Paying for large purchases with a card can be an excellent way to generate a substantial amount of points.

When former TPG contributor Richard Kerr charged a new car to The Platinum Card® from American Express, he earned almost 40,000 American Express Membership Rewards points, which are worth $800 based on TPG’s December 2024 valuations.

Still, making a purchase this major isn’t always easy; he had to negotiate with five dealerships before he found one that would allow him to charge the entire amount to his card. Enrollment is required for select benefits; terms apply.

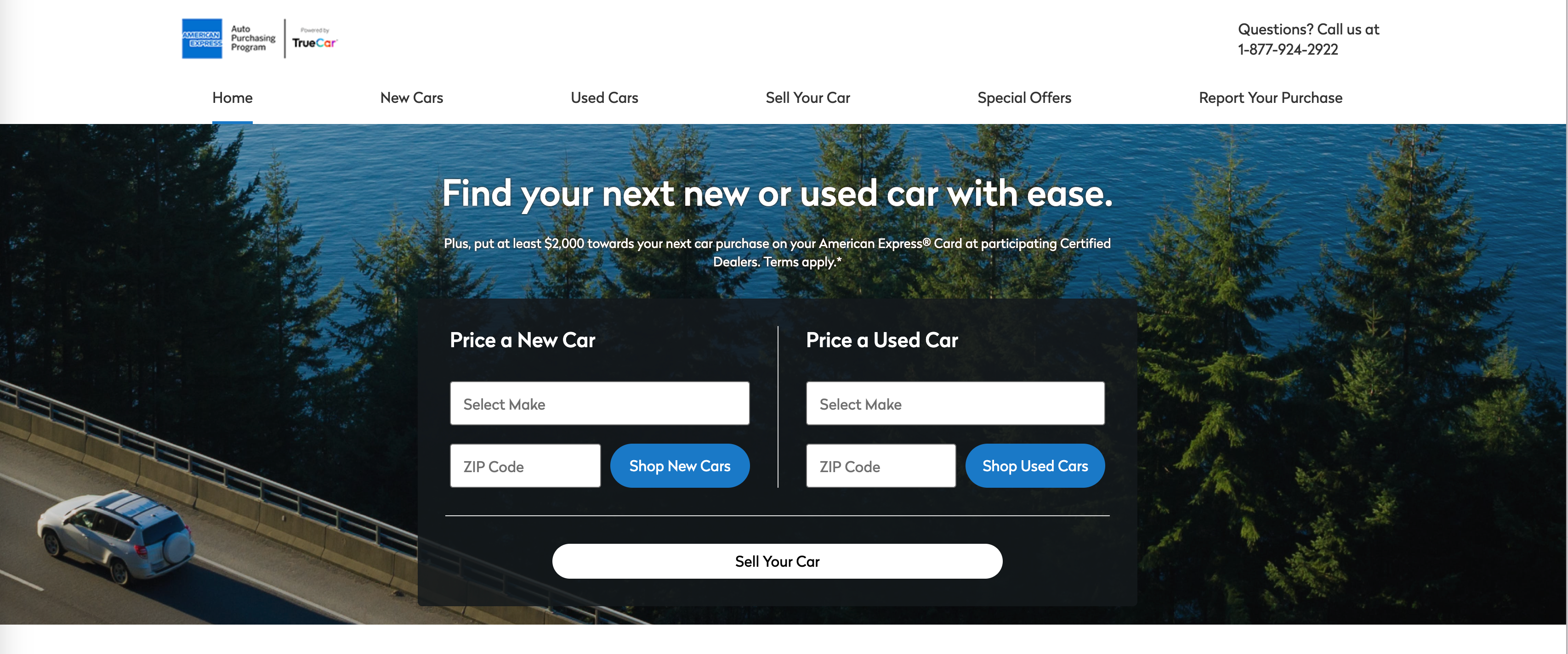

If you want to use an American Express card to purchase a car, Amex’s Auto Purchasing Program may be the way to go. All the dealers affiliated with this program allow you to charge at least $2,000 on an Amex card, and some dealers will allow you to charge the entire purchase price. Here’s what you need to know about Amex’s Auto Purchasing Program.

Related: How to redeem American Express Membership Rewards for maximum value

What is the Amex Auto Purchasing Program?

The Amex Auto Purchasing Program is an Amex-specific version of the TrueCar digital automotive marketplace. TrueCar provides data on what other consumers have paid for specific vehicles and “upfront price offers” from participating certified dealers in your area.

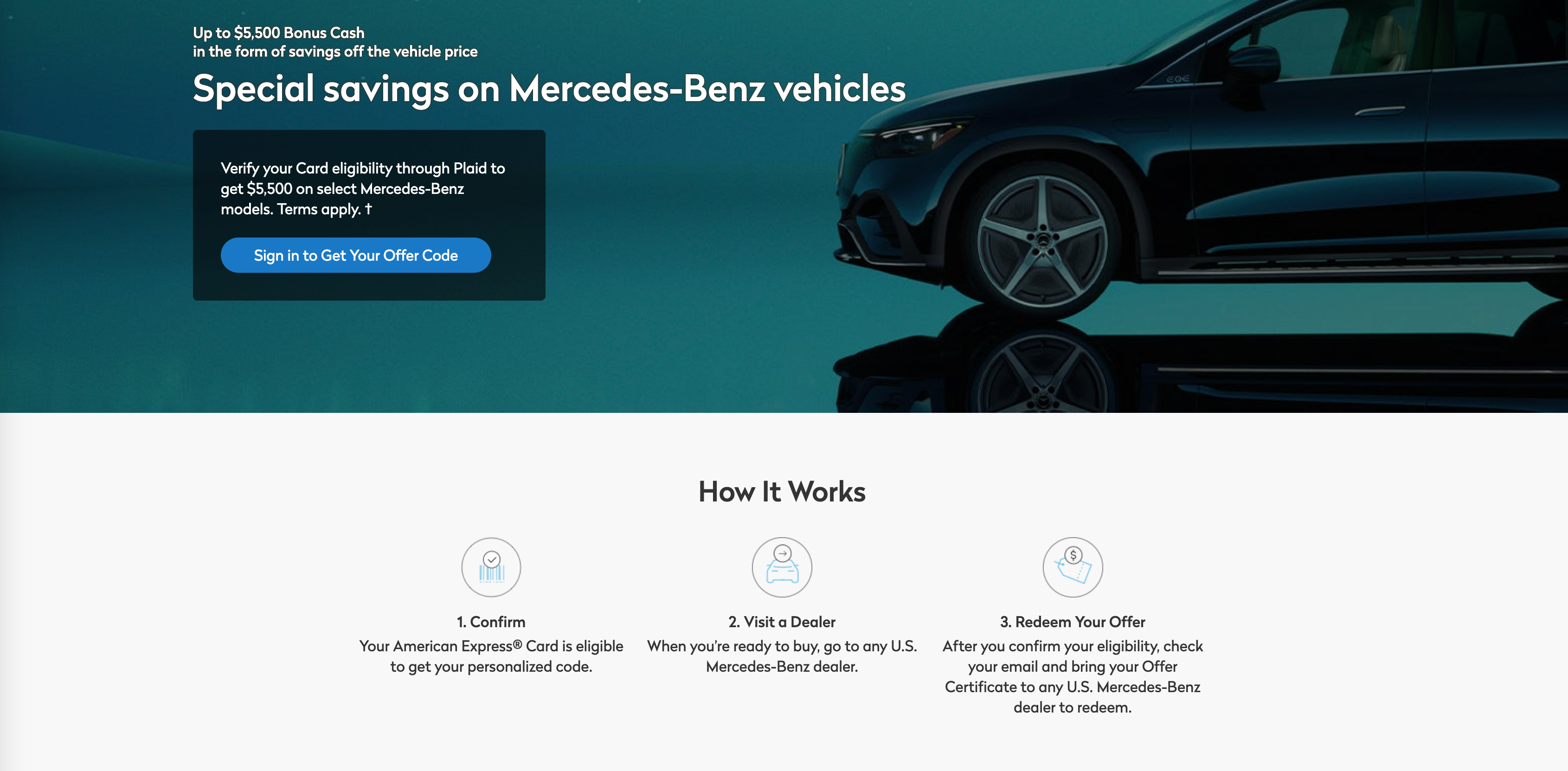

The Amex version of TrueCar lets Amex cardholders connect with 7,000 dealers that accept American Express. All participating dealers accept American Express cards for at least $2,000 of the purchase price, and some allow Amex cardholders to use their cards to pay for the full purchase price. Plus, you can use the site to request discounts from certain dealers, such as Mercedes-Benz dealers in the U.S., for special savings.

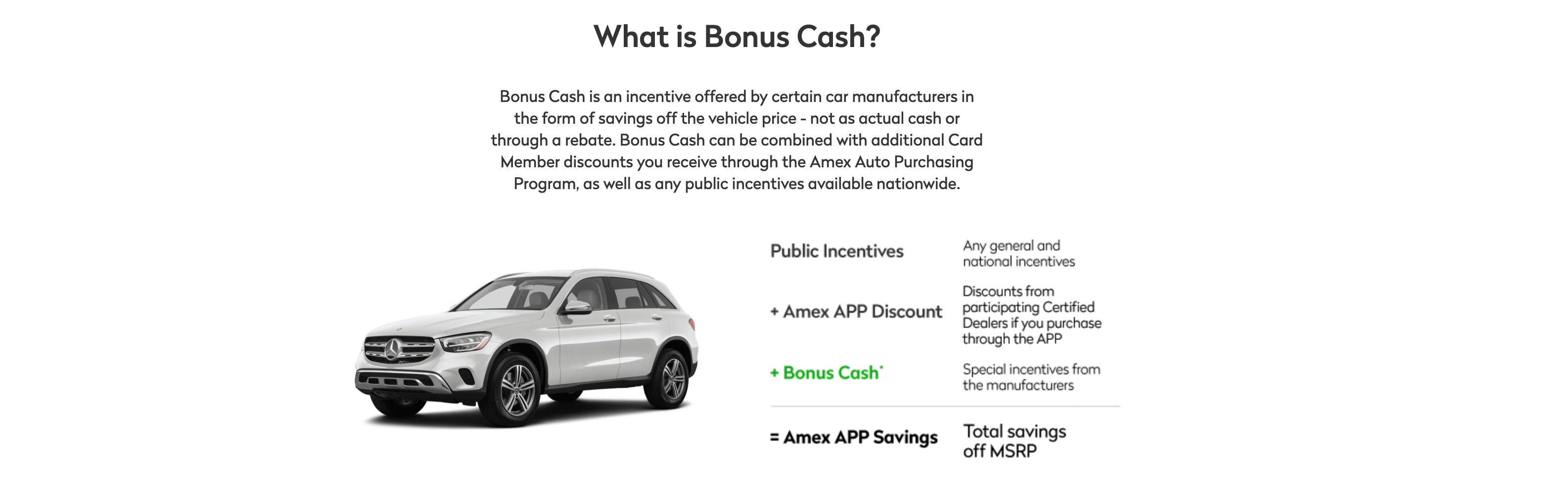

You could also stack these deals with bonus cash offerings from certain car manufacturers.

These deals contribute to total savings off the manufacturer’s suggested retail price.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: Save money on your next trip: Use these tips to never pay full price for a rental car

How does the Amex Auto Purchasing Program work?

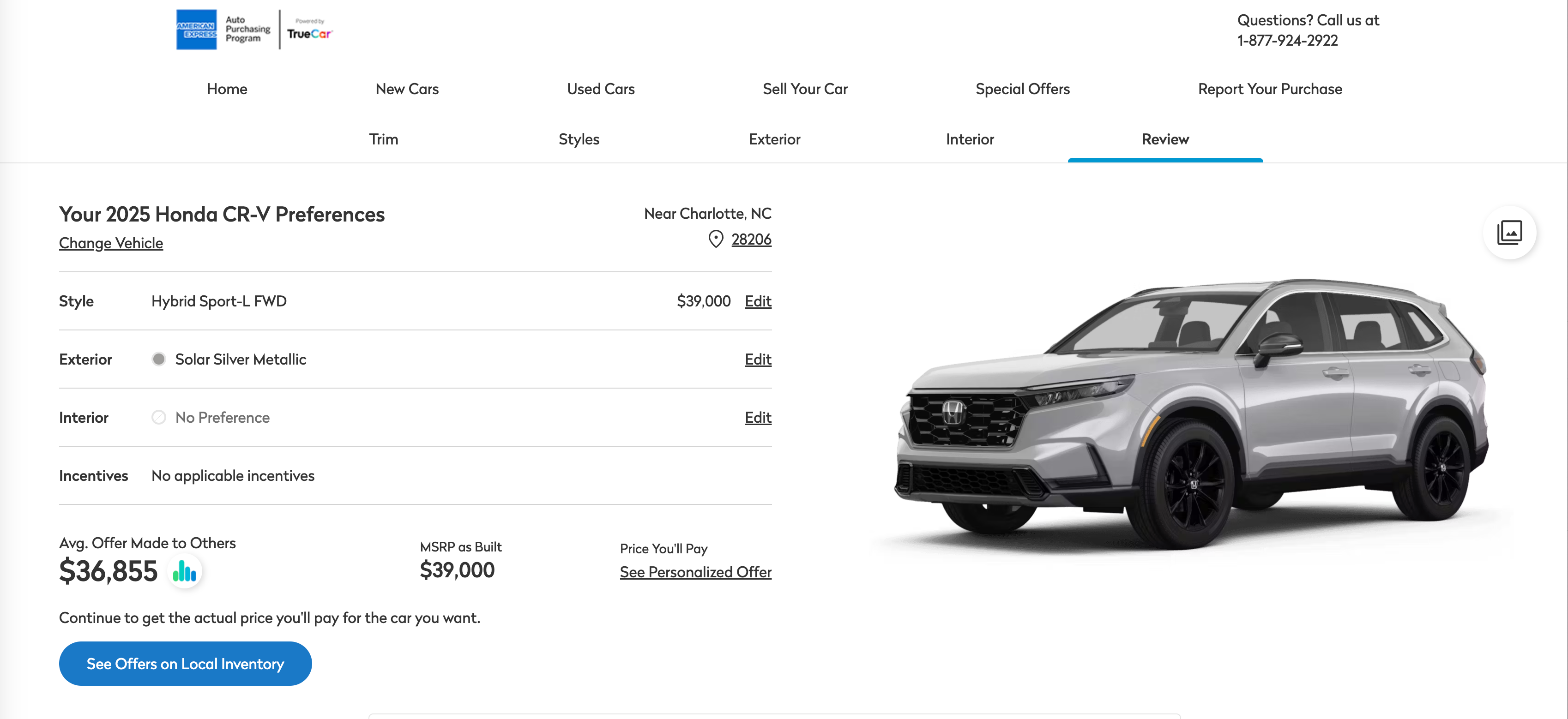

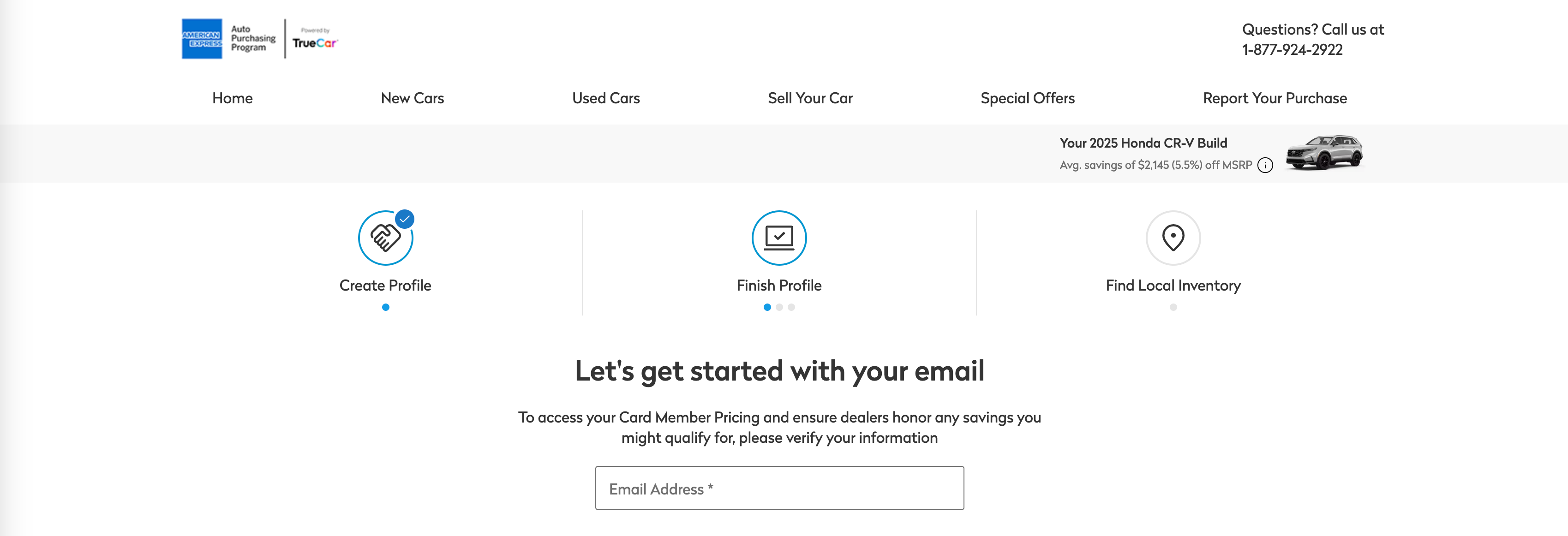

Once you know what type of car you want to buy, you can check your options through the Amex Auto Purchasing Program by visiting amexnetwork.truecar.com. Enter the make of the car you want to purchase, as well as the ZIP code for the area in which you want to make the purchase. Then, select the desired model type and continue to the next page to select the style, color and options.

Once you click “See Offers on Local Inventory,” you’ll be taken through a series of pages where you’ll need to provide your name, email, phone number and address. The phone calls and emails will start about a minute after you enter this information, so I recommend not using your primary phone number and email — or setting up filtering options so you can shop and communicate on your own schedule.

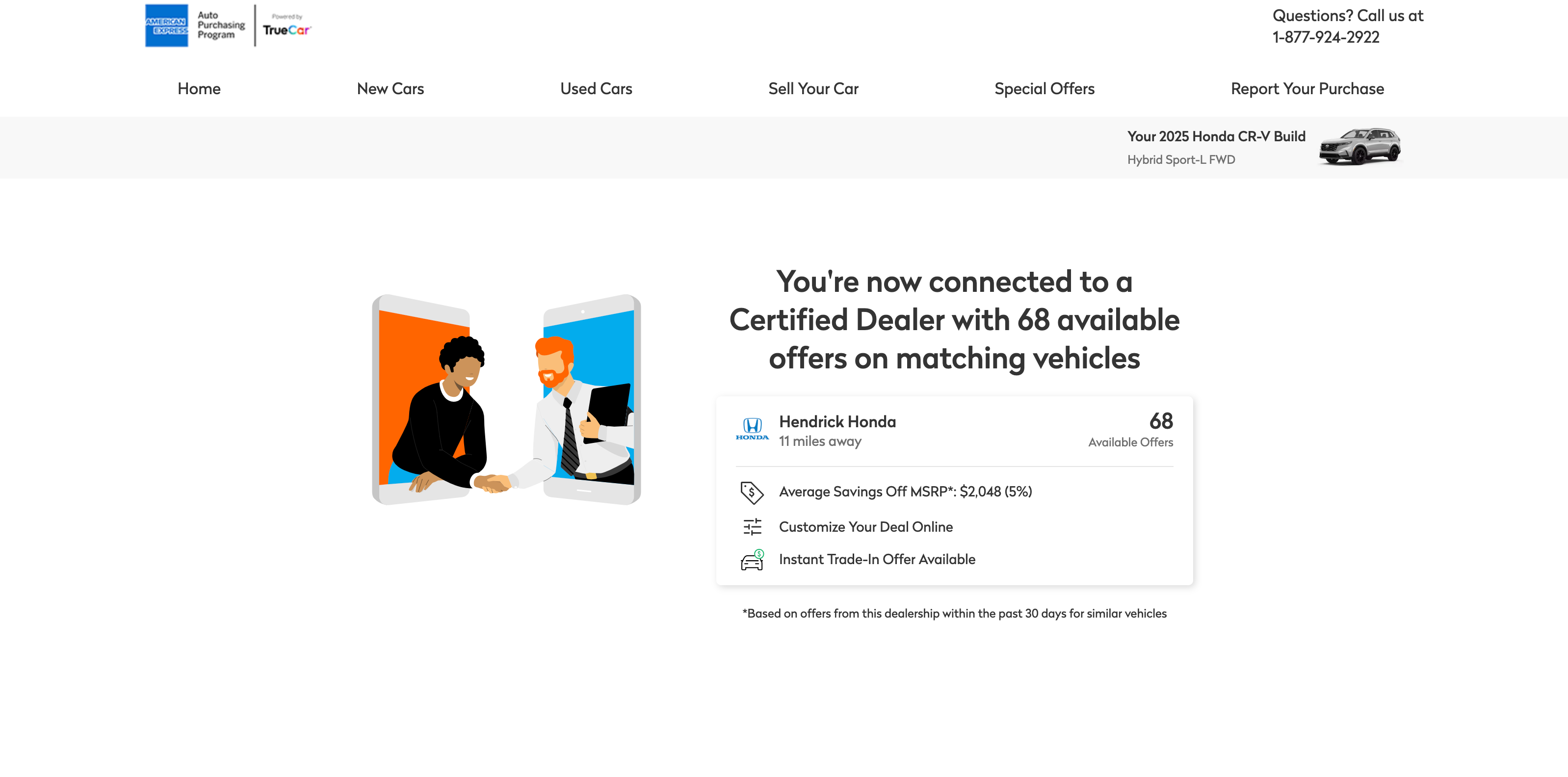

You’ll be given a few options on the next page. For my search in Charlotte, I was given five dealers with a large number of offers available at each.

Although I inputted the car style, color and options that I wanted on a previous page, the results shown to me at this point seemingly ignored these selections and instead simply showed me all the options for the model type, which was a bit overwhelming.

I wasn’t able to find an explicit mention of whether these dealers would allow me to pay in full with an Amex card, though each is required to accept at least $2,000 from the card. You may need to negotiate with each dealer regarding the exact amount they’ll allow you to charge.

Related: 9 best rental car rewards programs you need to know about

Pros of the Amex Auto Purchasing Program

There are three main reasons why you might want to use the Amex Auto Purchasing Program when buying a car:

1. It can help you gather data on what others have paid for the car you want.

2. You can obtain a special savings offer code that could save you thousands off the MSRP.

3. It will show you dealers that will accept an Amex card for the purchase.

The special savings offer code gives you a dealer-provided price on the car and options you selected, as well as your guaranteed savings. If you don’t like haggling, this may be a good way to ensure you pay a reasonable price.

Plus, if you’re looking for a dealer that will accept an Amex card for part or all of a car purchase, the Amex Auto Purchasing Program will help you find such a dealer.

Related: 11 common rental car mistakes — and how to avoid them

Cons of the Amex Auto Purchasing Program

The two main benefits of going through the Amex Auto Purchasing Program are:

1. The special savings offer that you receive should provide you with a fair price, especially if you aren’t good at negotiating.

2. You can find a dealer that will allow you to charge most or all of a purchase to your card. Enrollment is required for select benefits; terms apply.

After looking into the program, though, I believe most customers can do better on their own.

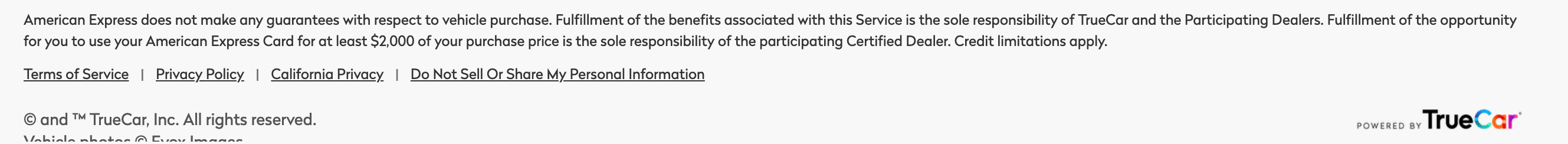

I was unable to find evidence that dealers would allow you to pay full price for your car with an Amex card. The only term I found that explicitly mentioned the amount you can use your card toward said: “Fulfillment of the opportunity for you to use your American Express Card for at least $2,000 of your purchase price is the sole responsibility of the participating Certified Dealer. Credit limitations apply.” Therefore, how much you’re able to put on your Amex card appears to be determined on a case-by-case basis.

If you have the cash saved up to pay for your purchase, the most appealing aspect of using the Amex Auto Purchasing Program is likely being able to put the full amount on your Amex card.

But, unless there happens to be a dealer marked as willing to accept an Amex card for up to the full purchase price in your area, it will likely be better to work with dealers directly. After all, it shouldn’t be difficult to find a dealer that is willing to accept a $2,000 to $5,000 down payment on a card. And, if you’re a good negotiator, you may be able to work out a better deal.

Related: How to rent a car without a credit card

Which Amex card should you use?

So, you’ve found a dealer — either through the Amex Auto Purchasing Program or directly with a dealership — that will let you charge part or all of your vehicle purchase to a card. Now you need to decide which card to use. You should consider the following:

- Do you have any minimum spending requirements to reach? Do you want to sign up for a new card for this purchase?

- Are you planning on using a card? Do you have any credit cards with high credit limits? Can you increase your credit limit on any cards?

- What is the earning rate you would get? Enrollment is required for select benefits; terms apply.

Here are some Amex cards you might consider for the purchase:

You should only charge as much to your card as you can pay off when your bill comes due. Some cards do have 0% introductory annual percentage rate offers. If you use a card with a 0% introductory APR offer to finance your car purchase, be sure to pay off your balance completely before the end of the introductory period to avoid interest and fees.

Related: 9 things you didn’t know you could pay for with a credit card

Bottom line

I had high expectations that the Amex Auto Purchasing Program would simplify the process of finding a dealer that would accept a card for most or all of a car purchase. However, the website interface is frustrating to use, and I was unable to find a guarantee that I could pay for my entire purchase with a card.

If you want to use a card to pay for some or all of an upcoming vehicle purchase, you may just need to do what Richard Kerr did: Visit a dealership, negotiate a firm price offer and then say you plan to pay for the entire purchase using your card. If the dealer won’t allow you to charge as much as you want, then move on to the next dealer.

You’ll eventually find a dealer that’s willing to make the sale — although it may cost you some time and energy to do so. But getting points on the purchase as well as a good deal will be worth it. Enrollment is required for select benefits; terms apply.

Apply here: Amex Platinum

Apply here: Amex Business Platinum

Apply here: Blue Business Plus Amex

For rates and fees of the Amex Platinum, click here.

For rates and fees of the Amex Business Platinum, click here.

For rates and fees of the Blue Business Plus Amex, click here.