Posted: 1/14/2024 | January 14th, 2024

Travel insurance provides a vital safety net against unexpected costs that may arise due to the myriad things that can go wrong on the road. That includes everything from illness and injury to canceled flights and lost luggage to the death of a family member back home.

I know, it’s not fun to think about, but travel insurance is the single most important thing you should purchase before your trip. It’s something I strongly advise travelers to never leave home without (I buy it for every single one of my trips). I’ve seen it help many, many people over the years. Myself included.

It’s easier than ever to find a policy that meets your needs and budget, especially with tools out there like InsureMyTrip.

In this InsureMyTrip review, I’ll go over what the company offers and the pros and cons of using them as a service to use when planning your trip.

What Is InsureMyTrip?

InsureMyTrip (IMT) is a travel insurance comparison site that has been helping people find their ideal policy since 2000. To be clear, this means that IMT does not provide any of the plans listed on its site. It does not offer any policies or underwrite any claims. Instead, it is a marketplace that makes it easy to find the best plan to meet your needs.

IMT searches all policies across 20 insurance companies according to your search criteria, and you’ll only be shown policies for which you’re eligible. This saves you the frustration of looking for travel insurance policies elsewhere, only to discover that they don’t cover your age range (or other requirements you have).

I’ll get into who IMT is ideal for further on in this review.

How InsureMyTrip Works

InsureMyTrip is a marketplace of 20 insurance providers. It searches all the plans offered by these providers to find the best plan for you. Obviously, this would take a ton of time to do yourself if you checked each policy individually. With IMT, it happens in a matter of seconds once you fill in your trip information and build a quote.

Plus, thanks to InsureMyTrip’s Best Plans Guarantee, you know that you’re only seeing plans with multiple positive ratings and reviews from actual customers.

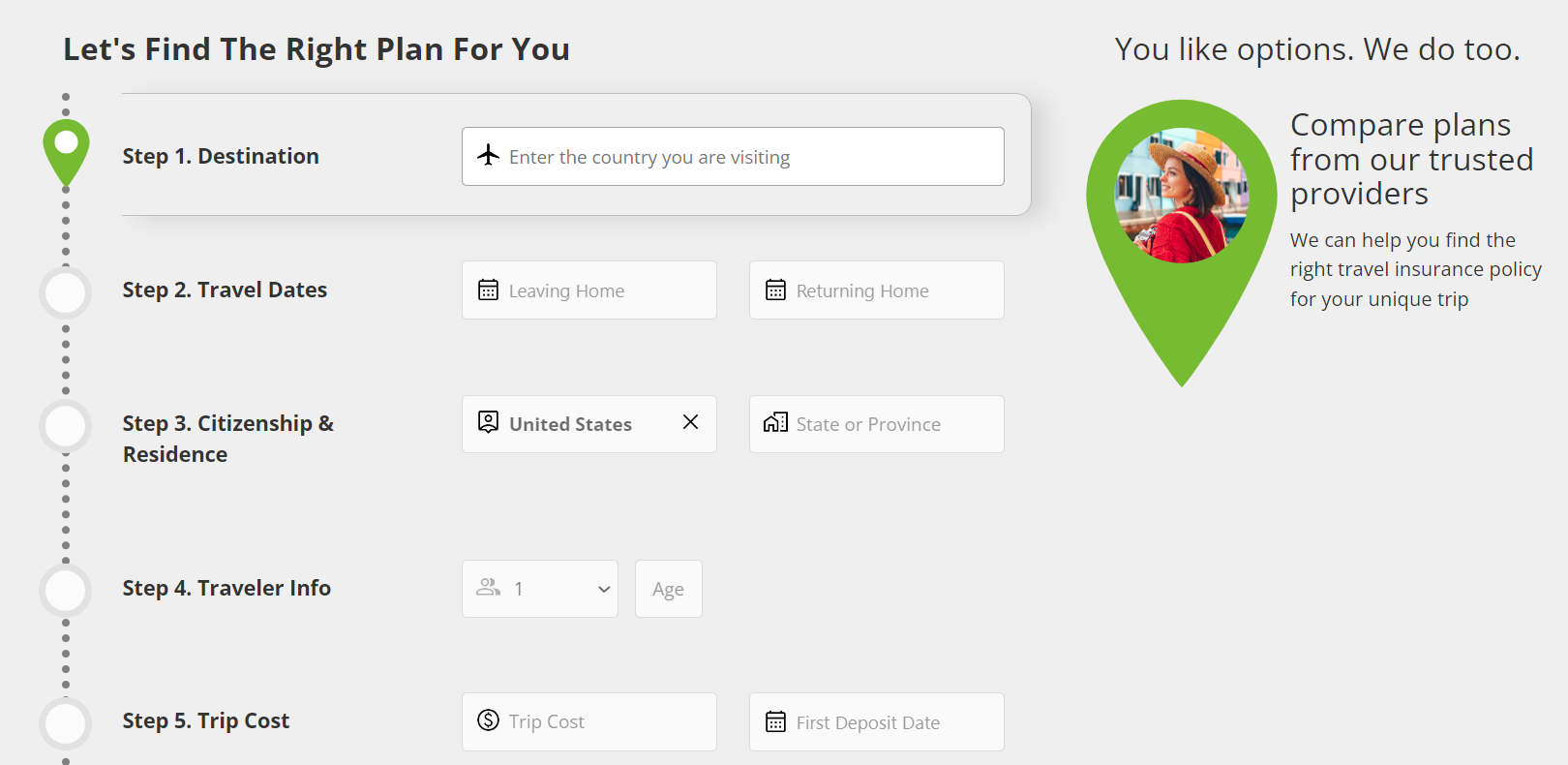

Here’s the information you’ll fill in to get a free quote:

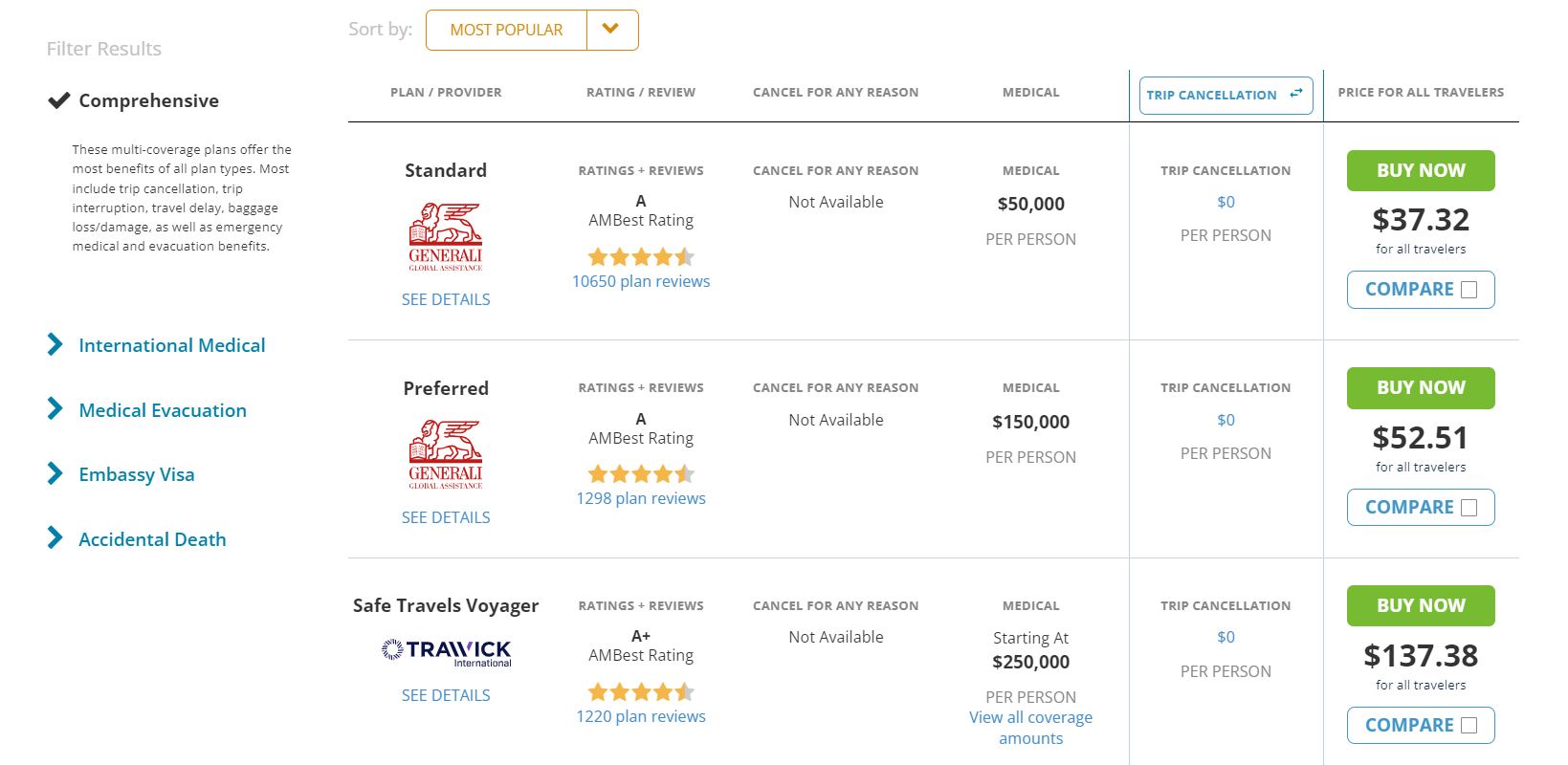

Once you enter your details, you’ll be brought to a page with various plans. The prices shown below are from an example quote for a 42-year-old traveler from New York going to Thailand for two weeks:

This is just a snippet of three (out of many) suggested plans and, as you can see, the price varies widely among them.

That’s where IMT’s comparison tool comes in. Just hit the “compare” box underneath the price to select and compare different plans side by side.

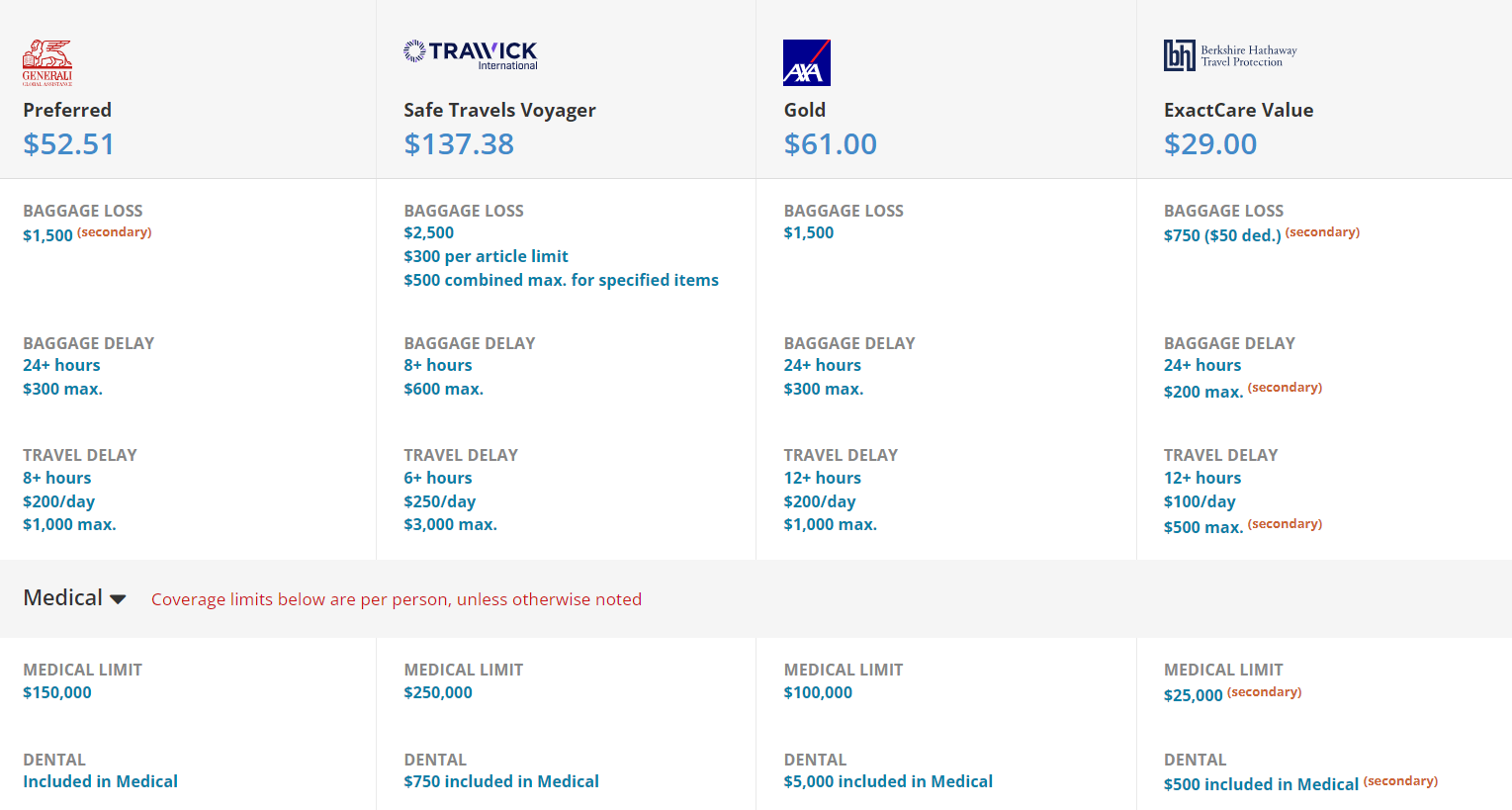

The comparison page looks like this:

The compare tool makes it easy to see the details of different plans side by side. This way you can easily see at a glance which ones work for your needs and which don’t. Ultimately, only you can decide whether you want higher coverage limits and are willing to pay a bit more for them but the comparison feature makes it easy to decide.

Personally, I always recommend getting at least $100,000 USD in coverage. You don’t want to skimp on coverage and, if something happens, end up hitting your limit before the problem is taken care of (read this post on buying travel insurance for more information).

No matter the plan you end up choosing, you’ll know that you’re covered with IMT’s Price Guarantee. This is another feature I really like, as it promises that you won’t find a lower price for the same plan elsewhere. So, when you search IMT, you know you’re getting the best possible price for that plan.

If that’s not enough to provide peace of mind, IMT also has a Money Back Guarantee. This means that you can cancel the policy during a review period (usually up to 10 days after purchase) and get a full refund as long as you haven’t made any claims yet or started your trip.

InsureMyTrip’s Guarantees

As mentioned above, InsureMyTrip has several important guarantees that ensure you buy the best policy for your trip. These guarantees include:

Price Guarantee

InsureMyTrip’s Price Guarantee means that you won’t find the same plan cheaper anywhere else. While there are sites out there that might advertise lower prices, the discounts they’re offering aren’t strictly legal. Insurance is regulated by state, with specific rules around offering discounts and cheaper prices. IMT offers the absolute lowest prices while remaining fully compliant with all such regulations. Don’t choose a less reputable site for the sake of saving a few bucks, as it could create problems for you down the line if you need to rely on that insurance.

Best Plans Guarantee

IMT promises to only offer the top plans on the market. Using data sourced from over 100,000 real customer reviews, it continually evaluates whether a provider can remain a recommended option to consumers. Each review contains a rating in the areas of coverage, cost, satisfaction, and claims (if any were filed). When you build a personalized quote, each plan will have a link to reviews, so you can read feedback from real users of that plan.

Money Back Guarantee

Last but not least is IMT’s Money Back Guarantee, which enables you to cancel your plan during the review period and get your money back. Most plans let you cancel for a full refund during this period, though eligibility and review period timelines do vary by policy. Some also charge a nonrefundable administrative fee to get your money back. As always, read the fine print before purchasing to verify eligibility. You can also reach out to IMT’s customer service team if you have any doubts about whether the plan you want to purchase is covered by this guarantee.

Pros of Using InsureMyTrip

- Quickly compare plans from 20 companies

- Friendly customer care representatives

- Easy-to-use website for fast and free quotes

- Ability to customize your plan with optional add-ons, such as CFAR (Cancel for Any Reason)

- Three guarantees for peace of mind (Best Price, Best Plans, Money Back)

- Anytime Advocates® to help if your claim gets denied by the insurance company

Cons of Using InsureMyTrip

- Does not search every travel insurance company

- Must have set trip dates and costs to get a quote

Who Is IMT For?

InsureMyTrip is a helpful marketplace for travelers looking to find a personalized insurance policy. Specifically, IMT is best for those going on trips with set beginning and end dates that have major fixed and nonrefundable costs, as with IMT, you purchase a policy based on your estimated trip costs. These could include round-trip airfare, prepaid accommodations, all-inclusive vacation packages (such as cruises or resorts), or group tour packages.

This could apply to many types of vacations and travelers. However, I especially recommend IMT for:

- Senior travelers as they include plans for folks over 70 and most other companies do not

- Anyone who wants add-ons, like CFAR coverage

- Cruisers (there are cruise-specific plans)

On the flip side, IMT is not a great option for digital nomads or long-term travelers who have ongoing expenses with no fixed end date and therefore won’t be able to insure a trip with a specific cost. (If this is you, check out this post on the best travel insurance for digital nomads.)

Travel insurance is something I never leave home without. Things can (and will) happen on the road. Be prepared by getting travel insurance. It can save you hundreds (or thousands) of dollars in unexpected costs and provide you with peace of mind and support should something go wrong.

You can click here get a quote.

I never, ever leave home without travel insurance. You shouldn’t either.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.