As a small-business owner and Capital One cardholder, I’m always looking for ways to maximize the rewards I earn while spending.

Many small-business owners don’t realize the vast number of expenses that can be paid with a business card — and how using a card for those expenses allows business owners to earn rewards such as cash back or even miles.

This is especially true with all the recurring expenses a typical small business deals with on a monthly basis (think: utility bills and uniform rentals, to name a few).

Right now, thanks to its referral program, you may be able to earn even more than usual with your Capital One business card.

Capital One Refer a Business program increases bonuses

If you’re not familiar, Capital One offers a referral program for small-business owners who hold a Capital One business card and want to refer other business owners to do the same.

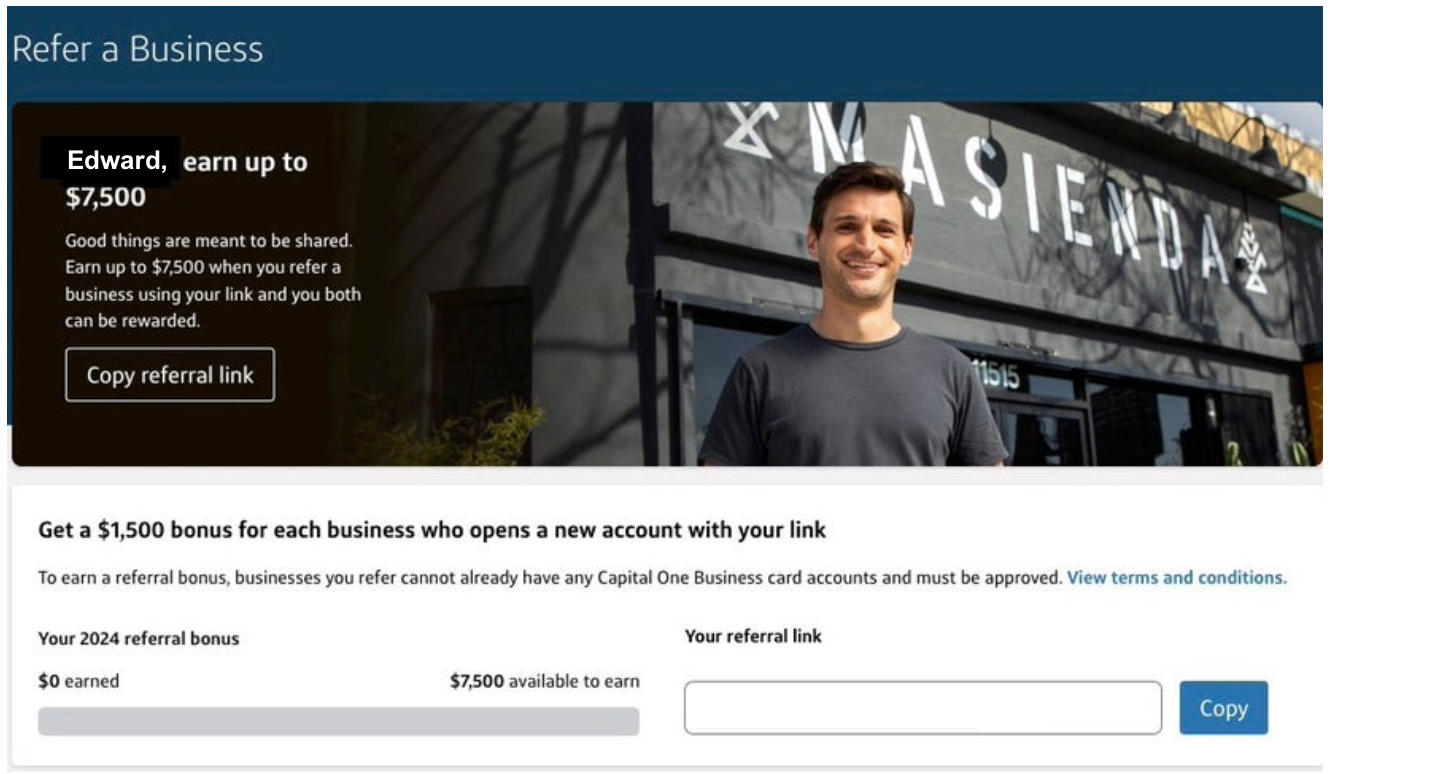

Right now, Capital One is offering some small-business owners increased referral offers. So, for example, customers who have historically received a $200 bonus per referral may now be eligible for an exclusive higher-value referral bonus of up to $1,500 per referral.

You can get a bonus on up to five referrals per year. Those eligible for a $1,500 bonus per referral can earn up to $7,500 in referral bonuses annually at these increased amounts.

How to refer businesses to a Capital One business card

Depending on which Capital One business card you hold, you may be able to earn a statement credit or miles for referrals. The higher amounts currently being offered to some customers are some of the best we’ve ever seen.

To see what you can earn for referral bonuses and help other business owners ramp up their rewards, navigate to the Capital One Refer a Business page located here or follow these steps:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

- Log in to your Capital One account.

- If using your desktop, open your account page and click on “Account Services” to find the “Refer a Business” landing page (located under “Benefits and Rewards”) to access your personalized referral link. If on a mobile device, log in to your Capital One account, then scroll down and select the “Refer a Business” option.

- From there, click on “Refer a Business” to get a personal link to share with your network.

- Share this link with your network, and tell them to apply with that specific link.

- Once they’re approved using your link, you’ll get a bonus of up to $1,500 — and they’ll start earning unlimited rewards for their business spending.

- You could earn up to $7,500 each year with a maximum of five referrals.

A win-win for existing customers and referred businesses

My small business uses the Capital One Venture X Business card for virtually every business expense, ranging from office supplies and paper products to food items. This translates to earning 2 miles per dollar spent on every transaction.

I use those miles to reward my employees with travel and to help pay for my own family vacations and getaways to boutique hotels. They even help me occasionally fly in business class by using some of Capital One’s airline transfer partners.

I’ve also redeemed Capital One miles to send employees to Hawaii, as well as to attend their kids’ sporting events around the country, which makes for a great way to show appreciation and say thanks for a job well done.

There’s no reason to keep that rewarding approach to managing business expenses a secret, which is where the referral program comes in.

When I tell other small businesses about the Capital One Refer a Business program, I can get a referral bonus when they’re approved for a Capital One business card using my unique referral link, and those businesses can start racking up rewards with their purchases, making it a win-win situation.

If you want to also refer small businesses via the Capital One Refer a Business program, you can head here to get started. If you aren’t yet a cardholder, you can head here to explore opening a Capital One business card for yourself.

The Referral Bonus Program (“Program”) is non-transferable and open to account holders with an eligible Capital One Business card in good standing. To receive a bonus, you must refer businesses that do not already have a Capital One Business card. Your referrals must apply through the link provided and be approved for a Capital One Business credit or charge card. You are able to refer businesses at any time. However, referral bonus amounts are individual offers which are only available for a limited time. Referral bonus amount and/or card product promotions may be subject to change. Bonuses are subject to an annual maximum bonus cap and may be taxable income. We may be required to send you, and file with the IRS, Form 1099‑MISC. Please consult with your tax advisor for questions about the impact of this form. Program may be terminated or changed by Capital One at any time. See Program Terms and Conditions for details.

Web access is needed to use Capital One’s mobile banking. Check with your service provider for details on specific fees and charges.

The Capital One site may be unavailable during normal maintenance or due to unforeseen circumstances.