When it comes to personal finance (including how to get the best credit cards), your credit score plays a large role. Creditors use it as a barometer for your trustworthiness as a borrower.

One of the main factors in determining your score is credit utilization, a term not everyone is familiar with. Let’s look at your credit utilization ratio and how you can maintain a low ratio to improve your credit score.

Related: What is a good credit score?

What is credit utilization?

The term “credit utilization ratio” describes the relationship between your balances and total available credit across revolving accounts (such as credit cards). It’s the percentage of your credit limits that you are using, as reported by the three credit bureaus. Credit utilization is sometimes known as your “balance-to-limit ratio” as well as your “debt-to-credit ratio” — but can also appear as “amounts owed.”

You can calculate your credit utilization with this simple formula:

- Total outstanding credit card balances ÷ total credit limits = credit utilization ratio.

Note that this will get you a number between zero and one — often multiplied by 100 to be expressed as a percentage.

Remember, though, that should include all of your revolving credit accounts. So, if you have four credit cards, you’ll want to add up your balances and the total credit limits across all cards.

For example, let’s say you have a combined credit limit of $12,000 across two different cards, and your credit report shows an account balance of $6,000 spread across those two cards. In this case, your credit utilization ratio is 50% ($6,000 ÷ $12,000 = 0.5 X 100 = 50%). In other words, you’re using 50% of the credit limit on your account.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

You can also calculate your per-card ratio using the same formula but using that particular card’s balance and credit limit. While your individual cards’ credit ratios are important, the most crucial ratio is the ratio of your overall balances to the total credit you have at your disposal.

Related: How to improve your credit score

How important is credit utilization?

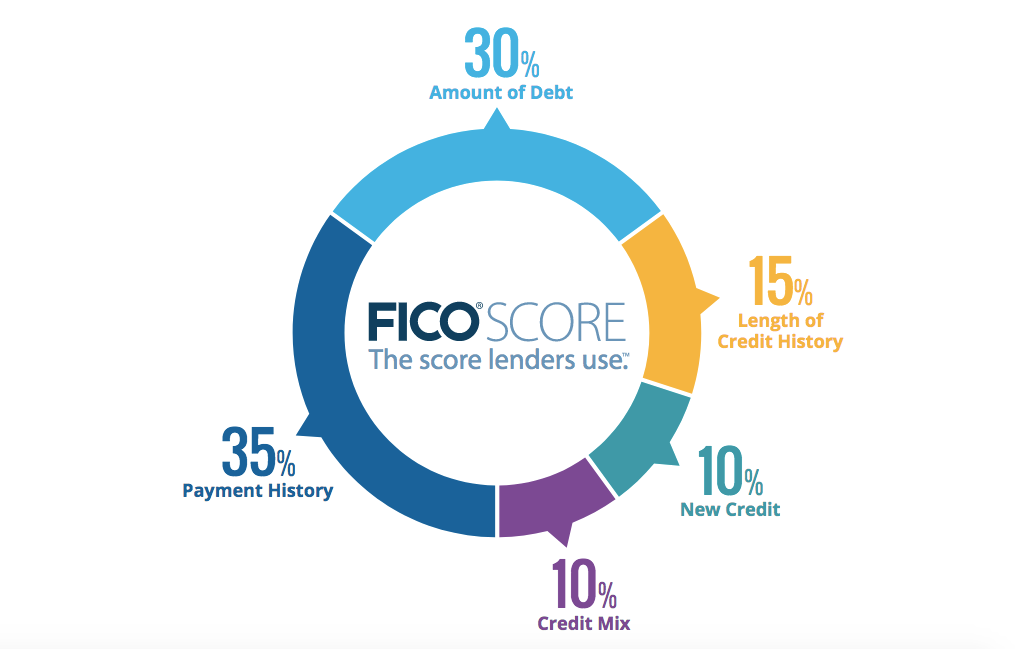

Credit utilization is one of the more important factors determining your credit score. Depending on which scoring model is used, it could make up as much as 30% of your score (as it does with your FICO score). The only other factor with that much weight is your payment history.

Why does it matter so much?

Well, from a creditor’s perspective, it can show whether or not you are doing a good job of managing your credit cards and whether or not you are overspending. If you consistently pay off your balances and do not REACH your full credit limit, that tells creditors (like card issuers) that you are a low-risk customer.

The lower your risk, the more likely you’ll be approved for a card and any additional credit needs, such as a mortgage and auto loans. In addition, higher scores may unlock better terms from lenders (like a lower mortgage interest rate), so paying close attention to your utilization can save you real money.

What is a good credit utilization ratio?

Credit scoring models reward you when you keep your credit card utilization rate low. If you’re looking for a way to boost your credit scores, paying down your credit card balances (and therefore lowering your utilization ratio) is often one of the most effective ways to accomplish that goal.

Generally speaking, you should keep your total credit utilization ratio below 30%. This is another reason we recommend paying off your balances in full each month. It’s the best way to avoid interest payments and helps keep your credit utilization ratio as low as possible.

If your credit card balance is higher than usual, the sooner you pay down those balances — even if it is before your monthly statement closes — the better off you’ll be regarding your credit utilization ratio.

Related: Holiday spending hangover: Tips to get you back on track

Why canceling a card could hurt your utilization ratio

When you cancel a credit card, you’re potentially hurting your score in two ways. First, you reduce the average length of accounts, especially if you’ve had the card for a long time. Second, you’re potentially increasing your credit utilization ratio.

Let’s say you close a credit card with a $0 balance and a $15,000 credit limit but still have two other credit cards:

- Card No. 1 has a $3,000 balance and a $10,000 credit limit

- Card No. 2 has a $3,000 balance and a $10,000 credit limit

With all three cards, your credit utilization ratio is 17.14% ($6,000 ÷ $35,000). However, if you cancel that card, the denominator of that equation (your total available credit) decreases significantly. Meanwhile, the numerator (your total outstanding balance) remains the same.

Canceling that card with the $15,000 limit will increase your aggregate utilization ratio to 30%.

Because of that, your credit scores may drop, even though your credit card debt is the same amount as before.

Related: How canceling a credit card affects your FICO score

Ultimately, the extent to which a credit card closure hurts your credit score largely depends on how many other accounts you have open and how much you use them. The available credit on the canceled card can also affect this equation. However, removing at least some of your available lines of credit will almost always result in a credit score drop.

To avoid decreasing your overall credit limit — and thus increasing your credit utilization ratio — you have a few options when you want to cancel a card.

First off, you can shift credit from one credit card to another. This only works if you have multiple credit cards within the same bank. Let’s say you have a $10,000 credit limit with a Chase personal card, but you also have a few other Chase personal credit cards in your wallet. Before canceling the card, you can call Chase to transfer your credit limit from the card you want to cancel to another card — or cards — in your account.

This will keep your credit tied to your account, thus not affecting your credit utilization score. Once the credit is relocated from one account to another — sometimes taking up to 24 hours — you can cancel the card.

Remember, though, that each bank has a different set of rules. Typically, there is a minimum amount of credit that you’ll need to keep tied to the card — typically between $1,000 to $5,000, depending on the bank — so you are still losing some credit, but not a significant amount. Additionally, shifting credit doesn’t require a hard credit pull unless the new card’s limit exceeds a preset number with the bank.

Another way to not lose your card’s credit is to request a downgrade from your issuer to a different product that doesn’t charge an annual fee. This will keep your credit with the new card and have zero impact on your credit utilization score. However, downgrading a card could exclude you from applying for a new card in the future and getting a welcome offer on that particular card.

And if the particular card you want to close is a no-annual-fee credit card, you can keep it open and tucked away in your sock drawer. It doesn’t hurt to keep it open, but it requires you to keep an eye on the account to ensure no fraudulent activity. We also recommend making at least a few purchases yearly to avoid the issuer proactively closing your account due to inactivity.

Related: Should I cancel my credit cards if I don’t use them anymore?

Applying for a new credit card

If you want to cancel a card while applying for a new one, the best practice is to apply for the new one before canceling the old one. Your existing credit line will still be factored into your score, and your utilization ratio will remain low while your application is being considered.

Of course, new applications also impact your credit score. Be sure to consider the situation from multiple angles before deciding.

Related: How to apply for a credit card

Bottom line

Although it is easy to forget about your credit score when deciding to apply for a new card with an enticing welcome bonus, it is incredibly important to keep in mind — especially your credit utilization ratio.

Since debt makes up the bulk of your score, your credit utilization should always be considered when canceling and applying for new credit cards.

Having a low credit utilization ratio will only help your credit score, which can lead to more favorable credit card, loan and mortgage applications in the future.