You might want to add authorized users to your travel credit cards for many reasons. For example, your authorized users can help you hit a minimum spending requirement to earn a welcome offer, or you might want to build your child’s credit history early on.

But some cards also offer authorized users many of the same benefits as the primary cardmember — one of the most popular being The Platinum Card® from American Express.

In this guide, we’ll consider the various perks that could still make adding authorized users to your Amex Platinum worthwhile. We’ll also consider how the new annual fee structure may change this calculus.

Overview of Amex Platinum authorized users

The Amex Platinum comes with a $695 annual fee (see rates and fees) and has so many benefits that it’s often referred to as a “membership card” (in some circles) — a card that you keep for its benefits rather than its earning potential. That said, it does come with a welcome bonus of 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership — or you could be targeted for an even higher offer using the CardMatch tool (subject to change at any time).

However, unlike some other premium travel cards, adding authorized users to the Amex Platinum incurs an additional cost.

You can add children as authorized users, but American Express requires them to be at least 13 years old.

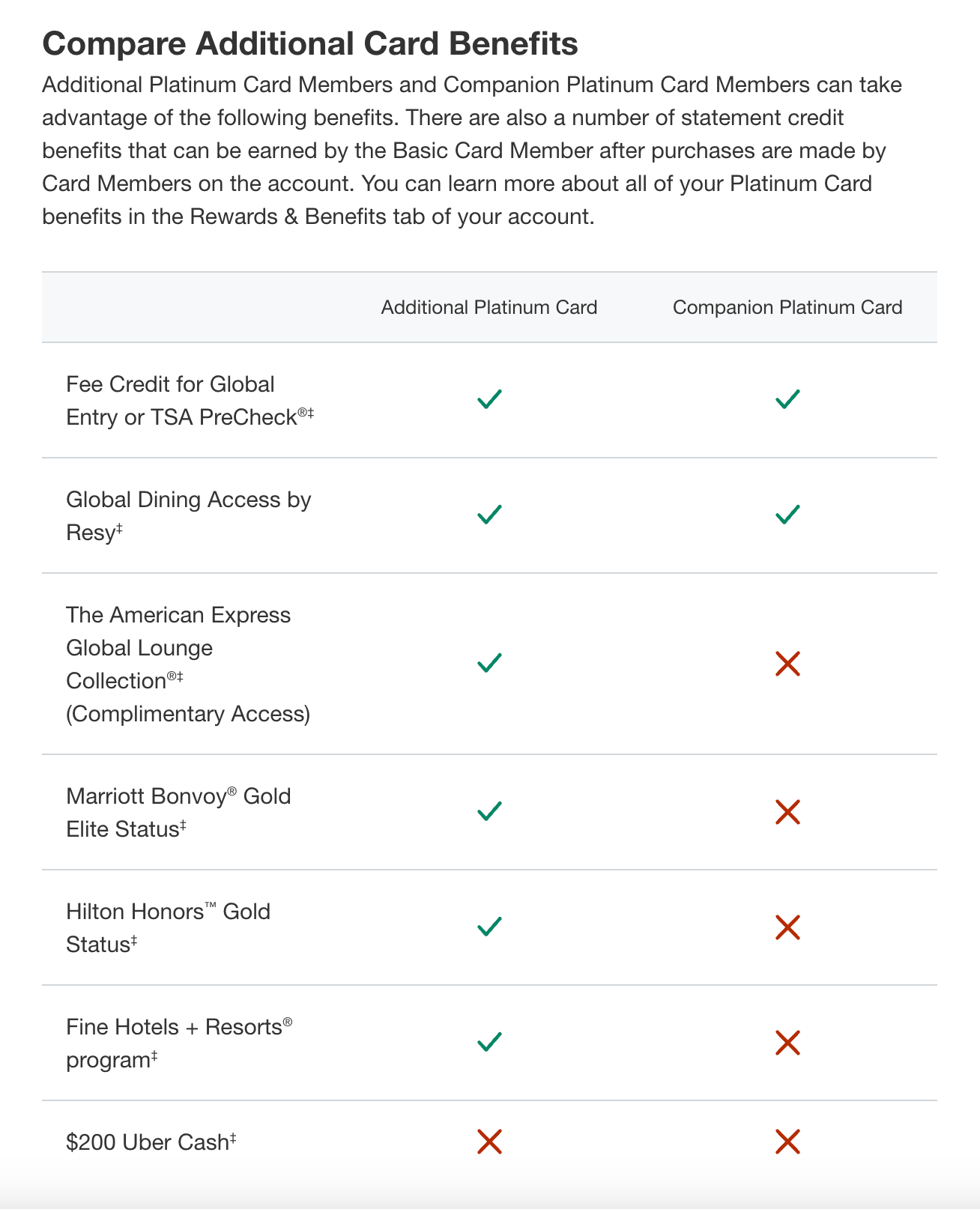

Amex also offers additional non-Platinum cards, known as companion Platinum cards, that you can add to your account. These cards don’t incur annual costs (see rates and fees) but feature very limited benefits.

However, adding additional Platinum cardmembers to your account (and paying $195 for each additional cardmember in extra annual fees; see rates and fees) unlocks a variety of perks.

Related: Authorized user on a company credit card: What to know

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Which Amex Platinum benefits apply to additional cardmembers?

Here’s a rundown of the key benefits that additional Amex Platinum cardmembers will enjoy. As noted above, these only apply to additional Amex Platinum cards, not companion cards.

Lounge access

The first key benefit that extends to additional Amex Platinum cardmembers is lounge access, even when traveling without the primary cardmember. The American Express Global Lounge Collection includes several networks, including American Express Centurion Lounges, Priority Pass lounges, Delta Sky Clubs on same-day Delta flights (limited to 10 annual visits from Feb. 1, 2025), Plaza Premium lounges and various other types of lounge access. (You can view a full list of participating locations at this link.) Terms apply. Enrollment is required.

American Express doesn’t allow most Amex Platinum cardmembers to bring in two complimentary guests when visiting Centurion Lounges. Instead, it’ll cost you $50 for each adult guest over 18, and you’ll pay $30 for each child between the ages of 2 and 17 (children under two are still free).

There are two ways to avoid this guest fee. First, you can charge $75,000 on your Platinum Card in a calendar year, unlocking the previous benefit of bringing in two guests.

Alternatively, if you frequently travel with your spouse (or children over 12), you can add them as authorized users.

Note that Centurion Lounges aren’t the only ones that can be difficult or expensive to access for Platinum cardmembers. If you hold the Amex Platinum, you can enter the Sky Club if you’re traveling on a same-day Delta-operated flight. The fee for bringing guests with you is $50 each time you visit — part of Delta’s efforts to combat lounge overcrowding.

However, you can avoid these charges altogether when adding additional Platinum cardmembers to your account.

If you think Amex or Delta lounge access is worth the $50 charge for guests, you will cover the $195 annual fee for authorized users after four visits each year.

Of course, this won’t help families with children under 12 (like mine). My 8-year-old daughter can’t become an authorized user on my card. However, the $50 guest fee at Delta Sky Clubs should trigger the Platinum Card’s up to $200 annual airline fee credit since I’ve designated Delta as my eligible carrier (enrollment is required).

Finally, it’s worth pointing out that you must enroll in Priority Pass to be eligible to access Priority Pass lounges (you can get into the other lounges in the American Express Global Lounge Collection by simply showing your Platinum Card). Additional cardmembers can’t enroll online; they need to call the number on the back of their Amex Platinum to enroll.

Related: The 10 best Priority Pass lounges around the world

Global Entry/TSA PreCheck application fee credit

Another great perk that extends to additional Amex Platinum cardmembers is the statement credit for Global Entry (up to $100) or TSA PreCheck (up to $85) application fees. Just like the benefit provided to primary cardmembers, each authorized user can use this benefit once every four years for Global Entry or once every 4½ years for TSA PreCheck. Also, you don’t even need to use the credit for your own membership — any qualifying charge for a friend or family member will trigger the credit.

If you add an authorized user who applies for Global Entry in the first year, that’s $100 worth of benefits right off the bat, which covers more than half of the $195 authorized user annual fee.

However, it’s worth pointing out that the above chart indicates that all additional members added to an Amex Platinum account — both additional Platinum Card and additional companion cards — are eligible.

Related: Top credit cards for Global Entry and TSA PreCheck

Marriott and Hilton elite status

Amex Platinum authorized users can also take advantage of complimentary Gold status with Marriott Bonvoy and Hilton Honors. Both the primary cardmember and authorized users should be able to enroll for these statuses online. If you frequent Marriott or Hilton properties, this can bring you room upgrades (when available), bonus points and additional on-property perks.

Keep in mind that there are other ways to get Marriott and Hilton status through credit cards:

Still, having an authorized-user Platinum Card covers both programs and thus may be easier than maintaining multiple other cards.

The information for the Hilton Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Guide to hotel elite status with the Amex Platinum and Business Platinum

Access to the Fine Hotels + Resorts and Hotel Collection

As an additional Amex Platinum cardmember, you can also use the Fine Hotels + Resorts and The Hotel Collection benefits on the card (minimum two-night stay required for The Hotel Collection). When you book a prepaid stay through the Fine Hotels + Resorts program, you’ll earn 5 Membership Rewards points per dollar and get access to the program’s elitelike benefits. Terms apply.

These benefits include a room upgrade upon arrival (when available), daily breakfast for two, guaranteed 4 p.m. late checkout, noon check-in (when available), complimentary Wi-Fi and a $100 experience credit.

Related: 12 hotels where you can stay for half price (or break even) with your Amex Platinum credit

Car rental elite status

Additional Platinum cardmembers receive complimentary Hertz Gold Plus Rewards President’s Circle, Avis Preferred Plus and National Emerald Club Executive status. You can enroll in each of these memberships on Amex’s website.

Related: How you can redeem points and miles for car rentals

Other benefits

Amex Platinum authorized users can also access the Cruise Privileges and International Airline Programs. Meanwhile, additional Platinum cardmembers and companion cardmembers can access Amex Offers and the Auto Purchasing Program. Note that enrollment is required for Amex Offers and that not all cardmembers will be targeted for the same offers.

Which Amex Platinum benefits are shared among cardmembers?

Beyond the above perks, primary and additional cardmembers share several Amex Platinum benefits. In other words, these perks are granted once per account — but purchases by any card on the account will trigger them.

- Airline fee credit of up to $200 per calendar year, provided as statement credits for incidental fees charged by the airline you select*

- Up to $100 Saks credit split into two up to $50 statement credits for the two halves of the calendar year*

- Up to $200 annual hotel credit, valid on prepaid reservations at Fine Hotels + Resorts or The Hotel Collection properties (requires a minimum two-night stay) made through Amex Travel*

- Up to $189 annual Clear Plus credit per calendar year, provided as statement credits for a Clear Plus membership*

- Up to $240 annual digital entertainment credit, split into up to $20 monthly statement credits for select merchants, including The Disney Bundle, Disney+, ESPN+, Hulu, Peacock, The New York Times and The Wall Street Journal*

- Up to $300 annual Equinox statement credit each calendar year to eligible Equinox memberships or access to the Equinox+ app (subject to auto-renewal)*

- Up to $155 in Walmart+ credits annually, where you can receive a statement credit each month that covers the full cost of one $12.95 (plus tax) Walmart+ membership (subject to auto-renewal). Plus Up Benefits not eligible*

This is a great way to ensure you maximize these statement credits. For example, you may not want to use the Equinox credit if you use a different gym or fitness provider. However, if your authorized user charges an Equinox membership to the card, those purchases will trigger the statement credit until the $300 annual maximum is reached.

*Enrollment is required for select benefits. Terms apply.

What benefits are not included?

Note that a few benefits aren’t granted to authorized users.

Most importantly, there’s no additional welcome offer. While all purchases count toward the card’s minimum spending requirements, it’s a single deposit of points.

In addition, the Amex Platinum includes Uber VIP status (where available) and up to $200 Uber Cash (enrollment is required) — split into monthly $15 credits for U.S. rides or U.S. Uber Eats orders, plus a bonus $20 in December (enrollment is required). However, this Uber Cash will only be deposited into one Uber account when you add the Amex Platinum as a payment method. To use it in an authorized user’s Uber account, you must delete the card from the original account and reenroll using your authorized user’s account.

Related: The best premium credit cards: A side-by-side comparison

Is it still worth adding authorized users to your Amex Platinum?

The annual fee structure for additional Amex Platinum cardmembers has existing customers questioning whether it’s worth it. More casual travelers may not benefit enough to warrant the $195 annual fee for each additional Amex Platinum cardmember.

If you’re thinking about adding new authorized users (or looking ahead to your next renewal and considering removing existing authorized users), here are some questions to ask:

- Will your authorized users sign up for Global Entry or TSA PreCheck? If so, that’s an immediate $100 in benefits. However, this isn’t an annual perk.

- How frequently will your authorized users use the card’s hotel perks? Semi-frequent travelers who won’t earn Gold status with Marriott or Hilton in their own right could still get hundreds of dollars in value from these benefits each year. The same holds true for stays at Fine Hotels + Resorts or The Hotel Collection properties. A single FHR stay for your additional Platinum cardmember (with complimentary breakfast and an on-property credit) could cover the $195 annual fee all by itself.

- How valuable is lounge access for your authorized users? As noted earlier, it’ll cost you $50 per visit to bring guests into Centurion Lounges and Sky Clubs as a Platinum cardmember. At face value, you’d need at least four visits per year to cover this added cost. However, this may be less valuable if you rarely visit these locations (or can offset Sky Club guest fees with the card’s airline fee credit).

Use these questions to estimate the yearly value your additional Platinum cardmember will get. If that’s significantly higher than the new $195 annual fee, it’s worth it. Otherwise, you may want to reconsider.

Key considerations

Of course, adding an authorized user is not as simple as gaining access to additional benefits. As the primary cardmember, you are responsible for all charges on your account, including those charged by others. For this reason, you should only add other cardmembers you trust to avoid running up your balance. Remember, too, that you must pay your Amex Platinum balance in full each month (though you should really do this with all credit cards).

If done right, adding an authorized user to the card can be a great way to build up their credit history. This can go a long way toward helping a friend or family member with poor credit since American Express will report the on-time payment history for every cardmember on your account to the respective credit bureaus. Again, make sure the authorized user is someone you can trust.

Related: The benefits of adding a relative as an authorized user

How to add additional cardmembers

If you’ve decided to add additional cardmembers to your Amex Platinum account, the process is relatively simple:

- Log into the dashboard for your Amex Platinum account

- Click on the “Account Services” link at the top

- Click “Manage Other Users” on the left-hand side

- Click “Add Someone to Your Account”

- Ensure you have the Amex Platinum selected, then click “Continue”

- Choose the type of card you want to add (Platinum or companion), enter the user’s information, then click Agree & Submit

Note that you don’t have to immediately enter the new authorized user’s Social Security number or date of birth, but Amex requires that information within 60 days of the card being issued. Otherwise, the card will be canceled.

Related: How to maximize benefits with the Amex Platinum Card

Bottom line

Having additional cardmembers can expand your earning potential, and on certain cards, it can unlock a variety of perks for your authorized users as well. On the Amex Platinum, it costs $195 for each new authorized user, but given the array of benefits they’ll enjoy, this can be a solid option under the right circumstances. Just be sure that this additional cost is worth it.

To learn more, read our full review of the Amex Platinum.

Apply here: The Platinum Card® from American Express

Related: 5 ways you might be missing the value of your Amex Platinum card

For rates and fees of The Platinum Card® from American Express, click here.

For rates and fees of the Hilton Honors American Express Aspire Card, click here.

For rates and fees of the Hilton Honors American Express Business Card, click here.

For rates and fees of the Hilton Honors American Express Surpass® Card, click here.

For rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, click here.

For rates and fees of the Marriott Bonvoy Business® American Express® Card, click here.