During one of our Workshops this month, I asked the group of tourism operators whether they seek out and read any research reports, and it was a unanimous ‘no’. They were later very engaged in the information I had to share with them about the insights from Tourism Australia’s Future of Demand Consumer Research Report.

Tourism Australia released this report back in November 2022, and within it contains some crucially relevant insights about traveller behaviour and profiling, but most importantly outlines what experiences motivate the future traveller (post-covid) from the traveller’s perspective.

Without getting into the nitty gritty of the research methodology, based on our understanding of consumer research methodologies (thanks to our in-house qualified professional researcher, Jaci) we can see that this piece of work is substantial, and therefore the insights are incredibly valid in terms of their relevance, especially for:

- Tourism operators seeking to enhance their experiences, and

- Destinations seeking to advise operators on developing new experiences.

After sifting through the insights ourselves, we have identified some key takeaways for the industry below.

Insight 1: Key Behaviour Traits of Future Travellers

Whilst some of these insights affirm what we already know about the change in expectations, motivations and behaviour of travellers, they also shed light on new opportunities, and lenses to ‘see’ future visitors, which can certainly help with the way we market our destinations.

The Post-Covid Hangover

Firstly, the report shares insight on the impact of COVID on travel planning, which relate to those looking to plan trips of overseas, and also domestically. This shows us what we’re up against, and some of the internal and external challenges that that’s required to mitigate through advocacy, partnerships and destination storytelling.

Explosion of Passions and Hobbies driving new demand

The other great insight shared was the impact of COVID on hobbies and passions – and the increased depth and breadth of passions points that people will travel to destinations for (case in point… I’m heading off to an Autumn Garden Festival today in my region, which I probably wouldn’t have gone to pre-covid thanks to me new interest in gardening!).

This data could potentially be game changing for destinations, as they look to ramp up their strategic events calendar, and also helpful for DMOs as they advice business owners on creating new or enhancing current ‘passion’ experiences.

‘Traveller Typologies’ help to sort wheat from chaff

This research uncovered a deeper layer of detail to help us to better understand the traveller ‘needs’ and how that affects key travel decisions such as destination, style of travel and activities or experiences engaged in.

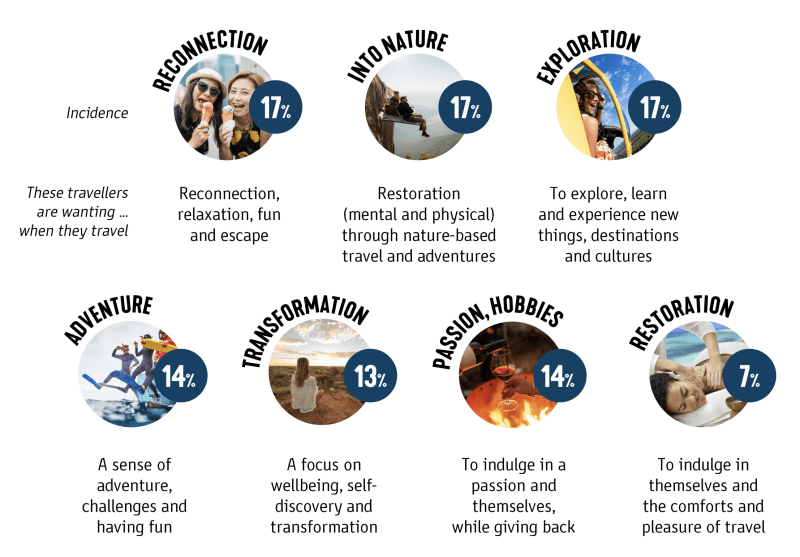

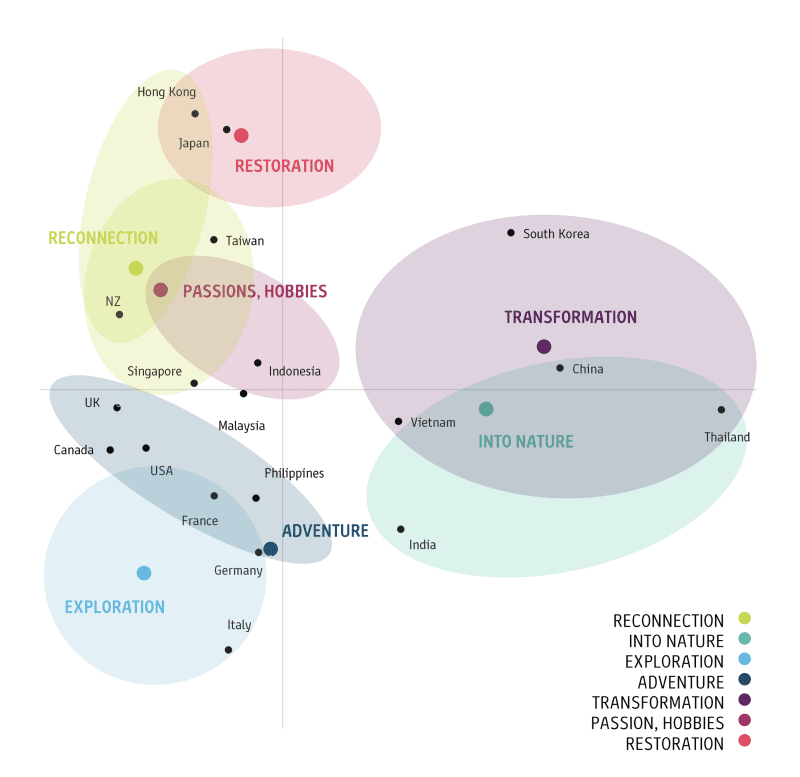

Seven traveller typologies are referenced throughout Report to help unlock the ‘why’ behind travel choices, and the demand for those choices which can help destinations looking to develop/refine traveller personas to focus their activities and investment.

In a fun twist, the data is also broken down into more specific market insights, showing what markets are more relevant for each typology – which can help destinations to better understand the potential market opportunity (specifically for those who are looking to target international visitors).

2. Experience Clusters show how Traveller’s segment our product

The next section of the data does a deep dive into what travellers want out of an Australian holiday experience.

Now this part of the research really takes time to get your head around – but do it, you’ll thank me later!

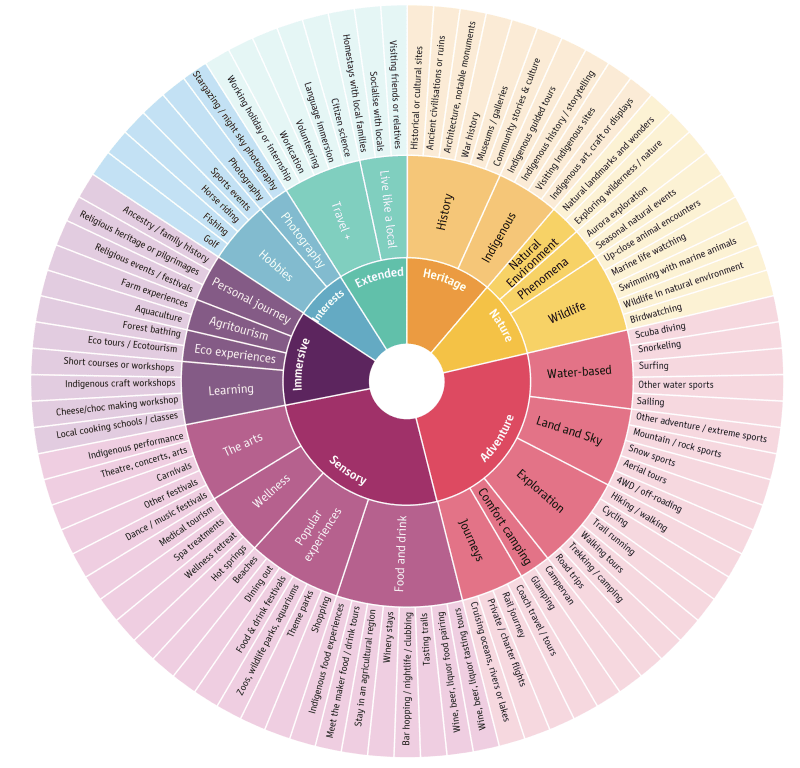

In what is possibly the most colourful wheel of experiences ever developed, the team at TA have painstakingly group experiences into clusters, and sub-clusters based on similarity to each other in terms of consumer appeal.

The data simply tells us how travellers make sense of our experiences, and what experiences then align with others. This is important when you are looking to group and market experiences in your region to effectively increase dispersal of visitation across your region.

But, further to this, they’ve created some deeper insights for each of the sub-clusters, which provides experience level insights that I’ve never seen before!

These incredible detailed fact sheets have been developed for each Sub-Cluster, which are brilliant to help determine what types of experiences travellers are interested in ‘in addition to’ their current experience.

This information is game-changing!

For Operators, this data can help operators get really clear on:

- The type of traveller (as above) that is most aligned to their experience

- The most relevant market and demographics for their experience

- What other sub-cluster experiences are likely to have appeal (to help with designing new, complimentary experiences, or partnership potential with other operators)

For Destinations, this granular information can be really helpful in supporting operators to seek out new markets, enhance their current experience, develop new experiences and to market their current experiences more strategically.

I told you it’s game changing!