Did you know that you can pay the annual fee on your United credit card using your airline miles? It’s called “Pay Yourself Back” — but I’m not talking about using your Chase Ultimate Rewards points with the Chase Pay Yourself Back program.

Instead, you can pay your card’s annual fee with regular United Airlines MileagePlus miles.

Don’t feel bad if you weren’t aware of this feature or the details surrounding it. The website that houses this information is not widely publicized and doesn’t provide much in the way of details.

I’ll walk you through how to pay your United credit card’s annual fee using United miles.

Cards eligible for this feature

United offers multiple cobranded credit cards, including the following:

The information for the United Club and United Club Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

*This card is discontinued and no longer accepting new applicants.

Any United card with an annual fee is eligible to participate in this offer — including ones that are no longer available to new applicants. That’s great news for anyone feeling on the fence about their card’s annual fee this year.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: No saver space, no problem: How to unlock additional award availability with United

How to pay your card’s annual fee with United Airlines miles

There is a website outlining this option: choices.unitedmileageplus.com. It mentions that you can use miles to pay off your annual fee, but unfortunately, it says you must call the number on the back of your card to start the process.

Moreover, the terms at the bottom of the page have a few important points you should note:

- This feature is only available after you have paid your annual fee within the last 90 days, meaning you will need to pay the fee first and then use United miles as a reimbursement after the fact.

- Redemption values aren’t published and can change at any time. Right now, the value is 1.5 cents per mile (more on that below).

- The statement credit will appear on your account within three business days, and you’ll see the reimbursement and use of miles on your billing statement within one or two billing cycles.

- Reimbursement of your annual fee using miles does not count as a payment to satisfy your minimum payment due that month, so ensure any minimum payments are still met.

There are a few ways to get started. You can call the number on the back of your United credit card as a first method. Remember to pay that fee first and then request to use your United miles as a reimbursement.

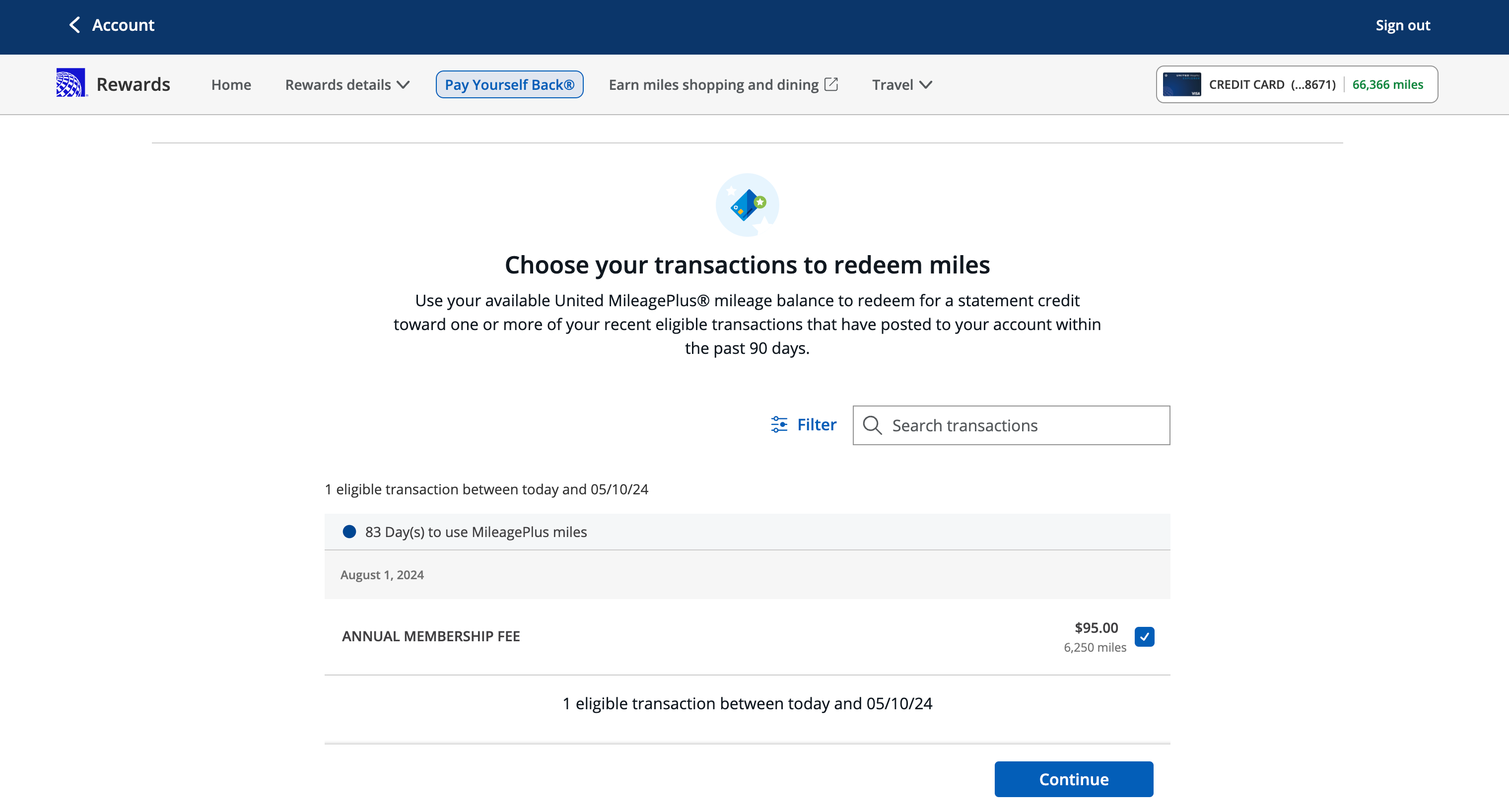

There are two other ways to pay your annual fee with miles. This website outlines how to redeem your miles against your annual fee online. It’s a very simple process as long as you follow the directions.

Lastly, you can complete this process in the Chase app. Log in to the app and select your United card. Then go to the Rewards and Benefits section and select Pay Yourself Back.

Related: United Premier status: What it is and how to earn it

What it costs

How much does it cost? Or, to rephrase this question, how many miles will you need?

Since you will pay the annual fee and seek reimbursement with your miles, let’s look at the cost in terms of how many United miles you’ll ultimately use to reimburse yourself after paying the annual fee on your United credit card.

While the MileagePlus Choices page states, “Redemption values may be changed at any time,” we’ve seen no change in the redemption rate for over two years now. You can use your United Miles at 1.5 cents apiece against your card’s annual fee.

Despite this, online forums show that some cardholders have received targeted email offers to use United miles as high as 1.75 cents apiece against their card’s annual fee.

TPG August 2024 valuations peg United Miles at 1.35 cents each. Thus, this redemption is above the average value for United miles. On the face of it, that looks like a pretty good deal.

That said, if you routinely redeem your miles for first—and business-class awards, you are likely getting more than 1.5 cents each in value from your United miles. In this situation, you might be hesitant to use your miles in this way.

Overall, though, this is a fair use of United miles when considering all of your redemption options, but it will be up to you to decide whether it works for you.

Here are approximately how many miles you can expect to pay based on your card’s annual fee (keep in mind that these can change at any time):

- United Business Card ($0 introductory annual fee for the first year, then $99): 6,600 miles

- United Club Business Card ($450 annual fee): 30,000 miles

- United Club Card ($450 annual fee): 30,000 miles

- United Club Infinite Card ($525 annual fee): 35,000 miles

- United Explorer Card ($0 introductory annual fee for the first year, then $95): 6,334 miles

- United Quest Card ($250 annual fee): 16,667 miles

Is paying your United Card annual fee with United miles worth it?

Whether this process is worth it depends on the number of miles it will cost, the types of redemptions you typically do with United and how many miles you have available. Remember that you need to pay your card’s annual fee upfront.

In case the statement credit from your miles redemption doesn’t post in time, you should still have the cash available to pay your card’s annual fee.

Unless you routinely book first- and business-class award tickets with United, covering your card’s annual fee with United miles is a great way to use your extra miles. TPG senior editorial director Nick Ewen has the United Explorer Card; he’s considering this option, as his annual fee just came due on Aug. 1.

“I’ve been disappointed by the rash of recent devaluations from United,” he says. “Our data shows that MileagePlus miles are worth 1.35 cents as of our August 2024 valuations, but I frequently see them lower — even with my discounts as a cardmember. Using 6,250 miles for my $95 annual fee is actually 1.52 cents per mile. Or, put another way, I’m using 6,250 for a pair of one-time United Club passes, free checked bags and a Global Entry or TSA PreCheck statement credit every four years. That’s not a bad option.”

Bottom line

Using United miles to offset your credit card’s annual fee is an interesting option. Not everyone will find value in it, depending on how you prefer to use your miles, what value you assign to them or even how many are in your account right now.

And since there’s not much information online about this option, you may have never even considered it. That said, I am a big fan of options, especially when you get decent value from a redemption.

If you’re interested in using your United miles to reimburse your card’s annual fee, call the number on the back of your card or visit the Chase app or website to get started.

To learn more, read our guide on the best United cards.

Related: 6 of our favorite under-the-radar credit card perks