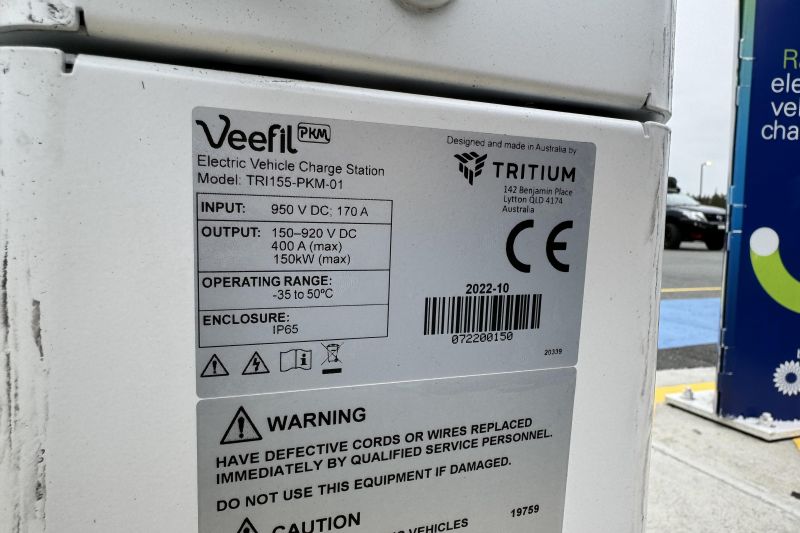

Electric vehicle owners who have recently visited a public charging station and seen ‘faulted’ or ‘out of service’ notice on one, if not all of the chargers, are likely to have come across a Tritium charging unit.

The Brisbane-based company was once one of Australia’s biggest success stories, as the manufacturer of electric vehicle chargers deployed all over the world and used by brands such as Tesla, BMW, Mercedes-Benz, ChargeFox, and many others.

Tritium’s current financial and business issues have been well documented, with the company that was once valued at over $2 billion USD ($3 billion) on US NASDAQ now worth a little over $25 million ($38 million) and fighting for survival amid a series of issues, including the quality of its product and its capacity to provide ongoing warranty.

The company is currently in negotiations to find external capital as state and federal governments refused to hand over taxpayer funds to keep it afloat – despite already tipping millions into the company over the past few years.

With the Brisbane factory closed for good and NASDAQ hitting the business with a show-cause notice late in 2023 about its underperformance (applicable to companies with a share price of under US$1 for more than 30 consecutive days), CarExpert spoke with numerous ex-Tritium employees on the condition of anonymity to shed light on the company’s apparent mismanagement from the top, and the quality of the chargers produced.

“There were a lot of design flaws [in the chargers] that were mostly ignored. People at the top refused to make the necessary changes,” one former employee told CarExpert.

“I loved the company and the career progression opportunities that were at hand, but it wasn’t too long until I started to notice the company was losing its spark due to bad management. No one wanted to take accountability when things went wrong but rather played the blame game. Issues were never resolved because of that.”

Tritium had been a point of pride for Australia overseas with even the likes of Prime Minister Anthony Albanese mentioning the manufacturer as a local example of innovation and success as recently as October 2023.

CarExpert interviewed Tritium chief executive Jane Hunter in 2020, at which time the company had deployed more than 4500 charging stations and provided over 600,000 sessions in more than 33 countries. It claimed to hold around 50 per cent share of the world-leading market for DC chargers in Norway, and around 15 per cent of the wider global market.

So how did a company in such a seemingly dominant position have such a spectacular fall from grace?

“New employees were not being trained properly to do the job on the assembly line. That resulted in a lot of mistakes, which set them back. They also neglected consumer feedback and were very reluctant to make necessary changes to please the consumer,” another former employee told CarExpert.

“When they started losing customers and contracts, the panic began, and they started to get rid of employees with very little notice… I had high hopes for the company and wanted to be part of their success.”

Tritium posted $US185 million ($280 million) in revenue for the 2023 financial year, which was more than double its performance for the year before. Nonetheless, it has been running at a consistent loss since going public.

At one stage last year, Tritium reportedly asked for government assistance to the tune of $90 million as a cash for equity injection, or a $30m investment to keep its Brisbane factory open. Both requests were seemingly denied.

Since March 2020 Tritium has been led by Jane Hunter, who was previously the chief operating officer of Boeing Systems Analysis Laboratory (SAL, part of the Boeing Phantom Works) also based in Brisbane.

Since going public in March 2021 the company’s share price has fallen from over $10 USD to $0.14 USD cents today – a 98 plus per cent decline in valuation.

One of Tritium’s largest shareholders, billionaire Brian Flannery whose shares fell from almost $140 million in valuation in 2021 to around $2 million today, told the Australian Financial Review in November last year the company had not made the right calls to reduce costs.

“The current directors have let it go too far and watched the margins disappear,” he told the AFR.

Former employees concurred with that assessment, with one calling out the rotating door of high-ranking officials at Tritium as a red flag.

“The issue was internal. Company directors would either quit or get fired. There are people within the company responsible for the dysfunction. The ones with good intentions had little power and could not do anything but give up. There were too many egos within the company. They needed to filter that out for better progress.”

With the cost of electric vehicle charging infrastructure partially funded by the taxpayer in Australia, Tritium’s fall from grace is a bitter pill to swallow not just for current and future electric car owners, but for the future of technology manufacturing in the country as whole.