At TPG, we devote a significant amount of time to talking about how credit scores work, ways to improve yours and how you can keep it in shape. Although a decent credit score will likely be enough to get you approved for many travel credit cards, some of the most rewarding premium cards require top-notch credit.

There isn’t a magic number that guarantees approval for a specific card, but we can analyze public data points to gauge your odds.

Let’s talk about one of the best premium credit cards currently on the market: the Chase Sapphire Reserve® — and what the unpublished credit score requirement looks like to get approved when you apply.

Overview of the Chase Sapphire Reserve

The Chase Sapphire Reserve has consistently been one of the best travel rewards credit cards since its launch in 2016. It offers a respectable 3 points per dollar spent on all travel and dining, and it comes with some of the most extensive travel protections available on any credit card.

It has a $550 annual fee, but benefits like an annual $300 travel credit, up to $5 in monthly DoorDash credits (through Dec. 2024), Priority Pass airport lounge access and a Global Entry/TSA PreCheck application fee credit help offset it.

Plus, new cardholders can earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months — worth $1,538, based on TPG valuations.

Related: Chase Sapphire Reserve credit card review

What credit score do you need to get the Chase Sapphire Reserve card?

The Chase Sapphire Reserve has slightly stricter approval requirements than its sibling, the Chase Sapphire Preferred® Card. Reports suggest that you’ll typically need a score of at least 740 to get approved for the card, though the average score is slightly higher. People with scores below 700 have been approved for the card, but the approval usually isn’t instant in those circumstances.

If your score is on the lower end of the range, keep in mind that many other factors go into qualification, such as your income and your credit accounts’ age. In the context of Chase, another big factor is your relationship with the bank.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

If you’ve been a longtime Chase customer and have other Chase cards to prove you can pay your bills on time or have large balances in your banking accounts with them but below-average credit history, you may have better approval odds.

Reports suggest that those with a banking relationship may also be able to boost their odds by applying in a branch.

Another idea is to apply for the Chase Sapphire Preferred with the lower score requirement and then request a product change to the Chase Sapphire Reserve.

Related: What credit score do you need to get the Chase Sapphire Preferred card?

How many card accounts can I have open?

The Chase Sapphire Reserve is subject to Chase’s unpublished 5/24 rule. This means that if you’ve opened five or more personal credit cards with any issuer in the last 24 months, Chase will automatically reject your application for this card, even if you have a perfect credit score.

The 5/24 rule is hardcoded into Chase’s systems and can’t be manually overridden, so if you’re over 5/24, there’s no benefit to taking a chance on an application just to see what happens.

You also won’t be approved if you currently hold the Chase Sapphire Preferred; plus, you need to wait at least 48 months between earning the sign-up bonus on one card before you can earn it on the other.

Related: How to calculate your 5/24 standing

How to check your credit score

It would be best if you never shelled out cash to check your credit score. Most credit cards come with a free FICO score calculator which makes it easy to see where your score lies on the scale from good to bad and keep up to date on how you’re doing.

You can also easily open accounts on sites like Credit Karma or Credit Sesame. These sites are free and can help you keep even better track of your score and its factors. You can also use these services to dispute any information on your score that isn’t accurate or appears to be fraudulent.

Sites like Credit Karma also provide regular, automatic updates when your score changes, as well as alerts any time a new inquiry is added to your credit report. Since these sites perform soft pulls, they won’t negatively impact your credit score.

Factors that affect your credit score

Before you start applying for any credit cards, it’s important to understand the factors that make up your credit score, as applying for new lines of credit will change your score.

Related: 5 lesser-known things that affect your credit score

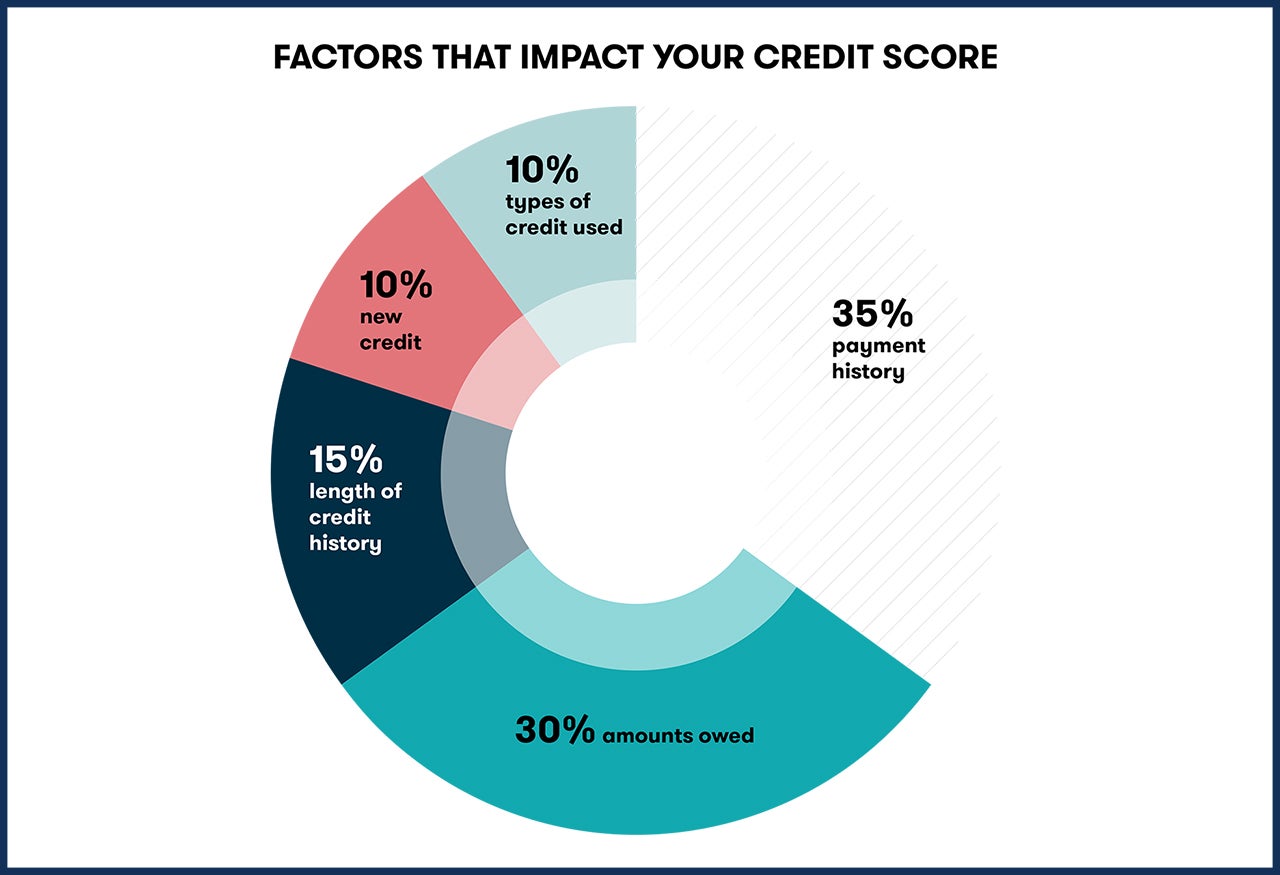

While the exact formula for calculating your credit score is kept secret, FICO is very transparent about the different factors they assess and how much weight each is given:

- Payment history. 35% of a FICO score is made up of your payment history. If you get behind in making loan payments, it can result in a drop. The longer and more recent the delinquency, the greater the negative impact on your credit score.

- Amounts owed (utilization). 30% of your FICO score consists of the relative size of your current debt. In particular, your debt-to-credit ratio is the total of your debts divided by the total amount of credit you’ve been extended across all accounts. Many claim it’s best to have a debt-to-credit ratio below 20%, but it’s not a magic number.

- Length of credit history. 15% of your score is based on the average length of all accounts on your credit history. This becomes a significant factor for those with minimal credit histories, such as young adults, recent immigrants and anyone who has largely avoided credit. It can also be a factor for people who open and close accounts within a concise period.

- New credit. Your most recent accounts determine 10% of your credit score. Having recently opened too many accounts will hurt your score, as the scoring models will interpret this as a sign of possible financial distress.

- Credit mix. 10% of your score is related to how many different credit accounts you have, such as mortgages, car loans, credit loans and store charge cards. While having a larger mix of loans is better than having fewer, no one recommends taking out unnecessary loans to boost your credit score.

Related: Ways to improve your credit score

A significant factor for the Chase Sapphire cards is your average age of accounts. While a lengthier credit history will boost your score, many issuers focus on the one-year cutoff. That means that having an average age of accounts of more than a year can increase your odds of approval. In contrast, you might have trouble getting approved with 11 months of credit history, even if your numerical credit score is great.

Also, if you have any delinquencies or bankruptcies on your credit report, Chase might be hesitant to approve you for a new line of credit even if your score is otherwise solid.

It’s important to remember that your credit profile is more than just a number. It’s a collection of information given to the issuer to analyze your creditworthiness.

What to do if you get rejected

Do not give up if your application for the card initially gets denied. If you receive a rejection letter, you should first look at the reasons given for your rejection. By law, card issuers are required to send you a written or electronic communication explaining what factors prevented you from being approved.

Related: The ultimate guide to credit card application restrictions

Once you’ve figured out why you’ve been rejected, call Chase’s reconsideration line. Tell the person on the phone that you recently applied for a Chase credit card “and you were surprised to see that your application was rejected, and you would like to speak to someone about reconsidering that decision.”

From there, it’s up to you to build a case and convince the Chase agent on the phone why you deserve the credit card.

If you were rejected for too short of a credit history, you could point to your stellar record of on-time payments. If you were rejected for missed payments, you could explain that those were a long time ago, and your record since then has been perfect. If you do your banking with Chase, mention that too.

While there’s no guarantee that this strategy will work, there are many reports of rejections being reversed on reconsideration, so it’s worth spending 15 minutes on the phone if it might help you get the card you want.

The other possible option is for your application to go into “pending” status. This means that you may (ultimately) be approved, but Chase needs additional time to review your application or new information to make a decision. If you receive this notice, you should definitely call the reconsideration line. You may just need to verify a detail on your application, or if you have other Chase cards, you may need to shift credit lines around.

Bottom line

It should be no surprise that, as one of the most premium cards out there, the Chase Sapphire Reserve requires an excellent credit score to be approved.

That said, there are ways you could increase your odds, such as establishing a banking relationship with Chase. Alternatively, you could apply for the Chase Sapphire Preferred first, get its 75,000-point welcome bonus after spending $4,000 in purchases within the first three months and then request a product change.

Further reading:

New to the points and miles game? Check out our beginner’s guide for everything you need to know to get started!

Apply here: Chase Sapphire Reserve and earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months.

Apply here: Chase Sapphire Preferred and earn 75,000 Ultimate Rewards points after spending $4,000 on purchases in the first three months.