If you’re looking for a great cash-back credit card to help you rack up rewards on everyday spending purchases, consider the Blue Cash Preferred® Card from American Express. This card earns an impressive 6% back on U.S. supermarkets (up to $6,000 in spending each calendar year; then 1%) and select U.S. streaming services, 3% back on transit and U.S. gas stations and 1% on everything else.

It also features a $0 introductory annual fee, then $95 thereafter (see rates and fees). Cash back is received in the form of Reward Dollars that can be redeemed for statement credits or used for Amazon purchases.

If the Blue Cash Preferred card sounds like a good fit for you, here’s what you should know about the ideal credit score needed to increase your chances of being approved once you apply.

Credit score required for the Blue Cash Preferred

No specific credit score is required to be approved for the Blue Cash Preferred. Like other issuers, Amex considers several factors to make an approval decision. So, having a certain credit score won’t automatically mean you’ll be approved for the card.

Amex recommends having “good to excellent” credit to apply for the card, which means you should aim for at least a 670 score. However, we recommend a 700+ credit score for increased chances of getting approved.

Related: What is a good credit score?

The Blue Cash Preferred is a mid-tier card, which means you’ll typically have an easier time applying for it than premium travel credit cards such as The Platinum Card® from American Express or the Chase Sapphire Reserve®.

Related: My mom got her first rewards card after using cash for 50 years

How to check your credit score

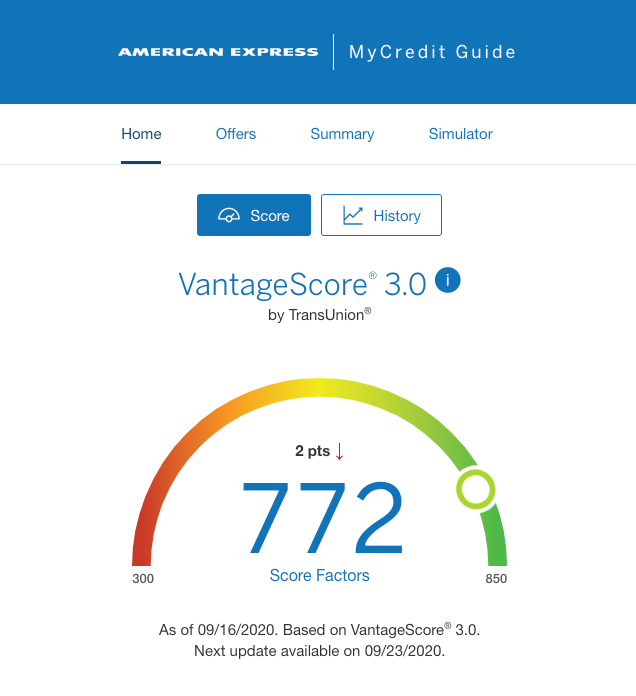

American Express actually offers a way for you to check your credit score (even if you aren’t already a cardholder) called MyCredit Guide, which gives you access to your Vantage 3.0 score. Upon creating an account or logging in, you’ll be able to see your credit score on an easy-to-read scale. You’ll also be able to see how your credit score measures up, a summary of which Amex cards you’re most likely to be approved for, a credit summary that gives you a status update on your late payments, opened accounts, current balances and other factors that contribute to your credit score.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

There are also a number of ways you can check your credit score with other issuers and third-party services.

Related: How to check your credit score

What other factors go into a credit card approval?

While your credit score is an important factor that issuers look at when determining whether or not you are approved for a credit card, it’s not the only thing they look at. Credit card issuers don’t share a full list of factors or how heavily each factor weighs on an approval, but here are a few of the general things credit issuers will look at:

- Payment history. This plays into your credit score, too, but issuers will also take your credit history into account separately when looking at an application. Paying your bills on time and in full is a signal to credit card issuers that you are a low-risk lender, which increases your chances of being approved.

- Income. You likely had to list your annual income on your application. Creditors use this to help ensure that you are earning enough money to pay off a credit card bill each month. It also plays a role in determining your credit limit.

- Number of accounts open. Many issuers limit the number of credit cards you can have open or at least limit the overall credit they will extend to you across accounts. Make sure you know the application restrictions of each credit card issuer before you apply for a card.

This certainly isn’t an exhaustive list of factors — some issuers take into account existing customer relationships and more when considering whether to approve you for a new card. Keep in mind that the requirements issuers look for frequently change depending on the economy and other external factors that you may have no control over.

Bottom line

If you’ve determined that the Amex Blue Cash Preferred card will be a good addition to your wallet and you’ve got a good to excellent credit score, you probably have good odds of getting approved. This isn’t to say that you absolutely have to have a 670 credit score for approval nor is it a guarantee that those with 700+ scores will be eligible for the card.

However, it does give you a better picture of your approval odds based on your current credit score and history. If you fall at the lower end of this range, there are a few things you can do to help improve your score before applying.

Check out TPG’s Blue Cash Preferred credit card review for more details.

Apply here: Amex Blue Cash Preferred

For rates and fees of the Blue Cash Preferred, click here.