vehicle charging station and seen ‘faulted’ or ‘out of order’ notice on one (if not all) the chargers, chances are high it’s a Tritium charging unit.

Tritium had been one of Australia’s success stories of the decade, with its chargers deployed all over the world and used by brands such as Tesla, BMW, Mercedes-Benz, Chargefox and many others.

The company’s current financial and business issues have been well documented – once valued at over US$2 billion (A$3 billion) on the Nasdaq, it’s now worth a little over US$25 million (A$38 million).

Tritium is now fighting for survival amid a series of issues including the quality of its product, and its capacity to provide ongoing warranty.

The company is currently in negotiations to find external capital after the state and federal governments refused to hand over taxpayer funds to keep it afloat – despite already tipping millions into the company over the past few years.

With the Brisbane factory closed for good and Nasdaq hitting the business with a show-cause notice late last year about its underperformance (applicable to companies with a share price of under US$1 for more than 30 consecutive days), CarExpert has been in touch with numerous ex-Tritium employees to find out what went wrong.

“There were a lot of design flaws [in the chargers] that were mostly ignored. People at the top refused to make the necessary changes,” one former employee told CarExpert on the condition of anonymity.

“I loved the company and the career progression opportunities that were at hand, but it wasn’t too long until I started to notice the company was losing its spark due to bad management.

“No one wanted to take accountability when things went wrong but rather played the blame game. Issues were never resolved because of that.”

We’ve reached out to Tritium, but have yet to receive comment.

Tritium had been a point of pride for Australia overseas with even the likes of Prime Minister Anthony Albanese mentioning the manufacturer as a local example of innovation and success as recently as October last year.

CarExpert interviewed Tritium chief executive Jane Hunter in 2020. At the time the company had deployed more than 4500 charging stations and provided over 600,000 sessions in more than 33 countries. It claimed to hold around 50 per cent share of the world-leading market for DC chargers in Norway, and around 15 per cent of the wider global market.

So how did a company in such a seemingly dominant position have such a spectacular fall from grace?

“New employees were not being trained properly to do the job on the assembly line. That resulted in a lot of mistakes, which set them back,” another former employee told CarExpert.

“They also neglected consumer feedback and were very reluctant to make necessary changes to please the consumer.

“When they started losing customers and contracts, the panic began, and they started to get rid of employees with very little notice… I had high hopes for the company and wanted to be part of their success.”

Though Tritium posted US$185 million (A$280 million) in revenue for the 2023 financial year, which was more than double its performance for the year before, it has been running at a consistent loss since going public.

At one stage last year, Tritium reportedly asked for government assistance to the tune of $90 million as a cash for equity injection, or a $30 million investment to keep its Brisbane factory open. Both requests were seemingly denied.

Since March 2020 Tritium has been led by Ms Hunter, who was previously the chief operating officer of Boeing Systems Analysis Laboratory (part of the Boeing Phantom Works), also based in Brisbane.

Since it went public in March 2021, the company’s share price has fallen from over US$10 to US$0.14 today, a decline in valuation of more than 98 per cent.

One of Tritium’s largest shareholders, billionaire Brian Flannery whose shares fell from almost $140m in valuation in 2021 to around $2 million today, told the Australian Financial Review in November last year that the company had not made the right calls to reduce costs.

“The current directors have let it go too far and watched the margins disappear,” he told the AFR.

Former employees concurred with that assessment, with one calling out the rotating door of high-ranking officials at Tritium a red flag.

“The issue was internal. Company directors would either quit or get fired,” one employee told CarExpert.

“There are people within the company responsible for the dysfunction. The ones with good intentions had little power and could not do anything but give up.

“There were too many egos within the company. They needed to filter that out for better progress.”

With the cost of electric vehicle charging infrastructure partially funded by the taxpayer in Australia, Tritium’s fall from grace is a bitter pill to swallow not just for current and future electric car owners, but for the future of technology manufacturing in the country as whole.