One of our favorite ways to redeem transferable credit card points is to transfer them to airline and hotel partner programs.

While you can redeem points through many credit card programs’ travel platforms to book flights and hotel stays, you’ll only get a fixed redemption value when redeeming your rewards through the travel platform. For example, when you redeem Capital One miles through the Capital One Travel portal, you’ll get a value of 1 cent per mile.

If you wanted to book this one-way flight from New York’s LaGuardia Airport (LGA) to Fort Lauderdale-Hollywood International Airport (FLL) through the Capital One Travel portal, it would cost you $98 or 9,810 Capital One miles.

While you may be saving yourself an out-of-pocket cost of almost $100, TPG values Capital One miles at 1.85 cents apiece, per our November 2024 valuations. Therefore, instead, consider transferring your rewards to an airline or hotel partner program where you can easily obtain a value of more than 1 cent.

However, there’s a very important rule to be aware of before you transfer your credit card rewards.

Related: Ultimate guide to Capital One airline and hotel transfer partners: How to maximize your miles

Credit card points and miles transfers cannot be reversed

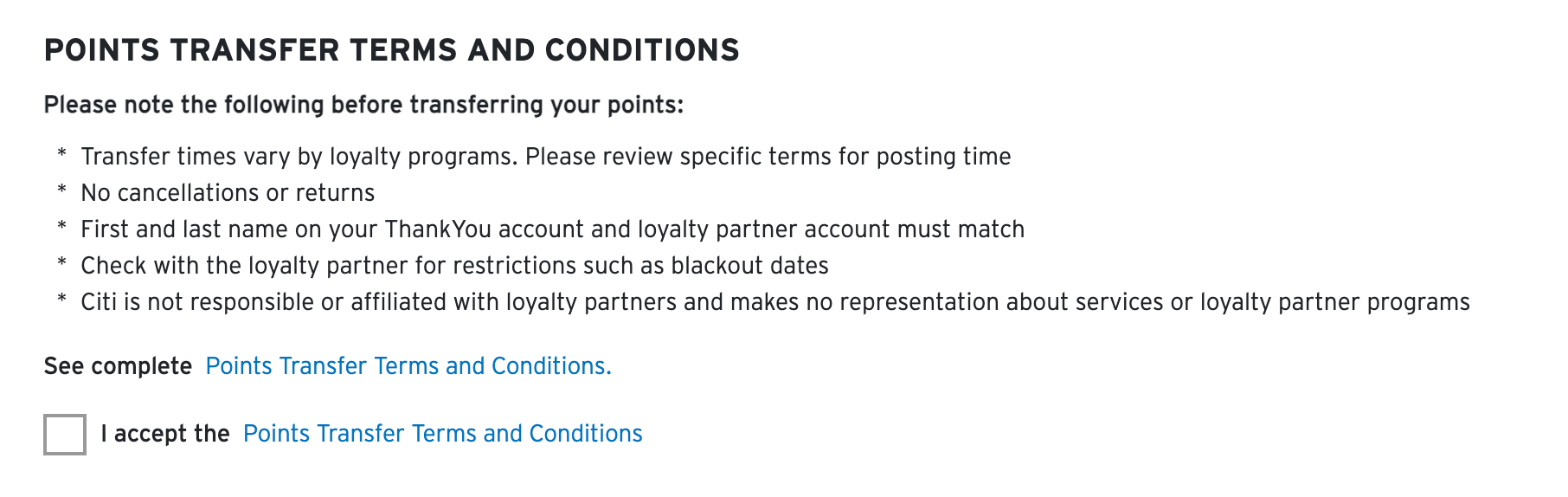

When initiating a points or miles transfer from a credit card program to an airline or hotel partner, you must agree to the terms and conditions of the transfer. These should specify, as Citi ThankYou Rewards does, that transfer times vary and that transfers cannot be reversed.

Therefore, if you decide to transfer your credit card rewards and the flight or hotel availability changes and/or disappears, you, unfortunately, cannot move your points or miles back to the credit card program you transferred them from. The transfer partner will not reverse the transfer on request, nor will the credit card program, and the points will be “stuck” in that program.

Related: Citi transfer partners: Maximize your ThankYou points with these loyalty programs

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

To help mitigate some of this transfer “risk,” you should always check award availability before initiating any transfers. We also recommend you sign up for airline and hotel loyalty programs well in advance of any transfer and not the day of, as this may reduce the chance of any significant delays. Also, be sure to check that the name on your credit card and the name on your airline or hotel loyalty account are the same.

While we have found that most program transfers are instantaneous, some programs take more than 48 hours for the transaction to be complete. Plus, transfer times can vary from person to person.

Related: Check transfer times before initiating points transfer requests

Credit card rewards programs regularly offer transfer bonuses, and you may be tempted to take advantage of these promotional offers even if you don’t have an immediate redemption in mind. While some frequent travelers are fine with stockpiling extra rewards because they know they’ll use them in the near future, there is a risk in this strategy. Even though you may increase your loyalty account balance by 20% or 30% through a transfer bonus, programs frequently devalue their award redemptions. Plus, finding availability to use those points or miles may be hard to find.

Therefore, a better strategy may be to stockpile credit card rewards points in your account and only move them when you act on a redemption opportunity.

Bottom line

While we regularly encourage and advise people on the best transfer options for their credit card points and miles, we do not recommend transferring any credit card points or miles to airline or hotel partner programs until you have a specific use for them. For example, just because transferring credit card points to Air Canada’s Aeroplan program can be a great way to book United Airlines flights doesn’t mean you should transfer all your credit card points or miles to Aeroplan.

Again, credit card travel partner transfers cannot be reversed.