Those big welcome bonuses that can come with new credit cards after you hit a spending threshold can really accelerate you to a great vacation courtesy of your points and miles. But, after you get past that glitzy reason to add a new credit card to your wallet, there’s more that rewards cards can do for you and your family’s bottom line.

In fact, there’s one valuable card benefit that’s saved me more than $1,000 over the years. It’s also quickly resolved some situations that could definitely have developed into big time-sucking headaches.

Extended warranty protection is one of those sometimes overlooked benefits available with certain credit cards that has saved me more times than once. It shouldn’t be an overlooked perk as it can put money back in your wallet quickly and easily when something goes wrong with an item you charged to the card.

You won’t find it on every credit card, but it’s a benefit you’ll find on a wide variety of American Express cards (terms apply).* In this article, I’ll share the time one American Express card helped keep money in my family’s pocket, this time to the tune of $120.

*Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Related: Your complete guide to shopping protections on American Express cards

The day the vacuum died

A few years ago, we purchased a cordless vacuum cleaner from Amazon for $119.99. The vacuum worked fine for a handful of months, but in December, it stopped working completely.

Under normal circumstances, this would have gotten me pretty hot under the collar since I hate wasting cash on things that quickly break. On top of that, I don’t have time to chase down some never-ending customer service loop on the off chance of maybe getting a refund.

Luckily, a few minutes of work with American Express solved the issue before it became a problem.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: The best American Express cards

Filing an extended warranty claim

In early January, I opened an extended warranty* claim with American Express for the recently departed vacuum. I purchased the vacuum cleaner using my Hilton Honors American Express Aspire Card, which turned out to be a very good decision when it quickly broke.

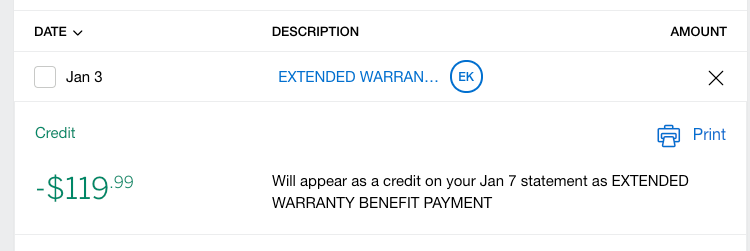

I didn’t have to submit any pictures of the broken vacuum or other documentation beyond completing a simple form on the American Express website. The next morning, on a Sunday no less, I received an email from American Express with a letter attached stating my claim had been approved for the full amount of my purchase.

Sure enough, the credit appeared on my account shortly after, and we were able to purchase a replacement vacuum without taking a financial hit.

How many times have you heard a story from someone who purchased an item from Amazon or another online retailer and ended up having to throw it in the trash a few months later? I have to wonder how many of those folks had a credit card in their wallet that would have protected their purchase, and they didn’t even know it.

The information for the Hilton Honors American Express Aspire Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: How American Express’ extended warranty saved me $150 — and a huge headache

Not my first purchase protection rodeo

This isn’t my first positive experience with American Express’ extended warranty coverage.

American Express’ extended warranty program* saved me a ton of money three years after I purchased a TV. A while back, I purchased a brand-new flat-screen TV from Costco using The Platinum Card® from American Express to the tune of $1,200.

I’ve held that card in my wallet for a decade, ever since my days in the military. It remains in my wallet now because it proves its worth year after year.

Three years of blissful and frustrating Sundays watching my beloved Atlanta Falcons were interrupted when the television suddenly stopped working. I called a television repair company, only to have them tell me the TV was dead-dead and, of course, we were just beyond the manufacturer’s included warranty.

Luckily, I held on to the purchase receipt. I submitted the report from the repair company along with my receipt to Amex, and they credited me the entire purchase amount, including taxes.

The Amex warranty* had picked up for one additional year when the built-in warranty dropped off. It didn’t take long for me to purchase the replacement television and get back to the important business of rooting for the Falcons and Georgia Bulldogs from the couch.

This sort of protection doesn’t cover you on every sort of purchase or in perpetuity. Generally, American Express steps in when other warranty options won’t cover you up to a certain length of time — in this case, one year beyond the included warranty.

So, if you’re covered by a “satisfaction guarantee” or built-in warranty from a store or manufacturer, you’ll probably need to pursue that first. Amex also won’t cover you for live plants, software, gift cards, jewelry and a handful of other items. Additionally, you’ll need to file your claim within 30 days of the incident.

Extended warranty protection on the Amex Platinum can cover claims of up to $10,000 per item and up to $50,000 in a calendar year within five years of your purchase date. You can see the full list of Amex cards that offer various ways to protect your purchases here.

It’s safe to say that the various protections American Express offers also make them a great choice for holiday shopping or any time you have a large expense.

If you are in the market for a card like this, know that new Amex Platinum cardmembers can currently earn 80,000 points after spending $8,000 on purchases on the card in the first six months of cardmembership.

Some people have targeted welcome offers of up to 150,000 bonus points available to them via CardMatch (offer subject to change at any time, and not everyone will be targeted for the same offer).

Bottom line

Those two claims saved me over $1,400 in cold hard cash.

To put it another way, that’s the same as over two years of annual fees on my beloved American Express Platinum Card (see rates and fees), and that’s before you consider all the other perks that card has to offer.

I got a bit lucky holding on to that Costco TV receipt for three years. I highly recommend choosing an email receipt from any local store when you purchase big-ticket items. That way, you can just search your email for the receipt when things go haywire.

Don’t leave yourself high and dry on big purchases. Make sure you’re getting all the value you can out of those credit cards you carry around in your wallet every day.

To learn more, check out our full review of the Amex Platinum.

Apply here: Amex Platinum

Related: 4 reasons why the Amex Platinum may be the ideal card for Delta flyers

For rates and fees of the Amex Platinum, click here.