Unprecedented EV sales and a lack of funding to keep pace with them have put Oregon EV and plug-in hybrid rebates on hold.

The Oregon Department of Environmental Quality (DEQ) recently announced that it is temporarily suspending the state’s Clean Vehicle Rebate Program due to projections showing that it will be oversubscribed by late spring. April 30 is the last day to purchase or lease a vehicle that can qualify for a rebate.

2023 Nissan Leaf

The program is funded annually from Oregon’s Vehicle Privilege Tax, which covers the rebates themselves as well as secondary costs like administration and community outreach, according to a DEQ press release, adding that some funds were carried over from last year. Based on the current volume of EV sales, the agency expects the current $15.5 million set aside for rebates to run out in the next few months.

The state’s Clean Vehicle Rebate Program was introduced in 2018, offering rebates of $750 to $2,500 for qualifying new EVs, plug-in hybrids, or electric motorcycles with a base MSRP under $50,000. A Charge Ahead component all those making up to 400% of the federal poverty guideline qualify for a rebate of up to $5,000, meaning that lower-income buyers can get up to a $7,500 state rebate on top of whatever federal rebate they’re able to claim.

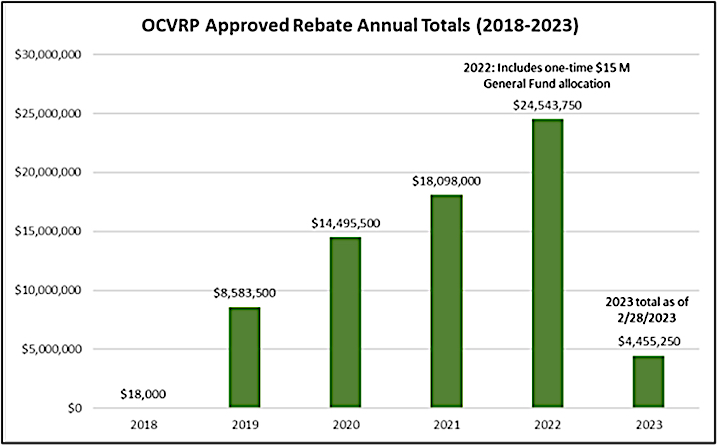

The Oregon program has issued more than $71 million in rebates since its launch.

2023 Kia Niro Plug-In Hybrid

Oregon residents who purchase or lease an eligible EV, plug-in hybrid, or electric motorcycle may still apply for a rebate, and the Oregon DEQ has launched an available funding page to track how much money is left for 2023 rebates. Once funding is depleted, applications will be placed on a waiting list pending renewed funding for 2024. There is no waiting list for vehicles purchased or leased after April 30; those vehicles will not receive state rebates, the DEQ noted.

EVs not covered by the state program could still qualify for federal tax credits, the DEQ noted, but that is also no longer straightforward because of new rules enacted under the Inflation Reduction Act (IRA). The rush leading up to the rule change may actually be exacerbating Oregon’s funding problem.

According to the electric vehicle advocacy group Forth, there is some hope for the rebate to continue, if the Oregon Legislature can pass a state bill that would appropriate another $30 million to the program, continuing it to 2025.

Oregon annual EV rebate totals

“Oregon’s electric car rebate is a key tool for fighting climate change, protecting families from unpredictable fuel costs and building energy independence,” said Forth’s executive director Jeff Allen. “This is a terrible time to make it more confusing and more expensive for Oregonians to choose a clean electric car.”

EV sales have been front-loaded this year because Internal Revenue Service (IRS) guidance will effectively cut the tax credit for some U.S.-built EVs to $3,750 or less when it’s released. The IRS has promised that it would fast-track the new rules, but that’s resulted in a strange run on purchases and claims for those who want the full federal amount while they can get it.

This isn’t the first time a state EV incentive program has run low on funds due to strong demand. California made its EV incentives smaller in 2021, partly because of funding, while also lowering MSRP and income caps.

The U.S. West Coast is now aligned, as part of California’s Advanced Clean Cars regulations and what’s effectively a ban on non-plug-in ICE vehicles by 2035, with both Oregon and Washington pledging to join California. In the short term, though, it seems Oregon won’t be able to use incentives as a tool to spur further EV adoption.

–with reporting from Bengt Halvorson