Germany wants to reduce its dependency on China, its most important trading partner, and that includes the materials it imports for semiconductor chips and electric vehicle batteries.

Calling China “simultaneously a partner, competitor and systemic rival”, German Chancellor Olaf Scholz has released a fairly high-level strategy document that asserts its values and outlines how it will protect its interests.

Germany says it will diversify its supply chains to spread risk more widely.

“The goal is not to disconnect us,” said Chancellor Scholz on Twitter.

“However, we want to avoid critical dependencies in the future. With [the strategy] we are responding to a China that is changing and taking a more offensive stance.”

“It is a priority for us to reduce such risks swiftly and at a cost that is acceptable to the German economy, especially if such risks concern products that are essential for health, the energy transition or technological innovation,” the strategy document reads.

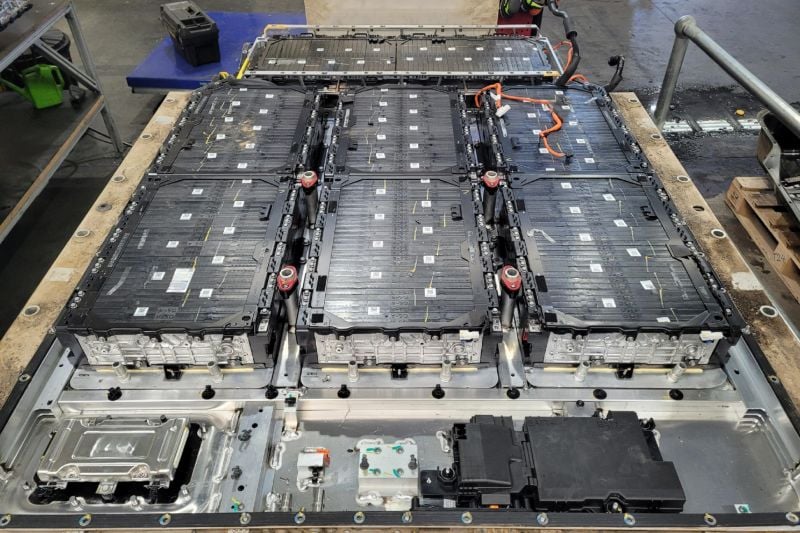

The strategy document specifically cites dependencies Germany has on China for various metals and rare earths and lithium batteries.

It says Germany’s raw materials partnerships will “benefit all countries involved”, with the aim to “support our partners in keeping more value creation in their own countries”.

“In so doing, we are not only promoting prosperity in the countries of origin, but also the long-term competitiveness of the companies there by acquiring expertise and innovations, independent from the mere extraction of raw materials.”

It’s not the only country looking to reduce its dependency on raw materials for electric vehicle batteries, with the United States’ recently passed Inflation Reduction Act incentivising automakers to produce EVs and batteries locally.

Germany says it’s “not pursuing decoupling from China” in the technology sector, as “the creation of separate technospheres is not in our interest”.

However, it says it’s intensifying international cooperation in the sphere of technological innovation and aims to strengthen its cooperation with “partners who share our values”.

Germany says it’s not just reducing its dependency on China as a means to alleviate risk, but also in response to concerns about setbacks in the Asian superpower regarding civil and political rights and curtailed contact with research institutes and government agencies.

It also argues China’s economic strategy “aims to make it less dependent on other countries, while making international production chains more dependent on China”.

“In terms of foreign policy, China is pursuing its own interests far more assertively and is attempting in various ways to reshape the existing rules‑based international order,” the document reads.

“This is having an impact on European and global security,” it adds, noting the country’s relations with others “have deteriorated significantly as a result of this robust approach”.

It also details various geopolitical concerns, including China’s growing influence in the Indo-Pacific region, its strengthened ties with Russia, and its second-largest spending on defence.

However, it says that despite its systemic rivalry, the two countries can cooperate – provided conditions are fair.

China is a critical market for Germany’s automakers.

Volkswagen was one of the first foreign automakers to establish a joint venture with a Chinese partner and build a factory there back in the 1980s.

Fast forward to the 21st century and it still enjoys significant market share in China.

While BYD took the first spot among automakers in China last year when it comes to retail sales, with 1,804,624 vehicles, if you combine the sales of Volkswagen’s two domestic joint ventures the total was 3,022,537 vehicles.

BMW and Mercedes-Benz also have joint ventures in what has become the world’s largest automotive market.

The market has become a lot more competitive, however, with Chinese automakers having taken quite a few lessons over the years and launching increasingly sophisticated vehicles with thoroughly modern technology.

Not only that, Chinese automakers have been expanding their global presence including in Europe itself.

In addition to vehicles Chinese-owned brands like Lotus, Polestar and Volvo, the European electric vehicle market is teeming with Chinese names like Aiways, BYD, GWM (through its Ora brand), MG, Nio and Xpeng. Some of these companies, like MG and GWM, also sell combustion-powered or hybrid vehicles.