Chase Ultimate Rewards points are a favorite currency among TPG staff, in part, because you can transfer them to a variety of airline and hotel partners. I often transfer my points to Southwest Rapid Rewards, where I can redeem them for cheap award tickets to destinations in North America, Central America and the Caribbean — and sometimes stretch my points even further with the valuable Companion Pass.

However, depending on the Chase credit card you have, you may be better off booking flights directly through Chase Travel℠, as this can require fewer points and allow you to earn Rapid Rewards points on the ticket.

Here’s everything you need to know about transferring your Chase points to Southwest.

Related: How TPG’s points and miles experts maximize Chase Ultimate Rewards points

How to transfer Chase points to Southwest

One of the great things about transferable points like Ultimate Rewards is that you can redeem them for award flights with airlines you’ve never flown or accrued miles with before. But if that’s the case, you’ll need to set up a Southwest Rapid Rewards account before you can transfer your Chase points to Southwest.

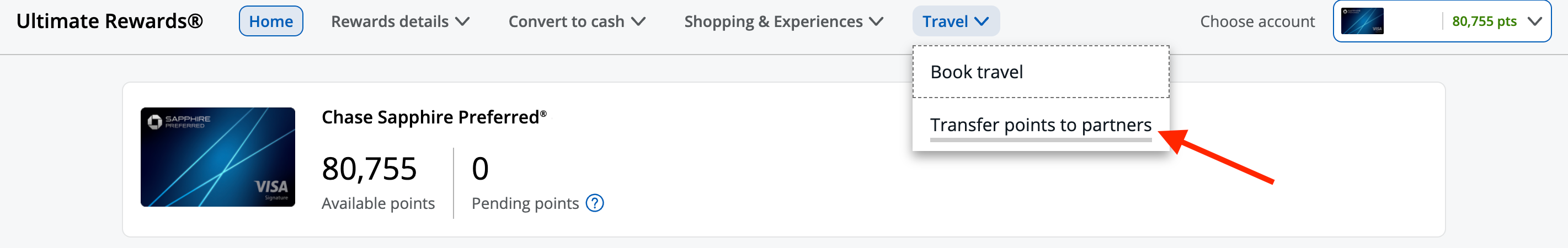

Head to Southwest’s site to create one for free. Then, visit your Chase portal and go into your Ultimate Rewards account. Click “Travel” on the top toolbar, and choose “Transfer points to partners.”

On the next screen, you’ll see a list of Chase’s travel partners, with any available transfer bonuses noted at the top. Scroll down, and click on the Southwest option.

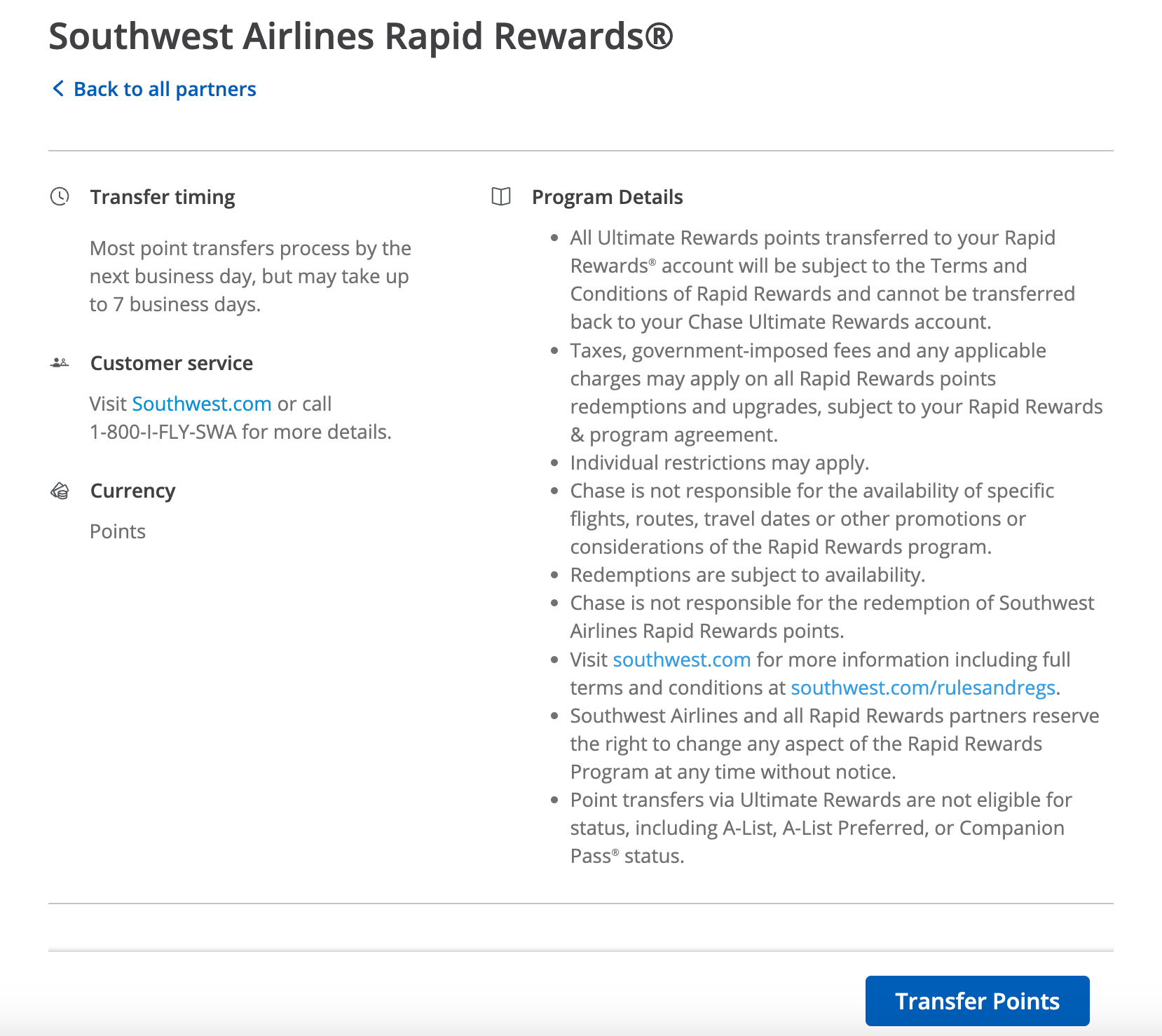

This will take you to a page with some rules about transferring your points to Southwest. For instance, points transferred via the Chase portal are not eligible for Southwest status. You’ll also have to pay taxes and fees on Rapid Rewards points redemptions.

After reviewing the fine print, click the blue “Transfer Points” button at the bottom right.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

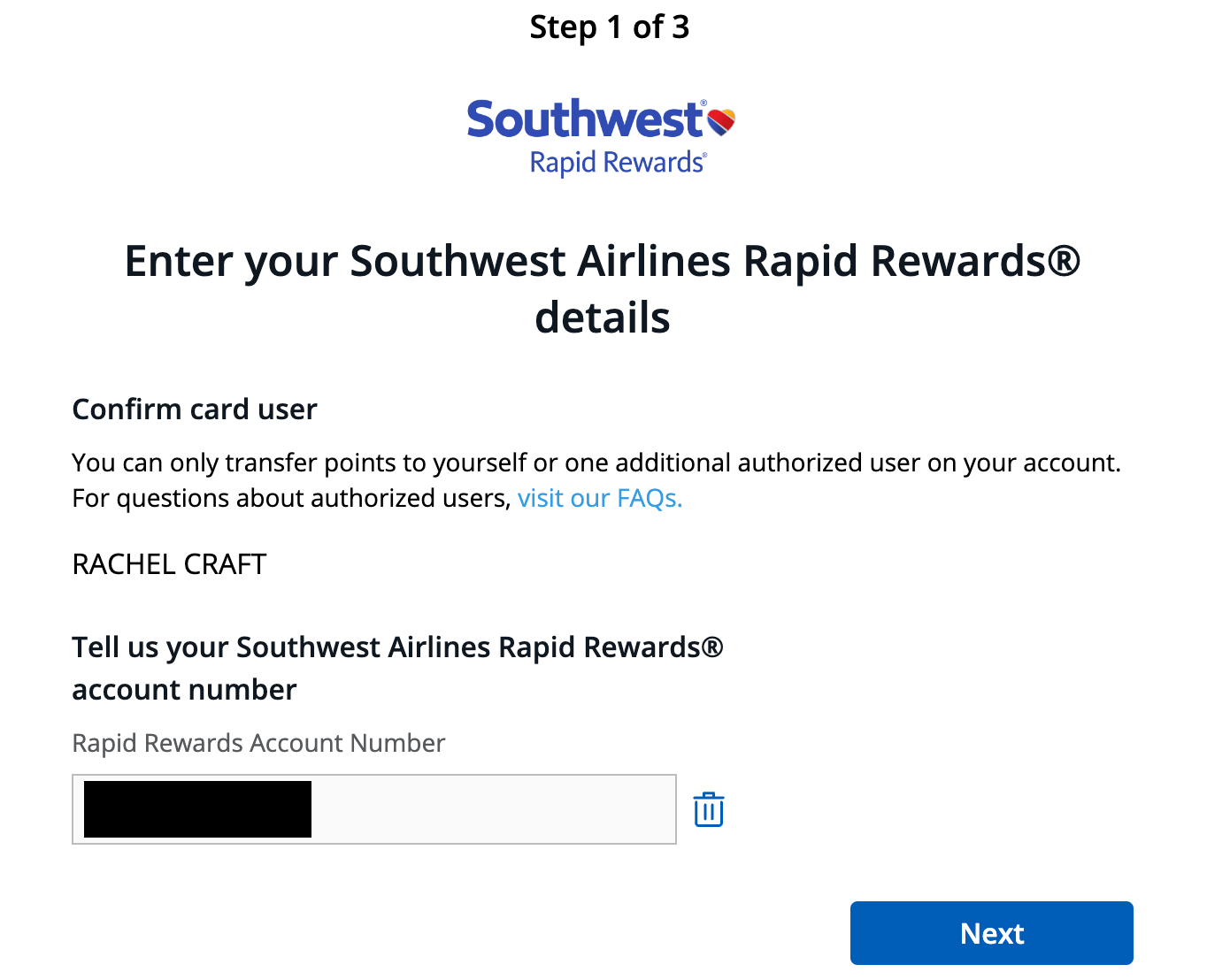

On the following page, you’ll need to enter your Southwest Rapid Rewards number. Chase also allows you to transfer points to one authorized user on your Chase account, so you could enter their Rapid Rewards number instead. Once you complete this step, click “Next.”

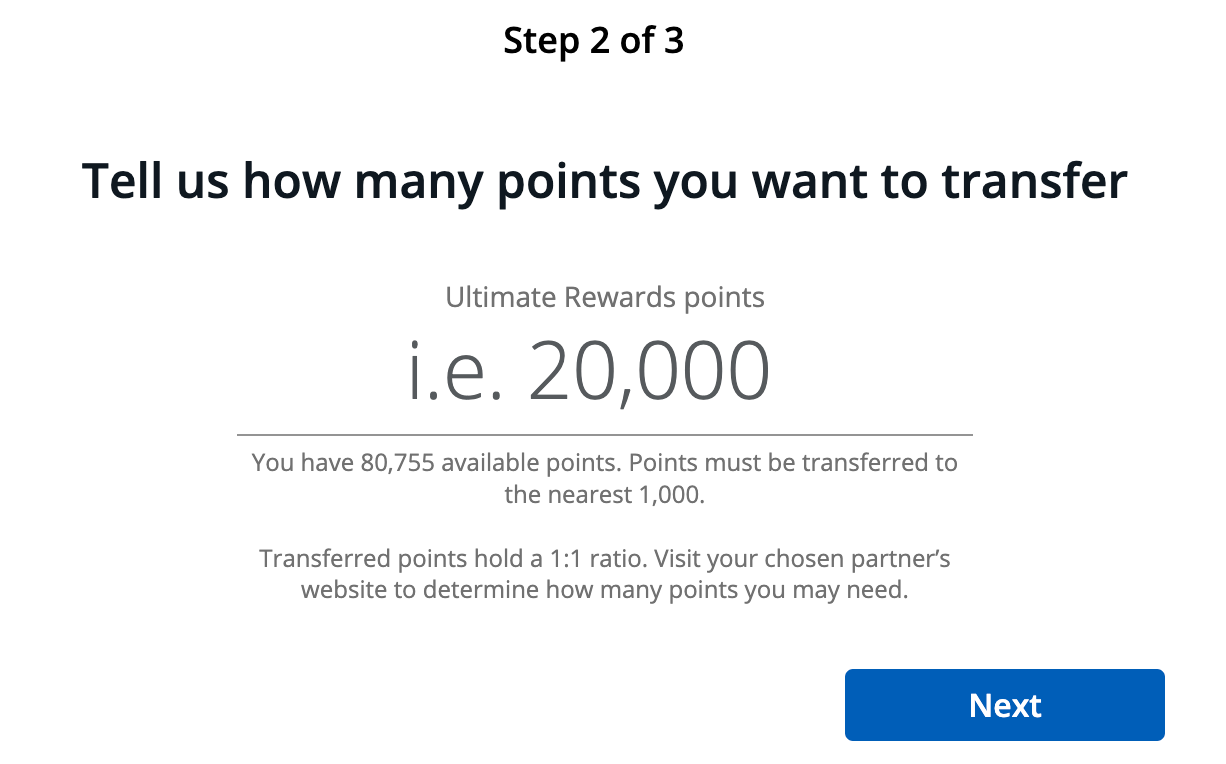

Then, enter the number of points you want to transfer. This must be a multiple of 1,000, so you may have to transfer a few more points than you need for your redemption.

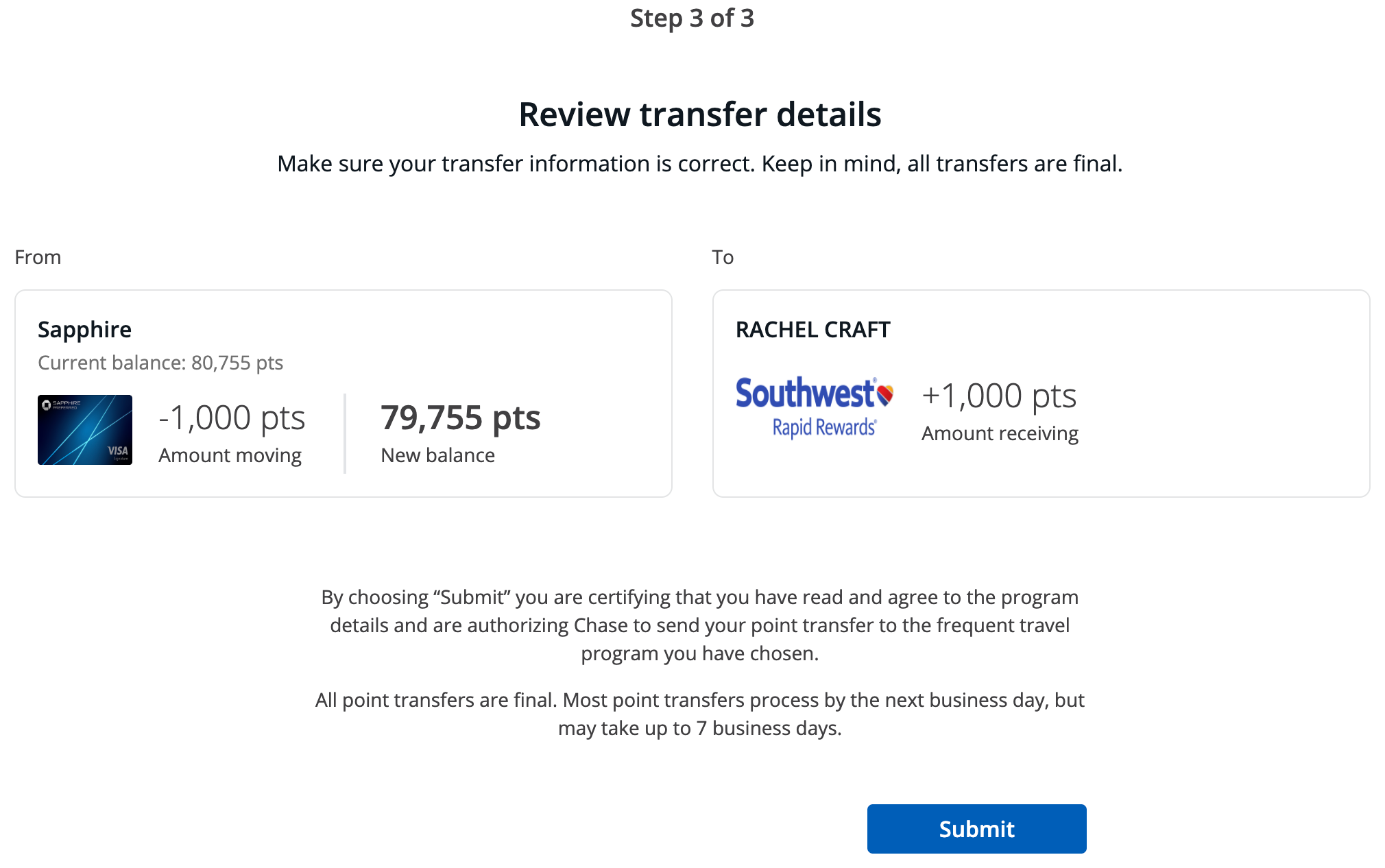

The next page will give you a chance to review your information before processing the transfer. Remember that transfers are irreversible, so be sure you have a redemption in mind and have confirmed award space availability before you transfer. It’s also a good idea to double-check the spelling of your name, your Rapid Rewards number and how many points you’re transferring before you hit “Submit.” An innocent typo could cause you to transfer thousands of hard-earned points when you meant to only transfer 10,000.

If you’re ready to pull the trigger on your Southwest redemption, click “Submit” and wait for your points to hit your Rapid Rewards account.

According to Chase’s site, “Most point transfers process by the next business day, but may take up to 7 business days.” However, TPG’s tests have shown that most transfers to Southwest happen instantly. That means you could be booking your award flight mere minutes after transferring your Chase points.

Related: It just got easier to use your Chase points to book Southwest Airlines flights

Chase to Southwest transfer ratio

As with all of Chase’s current transfer partners, Ultimate Rewards points transfer to Southwest at a ratio of 1:1. However, you may be able to get an even better ratio if you can take advantage of a transfer bonus. Chase transfer bonuses are rare, but if you find one that aligns with your travel plans, you can save yourself thousands of points.

Related: Best Southwest Airlines credit cards

Should I transfer Chase points to Southwest?

According to TPG’s August 2024 valuations, Chase points are worth 2.05 cents each while Rapid Rewards points are worth only 1.4 cents each. That’s because transferable points’ flexibility makes them inherently more valuable.

Since Southwest prices award flights based on cash rates, you’ll typically get a value right around 1.4 cents per point when you redeem Rapid Rewards points for flights. Other Chase transfer partners, like United Airlines, Air France and World of Hyatt, have better award sweet spots where you can get outsize value from your points. So, you may want to save your Chase points to use with these higher-value transfer partners.

However, depending on your situation, Southwest may make the most sense. Take a look at Chase’s other airline partners first and compare award rates and flight details. If Southwest is running a sale on your desired route or is offering flights at a better time for you than other airlines, it may be the best option. The same goes if you already have a stash of Rapid Rewards points or a Companion Pass in your account.

For instance, last year I transferred Chase Ultimate Rewards points to my Rapid Rewards account to purchase a round-trip ticket to Turks and Caicos. My ticket cost 46,000 points, but thanks to the Companion Pass I had at the time, I got my partner’s ticket for just the cost of taxes and fees. As a result, I spent 46,000 Chase points on two flights that would have cost nearly $1,400 total, giving me a value of around 3 cents per point. I couldn’t have gotten that kind of deal with any other airline.

But most importantly, make sure it’s not a better deal to simply book your Southwest flights directly through Chase Travel. Depending on the Chase card you have, you’ll get a value of 1.25 cents per point or 1.5 cents per point. Plus, flights booked this way will earn Rapid Rewards points like a normal revenue ticket. This could make it a better option, depending on the flight you’re taking.

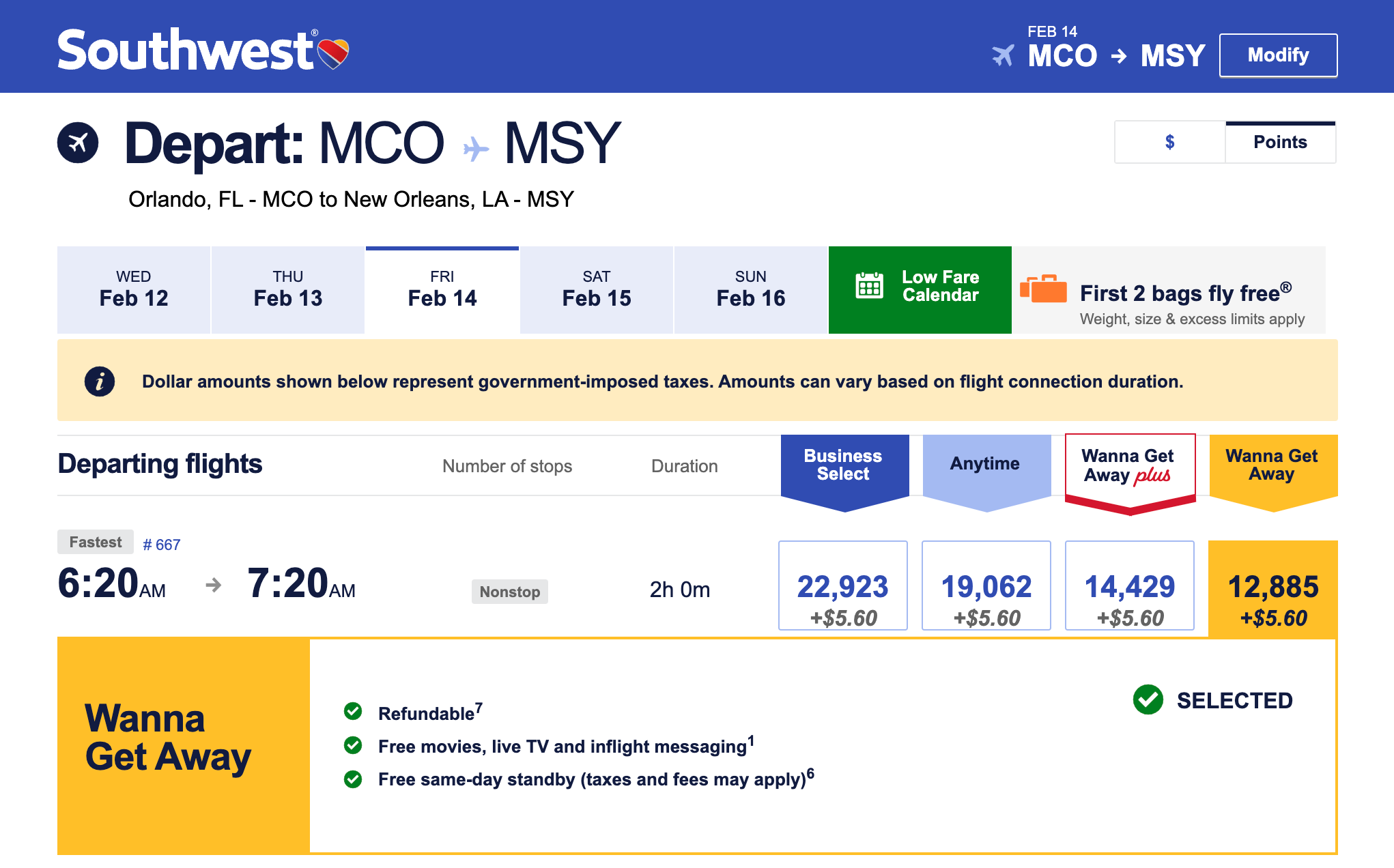

For example, this one-way flight from Orlando International Airport (MCO) to Louis Armstrong New Orleans International Airport (MSY) in February would be 12,885 points plus $5.60 in taxes and fees.

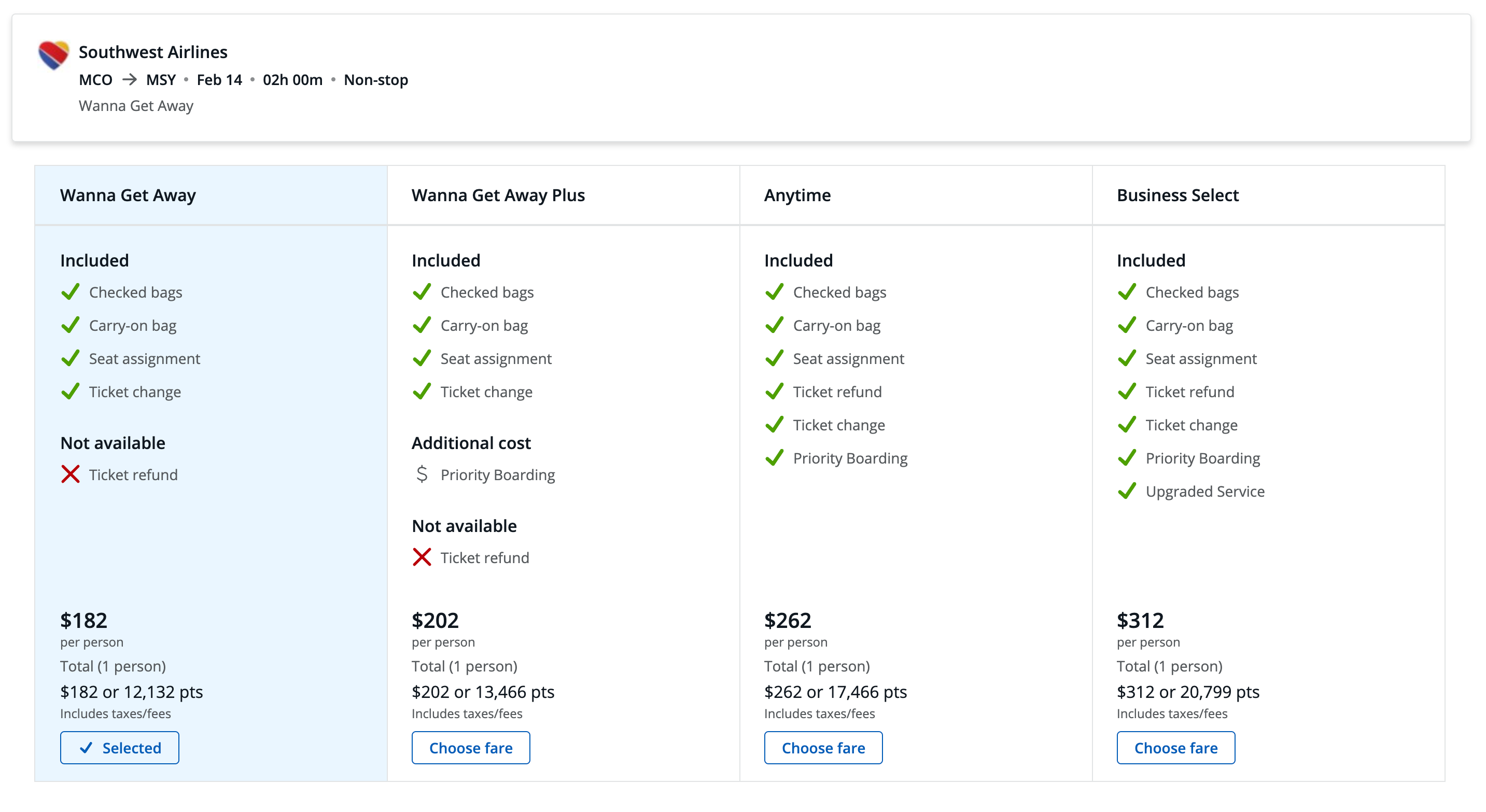

However, if you have the Chase Sapphire Reserve® (which means your points are worth 1.5 cents apiece when used to book flights through Chase Travel), you can get the same flight for just 12,132 points — and you’ll earn Rapid Reward points in the process.

In fact, you’re better off booking all of Southwest’s fare classes directly through Chase Travel on this flight. In each case, you’ll redeem fewer Chase points than if you transferred them to your Rapid Rewards account.

However, you’ll need additional points to book this flight if you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card — which may make transferring the better option. Additionally, if you already have a decent balance of Rapid Rewards points and just need to top off your account to have enough for the award ticket, it can also make sense to transfer your Chase points to your Southwest account.

As such, it’s important to always compare prices with Chase Travel and Southwest to make sure you’re not using more points than you need to.

Related: Free bags and open seating: Why I choose Southwest every time

How to earn Chase points

The more Ultimate Rewards points you accrue, the sooner you can redeem your next free trip with Southwest or any of Chase’s other partners. Here are some of TPG’s favorite cards that will help you earn Ultimate Rewards points through welcome bonuses and everyday spending:

Know, though, that you’re not limited to just these cards. I personally love the Chase Freedom Flex® and the Chase Freedom Unlimited®. They don’t earn Ultimate Rewards points by themselves, but if you also hold one of the cards listed above, you can transfer those cash-back points into full-fledged Ultimate Rewards points and transfer them to any of Chase’s partners.

Related: No-annual-fee credit cards that earn transferable points

Bottom line

If you’ve never transferred points from Chase, it can be a little nerve-wracking to watch the points vanish from your account and wait for them to appear in your partner account. Thankfully, the process is usually smooth and almost instantaneous. Just be sure to confirm the number of points you need, and make sure you can’t get a better deal by using your points directly through Chase Travel. Then, follow the steps above to transfer your points.