A good credit score is something every points and miles enthusiast should aim for. After all, good credit makes it much easier to qualify for the best credit card offers and can save you money along the way.

What is a good credit score?

FICO Scores, the credit score brand used by most lenders, range from 300 to 850. A good credit score is considered anything between 670 and 739. Scores that fall between 300 to 669 are classified as “very poor” or “fair.” Between 740 and 850, your score is considered “very good” or “exceptional.”

These are the five general credit score classifications. However, each lender sets its own criteria for credit scores. One card issuer might offer its best rate and terms at around the 720 score mark, while the next might want you to have a 740 score to get that same type of treatment.

Ideally, you should aim for a credit score of 760 or higher. All things being equal, a 760 score should get you the best available offers from lenders (including on mortgages and auto loans). When it comes to credit cards, a 740 score may grant you access to almost any credit card on the market.

What is the highest possible credit score?

The highest possible score is 850 for most credit score ranges. However, you don’t need an 850 score to be approved for a top credit card.

In other words, a perfect score isn’t necessary. You won’t gain much from having an 850 FICO score instead of a 760. Just like SPF 100 sunscreen doesn’t work significantly better than SPF 50.

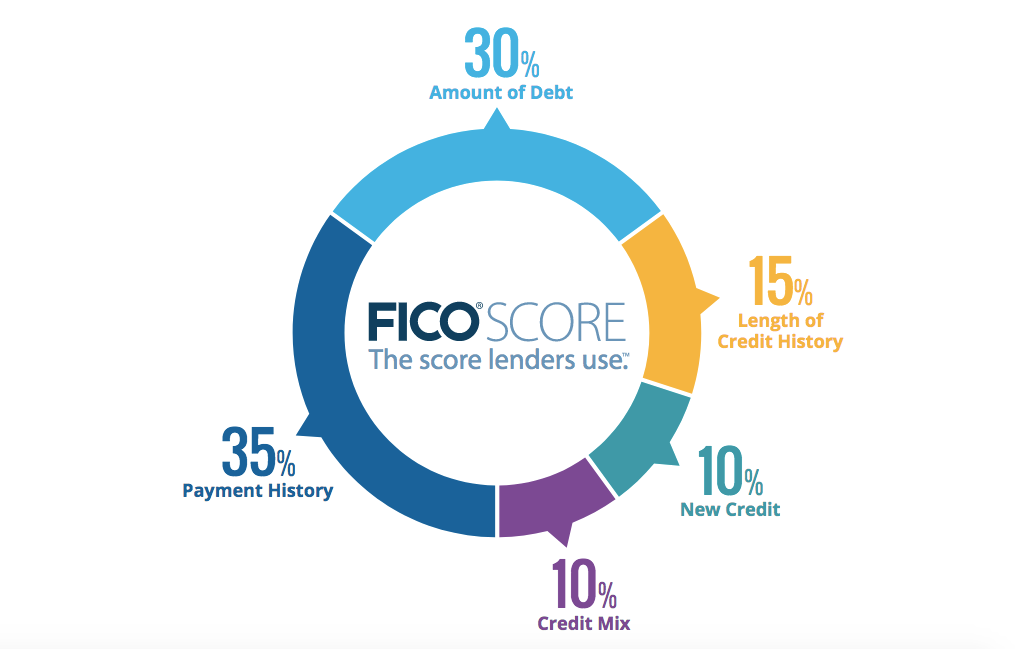

Still, it’s good to know how your credit score is calculated and how to improve it. With FICO scores in particular, your credit score is influenced by five factors — all of which can be found in your credit report.

Related: 5 lesser-known things that affect your credit score

Credit score factors

Payment history: 35%

Your payment history is the most important factor influencing your credit rating, impacting 35% of your FICO Score. Late or missing payments reported to the credit bureau by lenders can damage your score. Other negative information, such as collection accounts and charge-offs, can cause major problems in this category as well.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Paying your bill on time is a critical part of our 10 credit card commandments. If you’re worried about forgetting to make a payment, consider setting up automatic payments as a backup measure.

Amounts owed: 30%

After payment history, FICO focuses on your credit utilization. This influences 30% of your FICO Score. In short, your credit utilization rate measures the percentage of available credit you are using. For example, if you owe $2,500 on a card with a $5,000 limit, your utilization ratio is 50%. That is, you’re utilizing half of your credit limit.

Credit scoring models reward users who discipline themselves and maintain low credit card utilization rates. It’s best to pay your credit card balance in full each month. Following this advice will save you money and protect your credit score at the same time.

Length of credit history: 15%

While length of credit history is a less significant credit scoring factor, it’s still important. The concept is simple. Generally, your score improves as the age of your oldest account and your average age of accounts grows. Keep in mind that you may need a year or more of credit history to be considered for some premium rewards cards.

Your credit history should naturally increase over time. If you have a loved one willing to add you as an authorized user to an older credit card account, this might also help you in the length of credit history category.

Finally, it’s wise to maintain some activity on all of your credit cards. This can help you avoid having your account closed due to inactivity. A closed credit card will fall off your credit report after 7-10 years (depending on whether it’s negative or positive). Once the account falls off your report, it will no longer count in your average credit age.

New accounts: 10%

When you apply for new credit, a “hard inquiry” from the credit card company will appear on your credit report. This hard inquiry will factor into your credit score whether or not you’re approved. Hard inquiries can stay on your report for up to two years but only influence your FICO Score for 12 months (if they have any impact).

Lenders may view multiple account openings within a short period as a warning that you’re desperate to obtain credit. That said, new accounts are a minor factor, worth 10% of your FICO Score. You should be fine if you don’t go overboard with too many credit applications in a 12-month span.

It is also important to be aware of rules like Chase’s 5/24. This unofficial rule prevents you from opening a new Chase credit card if you’ve opened five or more credit cards with any card issuer in the past 24 months.

Credit mix: 10%

The final credit scoring category deals with the types of accounts that appear on your credit report. Ideally, lenders like to see a mix of credit cards, retail accounts and loans — and a history of managing them well.

However, it’s not important to have one of each. Plenty of people don’t have any loans and have no problem being approved for new cards. A credit builder loan is an option if you want to add an installment loan to your report without going into debt.

How to check your credit score

It’s a good practice to check your three credit reports (Experian, TransUnion and Equifax) often, especially if you’re trying to improve your credit and plan to apply for new financing.

You can access a free copy of all three reports from AnnualCreditReport.com once every 12 months. There are many other places online where you can check your credit reports and scores free of charge.

Remember, checking your own credit will never hurt your credit score. Look for signs of fraud or credit mistakes when you review your reports. If you find anything concerning, you can dispute those issues with the credit reporting agencies.

Related reading: How to check your credit score for free

Credit cards for excellent credit scores

Excellent credit scores are a requirement for some top premium rewards cards. Because of their added benefits, cards like the Chase Sapphire Reserve® or The Platinum Card® from American Express fall into this category.

Even if your credit score is below 700 or you don’t have one, it’s possible to establish or boost your score in a relatively short period of time. It’s also not as hard to get approved for other cards, such as the Chase Freedom Unlimited® or The Amex EveryDay® Credit Card from American Express, with a lower credit score.

Many card options are available if you haven’t achieved a “good” score yet.

The information for the Amex EveryDay Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

A good credit score can indicate whether you’ll qualify for a new credit card, but it doesn’t guarantee approval. You can still be denied credit based on other factors, even with an excellent score. If you’re building your credit, beginning with one of these starter cards may be best.

Above all, remember that building a good credit score takes time. So, pay your bills on time, keep your credit card balances low and be smart about opening and closing accounts.

Related: Got excellent credit? These are the best credit cards for you