Redeeming airline points and miles used to be so simple.

Once you had a destination in mind, you checked the award chart of your favorite program to see how many points or miles the program charged. Provided there was availability, you could book the flight for that fixed price plus a small amount of cash to cover mandatory government taxes and airport fees.

However, this value proposition became more complex over time. When global fuel prices rose, some programs added fuel surcharges to redemptions, arguing that providing these award seats was expensive (fuel usually being an airline’s biggest expense).

In theory, this was unwelcome but not unreasonable. The problem was that when fuel prices dropped, the surcharges did not. Many programs have now renamed these fuel surcharges “carrier-imposed surcharges,” as they bear no correlation with fuel prices.

Still, many airlines did not impose fuel surcharges. You could book a long-haul flight for as little as $5 in fees and taxes plus the points and miles, which was a great deal.

Then, the major U.S. airline programs started slowly but surely removing their award charts and switching to dynamic pricing. They reasoned that cash prices fluctuate depending on demand, so redemption levels should, too. During off-peak periods, members could still redeem their points and miles at the lowest levels, but when demand for seats increased, so did the amount of points and miles required.

If you have valuable transferable credit card points, you often have to choose between programs with fixed award charts but high surcharges and programs with low or no surcharges and dynamic pricing.

So, which is ultimately the better way to go?

Related: How much will your vacation really cost? The scourge of dynamic pricing is spreading like wildfire

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Business class to Europe

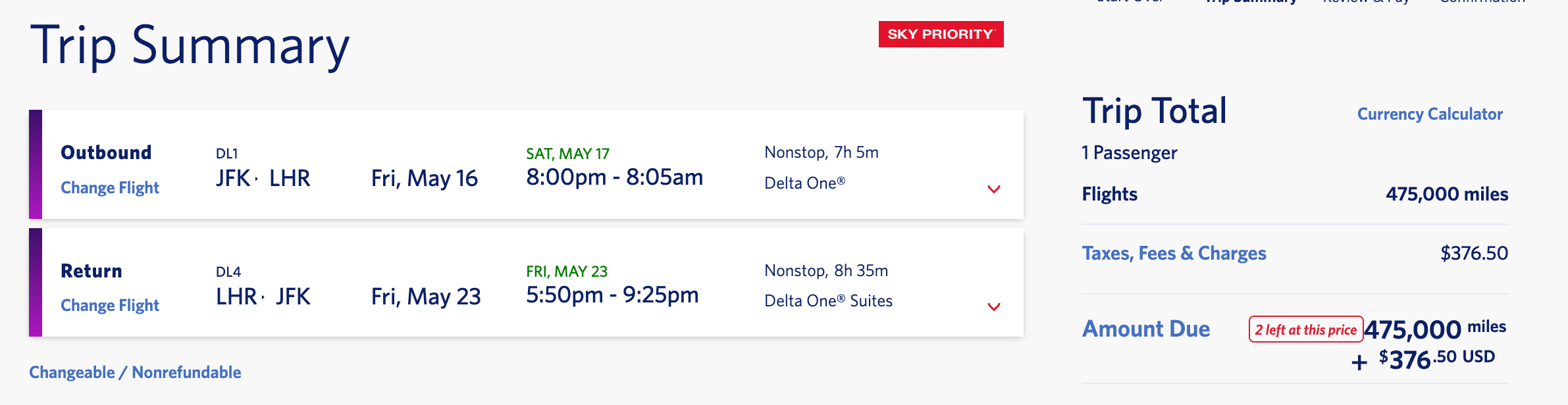

Let’s first look at your options to book business-class flights from New York to London in May 2025. You could transfer your credit card points to a program with dynamic pricing, like Delta SkyMiles, which doesn’t charge fuel surcharges. Fuel surcharges to this destination are higher because of the United Kingdom’s Air Passenger Duty tax.

While the cash required is only $376.60, you’ll need a whopping 475,000 SkyMiles per person round-trip.

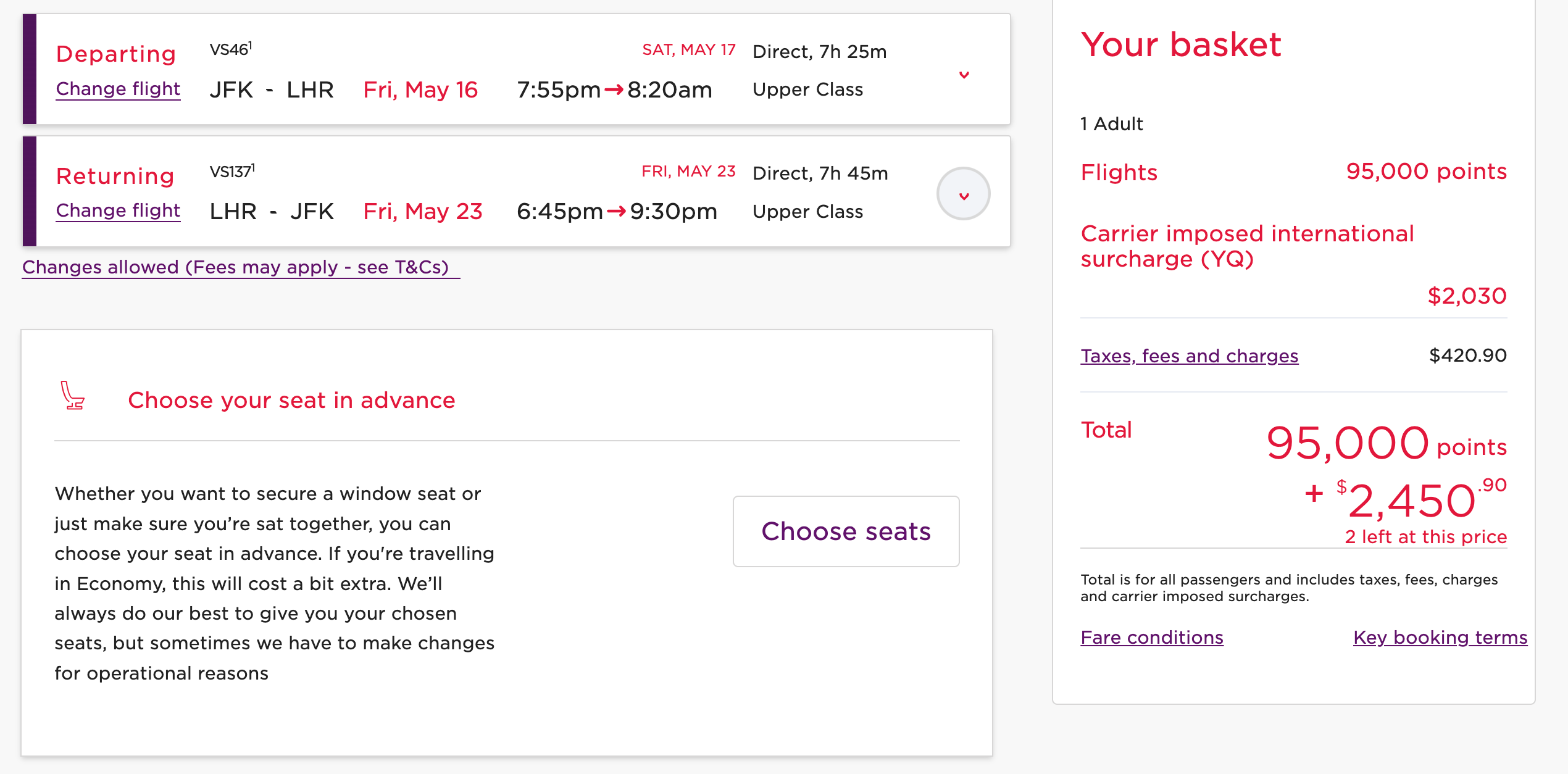

Alternatively, you could transfer your credit card points to a program that has a fixed award chart but adds surcharges, such as Virgin Atlantic Flying Club, the program for Delta Air Lines’ SkyTeam partner Virgin Atlantic.

Virgin Atlantic adds an eye-watering $2,000 as a carrier-imposed surcharge. However, you’ll only need to part with 95,000 Virgin Atlantic points, compared with the more than 475,000 SkyMiles option above on the same round-trip New York-to-London option.

So, which is the better option? Let’s estimate each cost using TPG’s September 2024 valuations.

- Redeeming Delta miles: 475,000 multiplied by 1.2 cents plus $376.50 equals $6,076.50

- Redeeming Virgin points: 95,000 multiplied by 1.4 cents plus $2,450.90 equals $3,780.90

In this case, booking with Virgin Atlantic Flying Club would provide much better value. Although a huge surcharge is needed, it requires a fraction of the points.

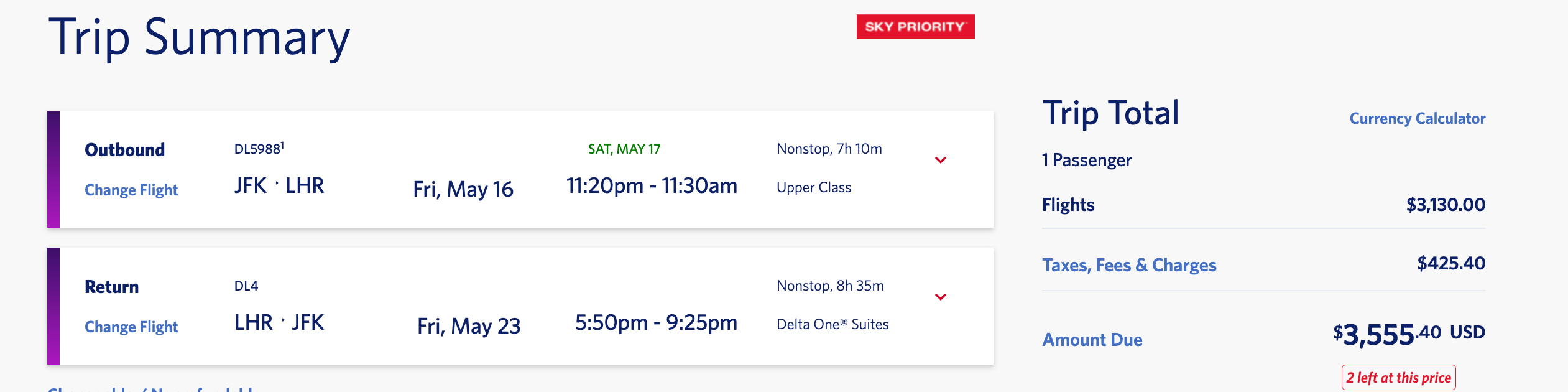

This redemption is still costly, so it’s worth checking the cash fares on the same dates. With Delta offering nonstop business-class flights for $3,555.40 round-trip, paying cash could make more sense since you will also earn SkyMiles for this cash fare.

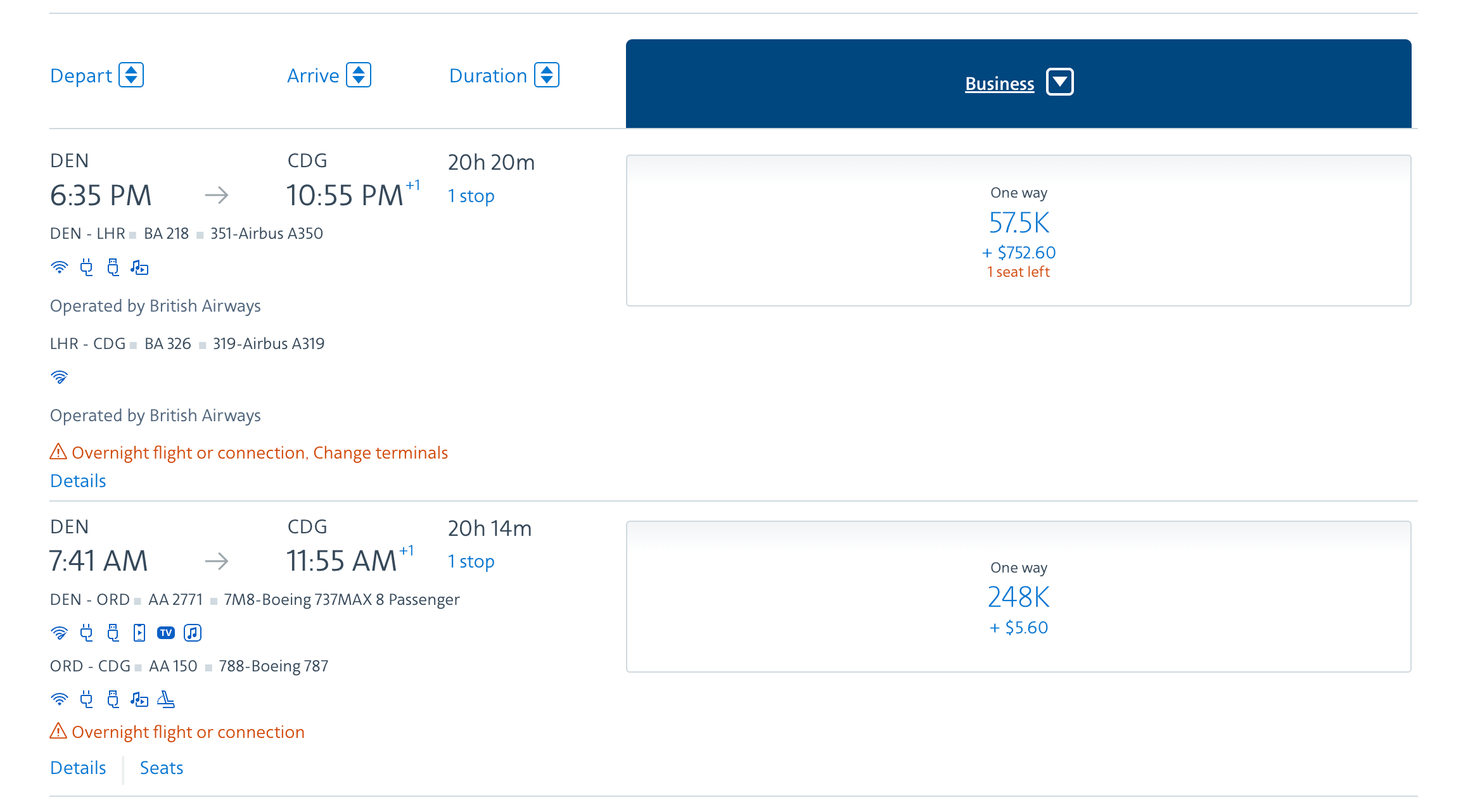

Let’s look at another example. American Airlines AAdvantage currently uses dynamic pricing for flights operated by American Airlines but has retained an award chart for partner airlines (passing on the surcharges where the operating carrier would charge its members the surcharges).

Let’s look at a one-way business-class redemption from Denver International Airport (DEN) to Paris-Charles de Gaulle Airport (CDG) in April 2025. As there are no nonstop options bookable through AAdvantage, you could choose to fly British Airways via London or American Airlines via Dallas. The British Airways option is priced using an award chart, so fewer miles are required, but the surcharges are greater; the American-operated option is priced dynamically but without surcharges, so more miles but less cash are required.

Here is the cost of each, using TPG’s September 2024 valuations.

- Redeeming AAdvantage miles flying American Airlines: 248,000 multiplied by 1.6 cents plus $5.60 equals $3,973.60

- Redeeming AAdvantage miles flying British Airways: 57,500 multiplied by 1.6 cents plus $752.60 equals $1,672.60

Again, in this example, it would be a much better deal to choose the surcharges option, as you won’t be using nearly as many miles. This would be an excellent redemption, with one-way cash fares starting from $3,800 on the same dates.

Premium economy to Dubai

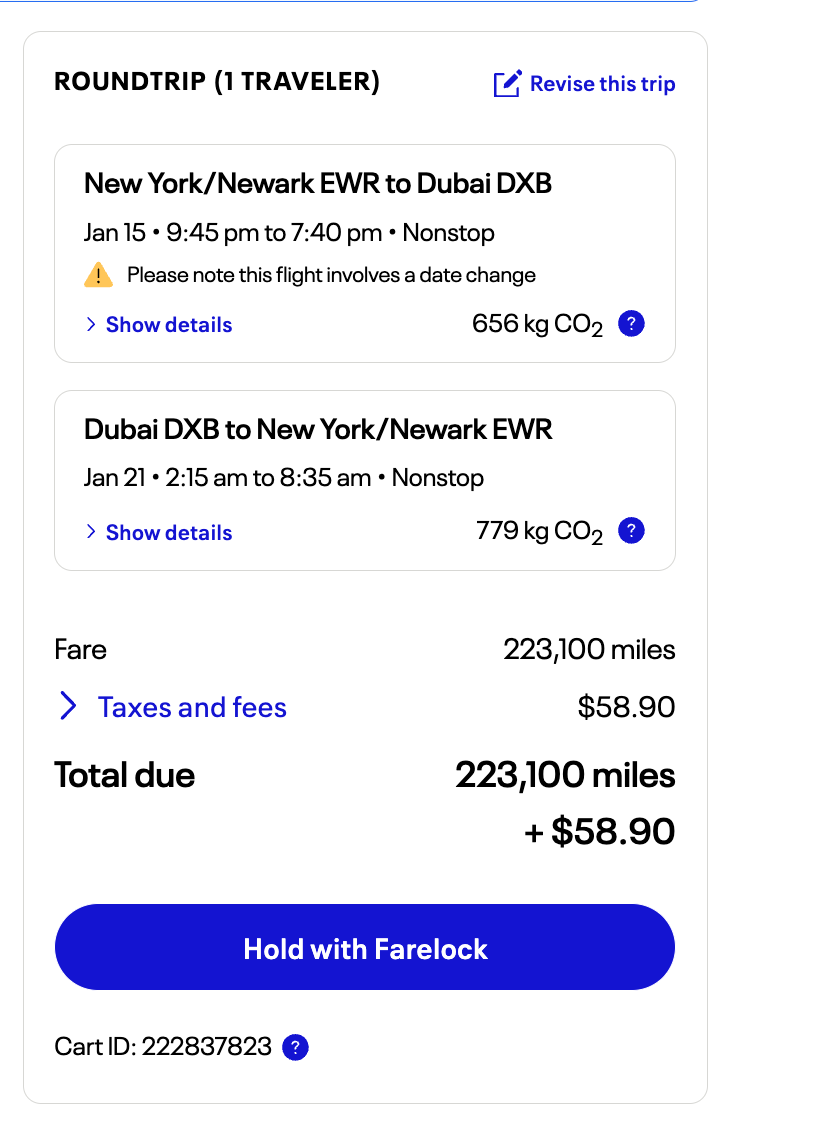

With United Airlines’ nonstop service from Newark Liberty International Airport (EWR) to Dubai International Airport (DXB) now operational, let’s compare the cost of flying the route in premium economy in January 2025, an excellent time to visit sunny Dubai. You could book through United MileagePlus for 233,100 miles plus a low $58.90 in fees and taxes, as United does not charge surcharges.

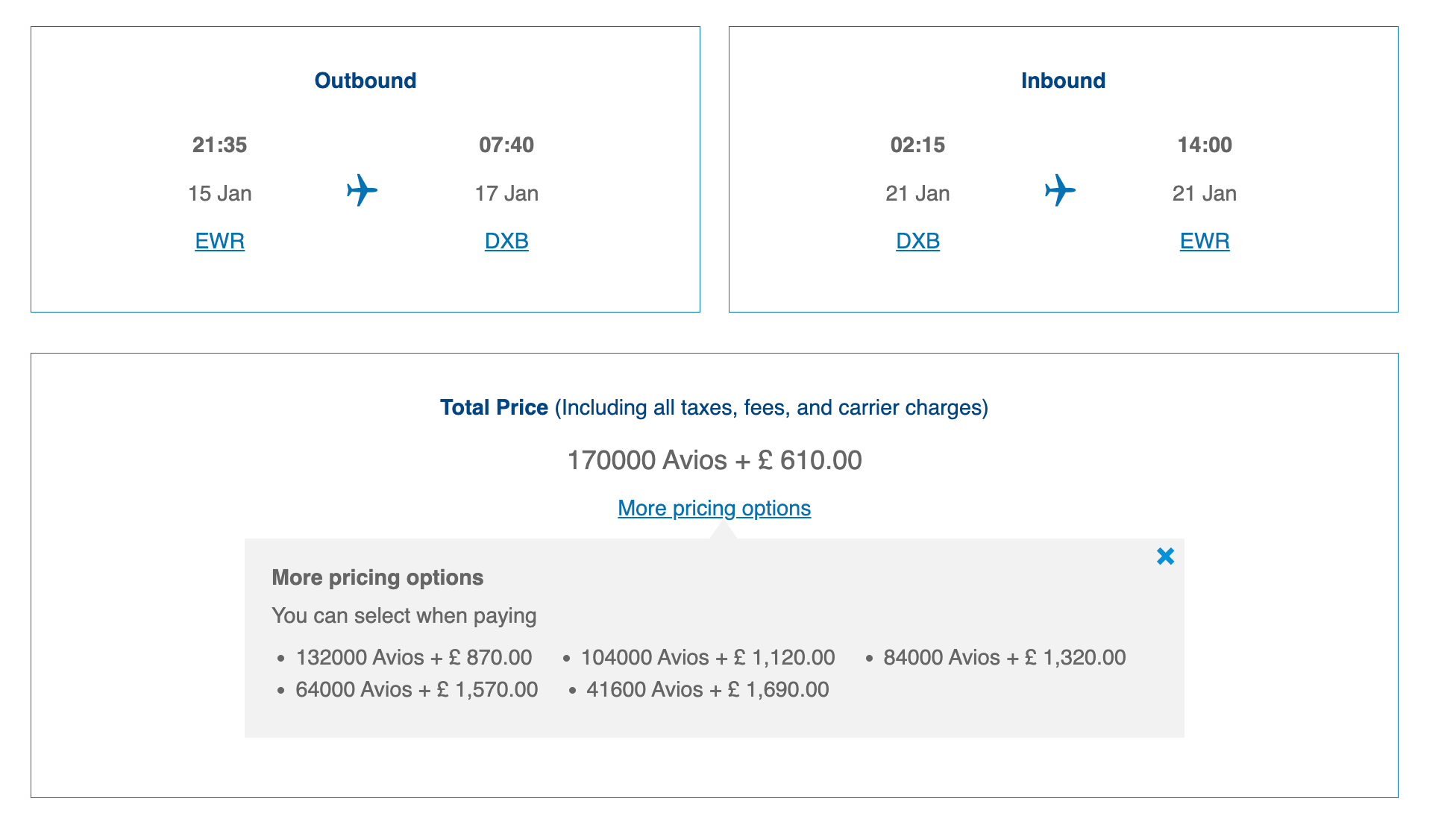

Alternatively, you could book through a program with a fixed award chart, like British Airways Executive Club. This program charges fewer Avios (170,000) but adds 610 British pounds ($854) in taxes, fees and surcharges for a similar route that is not direct.

Using TPG’s September 2024 valuations again, here is the cost between the two redemption options:

- Redeeming United miles: 223,100 multiplied by 1.35 plus $58.90 equals $3,070.75

- Redeeming British Airways Avios: 170,000 multiplied by 1.4 plus $718 equals $3,098

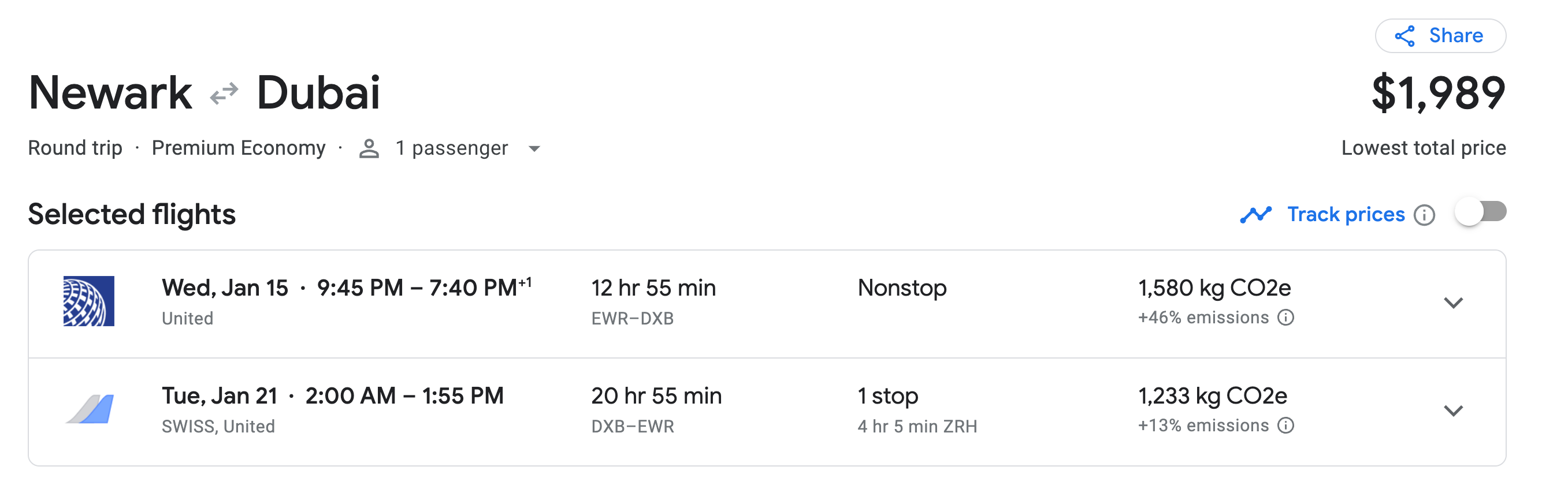

In this instance, both options are equal, noting that the United flight is probably preferable, as it is nonstop. But again, check the cash fares, as there is the option of flying on the nonstop United flight in premium economy and flying back on a combination of Swiss and United via Zurich Airport (ZRH) for under $2,000 round-trip.

How to earn transferable points

Transfer partners differ from card issuer to card issuer, but here are some of our favorite cards offering strong welcome bonuses you can convert to some, if not all, of the programs discussed above:

- American Express® Gold Card: Earn 60,000 bonus points after spending $6,000 on purchases in the first six months of card membership. Plus, receive 20% back in statement credits on eligible restaurant purchases (up to $100) within the first six months of card membership. Terms apply.

- The Platinum Card® from American Express: Earn 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. Check to see if you’re targeted for a higher welcome offer through CardMatch (offer subject to change at any time). Terms apply.

- The Business Platinum Card® from American Express: Earn 150,000 bonus points after spending $20,000 on eligible purchases in the first three months of card membership.

- Capital One Venture Rewards Credit Card: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.

- Capital One Venture X Rewards Credit Card: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.

- Chase Sapphire Preferred® Card: Earn 60,000 bonus points after spending $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred® Credit Card: Earn 90,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

Related: Why transferable points are worth more than other rewards

Bottom line

The great and terrible thing about dynamic pricing is that it wildly fluctuates daily. If you travel in off-peak times (such as to Europe in winter), these dynamic prices may be close to the old award chart prices. Combined with low fees and taxes, this can be a terrific way to redeem your points and miles.

If you want to travel when demand is high, choosing a program with fixed award charts can be better. This way, you know you will pay a reasonable amount of points and miles, even if the surcharges are high. If in doubt, do the math using our valuation of points and miles, as we did above.

As always, it is a good idea to check award availability before transferring credit card points to any program, as the transfers cannot be reversed if you’re unable to find award availability through your chosen program. Also, check cash fares, as you may be able to find a reasonable cash option instead.