Ulta Beauty Rewards Mastercard overview

The Ulta Beauty Rewards Mastercard offers decent earning rates on Ulta purchases. However, its limited earning rates outside of Ulta and its restrictive redemption options make it a poor choice for most shoppers. Card rating*: ⭐⭐½

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

If you’re a beauty product junkie, you’re all too familiar with the temptation to save on your Ulta purchase at checkout by signing up for an Ultamate Rewards credit card.

Even as a credit cards expert, I’m always tempted by this offer — probably because it’s presented at the precise moment I’m wondering why I can never make it out of there for under $100.

But I never sign up for a credit card without doing my research, and Ulta is no exception. Despite the Ulta Beauty credit card having no annual fee and offering the chance to reward my beauty product habit, I always say “no thanks” to this offer.

There are two different Ulta credit cards available: the Ulta Beauty Rewards Credit Card and the Ulta Beauty Rewards Mastercard. The first is a closed-loop card, meaning you can only use it at Ulta. The other card, the Mastercard version, you can use (and earn rewards with) anywhere Mastercard is accepted.

Since the Mastercard version is the most similar to other cards we talk about here at TPG, I’m focusing this review on that one rather than the closed-loop card.

The Ulta Beauty Mastercard has a recommended credit score of 700 or above. If you’re there and considering the card, let’s dig into the details to decide if it makes sense for you to get.

The information for the Ulta Beauty Rewards Credit Card and Ulta Beauty Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Ulta Beauty Rewards Mastercard pros and cons

| Pros | Cons |

|---|---|

|

|

Ulta Beauty Rewards Mastercard benefits

When you sign up for an Ulta credit card, you can save 20% off your first purchase at Ulta. Plus, you’ll get 500 bonus Ultamate rewards points after spending $500 outside of Ulta in the first 90 days of account opening.

Those 500 Ulta points are worth $17.50 at Ulta, so you’ll get that value plus whatever discount you receive on your first Ulta purchase with the card.

It’s that discount offer that always tempts me, but I remind myself that there are several no-annual-fee cash-back credit cards that offer a sign-up bonus worth $200. Since I’m never spending $1,000 on an Ulta purchase, I’ll get much better value from the bonus on one of those cards than with the Ulta Mastercard.

Cardholders also receive exclusive offers, such as a mystery gift with a $50 online purchase.

On top of a lackluster bonus, this card is missing additional benefits you’ll find on other cards, like purchase protection. This may not matter if you’re just buying $100 of makeup, but it could move the needle if you’re considering investing in something like a new Dyson hair tool.

Related: This month’s best credit card welcome offers

Earning and redeeming points on the Ulta Beauty Rewards Mastercard

When you use your Ulta Beauty credit card, you’ll receive 2 points for every dollar spent at Ulta Beauty and 1 point for every $3 spent outside of Ulta Beauty.

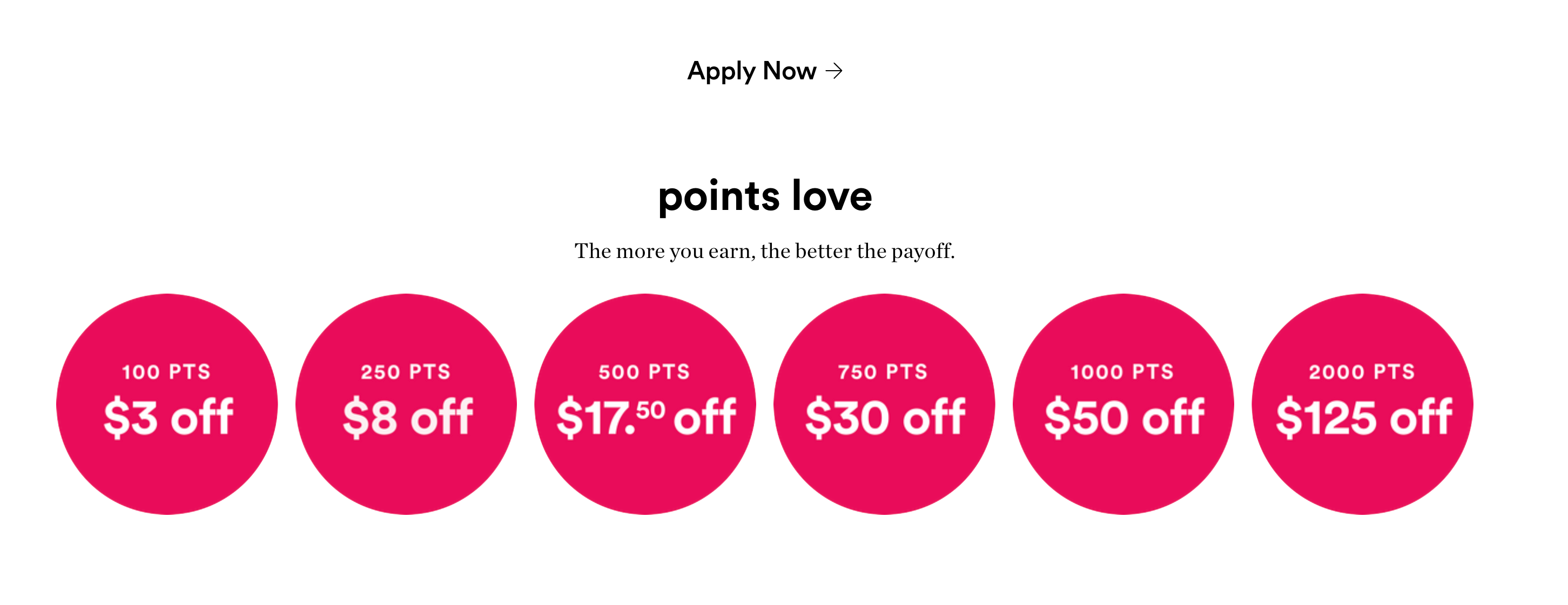

As this chart shows, the value of your points depends on how many you redeem at a time.

You must have at least 100 points to make any redemption. At this level, you’ll get a value of 3 cents per point. If you save up your points and don’t redeem them until you have 2,000 points, you’ll get a value of 6.25 cents per point. This means you’ll get between a 6% and 12.5% return on Ulta purchases and between a 1% and just over 2% return on purchases outside of Ulta Beauty.

This may sound impressive, and it’s not a bad return on Ulta purchases. However, you’re restricted to redeeming your rewards at Ulta.

If you used the Wells Fargo Active Cash® Card (see rates and fees) instead, you would earn 2% cash back on all your purchases and could redeem your rewards to cover your purchases at any retailer.

Related: 4 reasons store credit cards are (almost) always a bad idea

Which cards compete with the Ulta Beauty Rewards Mastercard?

The biggest competitor to a store credit card is a cash-back credit card. If you aren’t sure about the Ulta Rewards Mastercard, one of these may be a better fit:

For additional options, see our full list of the best credit cards.

Related: Store vs. cash-back credit cards: Which one should I get?

Is the Ulta Beauty Rewards Mastercard worth it?

If you spend a lot of money at Ulta, the chance to get exclusive offers and earn between a 6% and 12% return on your Ulta spending may be worth it. However, for purchases outside of Ulta, you’ll do better with a card that earns cash-back or travel rewards at a solid flat rate.

Bottom line

Resist the temptation to sign up for an Ultamate Rewards credit card just to save $20 the next time you check out at Ulta. The card can make sense if you spend a lot there, but you’ll want to crunch the numbers and weigh your other options before signing up.

After taking a look at my own spending habits and redemption preferences, I’ve decided to skip the Ulta Rewards Mastercard and instead put my Ulta spending toward earning a juicy, new welcome bonus or travel rewards on a different card.