Wyndham Rewards Earner Business Card overview

The Wyndham Rewards Earner® Business Card is valuable if you frequently stay at Wyndham hotels and resorts due to its perks, which include top-tier Wyndham Diamond status and a 10% discount off award nights. Plus, the 15,000 bonus points you get each anniversary year should offer more value than the card’s $95 annual fee. Card Rating*: ⭐⭐⭐⭐

*Card Rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

The Wyndham Earner Business Card is easily the best Wyndham Rewards card. I applied for this card earlier this year primarily because of its automatic Diamond Elite status, 10% award night discount and 8 points per dollar on gas purchases.

I also plan to keep the Wyndham Earner Business Card long-term. In addition to the valuable perks I mentioned above, it gives cardholders 15,000 bonus points on each account anniversary. I can easily redeem these points for more than the card’s $95 annual fee, so it makes sense to continue paying for it each year.

The Wyndham Earner Business Card is a small-business card, so you’ll need a business to apply. However, some types of nontraditional small businesses may count. You’ll also usually need at least a good credit score of 670 or higher to be approved for the Wyndham Earner Business Card.

The information for the Wyndham Earner Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Wyndham Earner Business Card pros and cons

| Pros | Cons |

|---|---|

|

|

Wyndham Earner Business Card welcome offer

The Wyndham Earner Business Card currently has a welcome offer of 45,000 bonus points after spending $3,000 on purchases in the first 90 days.

Based on TPG’s August 2024 valuations, 45,000 Wyndham points are worth $495.

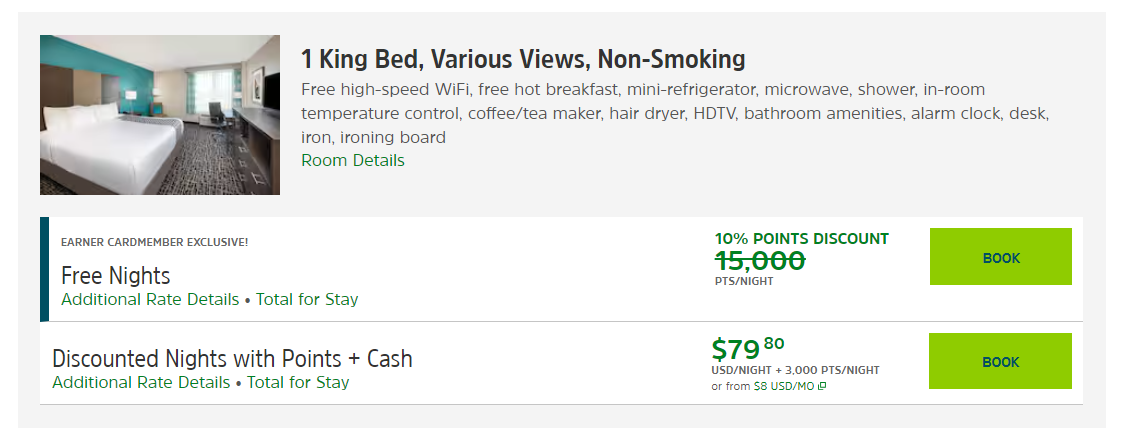

Award nights in the Wyndham Rewards program cost 7,500, 15,000 or 30,000 points per room, although Wyndham Earner Business cardmembers get a 10% discount. As such, this bonus could get you one to six nights if you redeem your points for stays at Wyndham properties.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Consider Barclays credit card application restrictions before applying, though. If you’ve held the Wyndham Earner Business Card in the past, you’ll usually need to wait at least six months after you cancel your card before applying for a new one.

Barclays may be inquiry-sensitive, so we recommend being under six inquiries over the past 24 months.

Barclays may also look at your recent spending activity on its cards, so you may want to use any other Barclays cards you have more frequently for at least a few months before applying for a new card.

Wyndham Earner Business Card benefits

As with many hotel credit cards, the Wyndham Earner Business Card offers travelers a variety of useful perks. Here’s a look at the perks you can expect from this card.

Wyndham Diamond status

Cardholders get automatic Wyndham Diamond status as a benefit of the Wyndham Earner Business Card. As a Wyndham Diamond member, you’ll get suite upgrades, early check-in, late checkout and 20% bonus earnings on paid stays.

However, many Wyndham Diamond perks (such as suite upgrades and late checkout) are only given upon request and are subject to availability at check-in.

Compared to other top-tier hotel elite statuses, the on-site perks of Wyndham Diamond are relatively weak.

However, you can match earned Wyndham status to Caesars Rewards. Matching status to Caesars Diamond status is, for me, one of the most valuable benefits of Wyndham Diamond status.

Caesars Diamond status offers 15% off the best advertised rate on rooms and suites, waived resort fees and a 20% discount at casino gift shops at Caesars Rewards properties.

Diamond members get complimentary valet and self-parking at most Caesars Rewards destinations, including all Las Vegas properties. Caesars Diamond members can also get a complimentary stay (including room taxes, but not the resort fees and gratuities) at Atlantis Bahamas once per year during most months.

Discounts on Wyndham stays

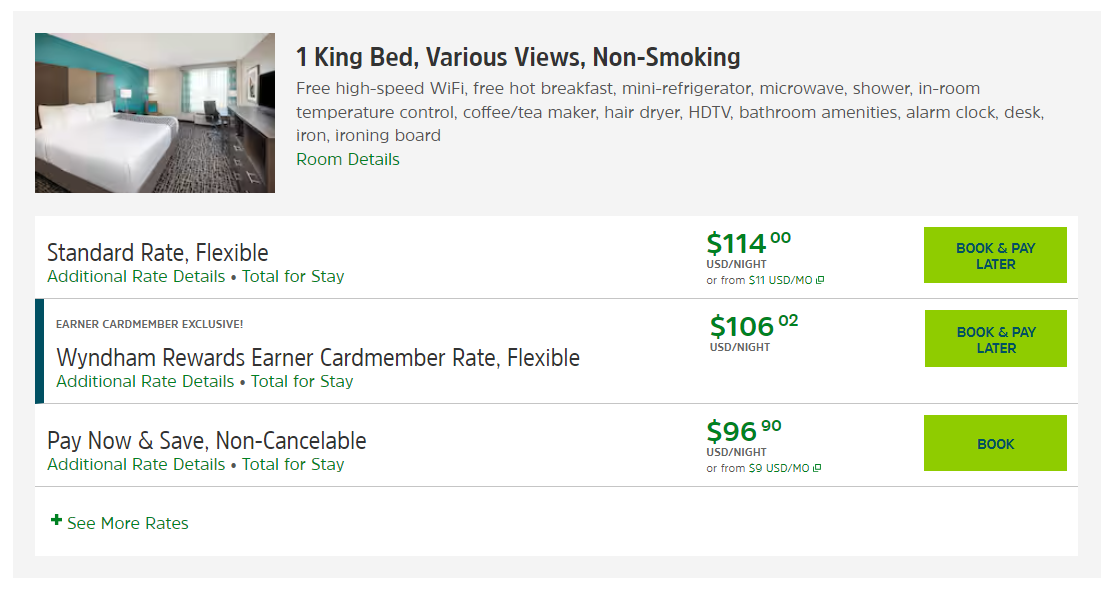

One of the most useful perks of the Wyndham Earner Business Card is discounts when booking paid and award stays. Cardmembers can get a booking discount on paid stays at participating Wyndham hotels.

Cardmembers also get a 10% discount when redeeming Wyndham points for Go Free award nights, which are nights booked fully with Wyndham points.

If you frequently stay with Wyndham, these discounts can save you serious points or cash on stays.

Annual points bonus

Wyndham Earner Business cardmembers get 15,000 bonus points each anniversary. 15,000 points is enough for two nights at properties that charge 7,500 points per night (discounted to 6,750 points per night for cardmembers), and it’s also worth $165 based on TPG’s August 2024 valuations.

As such, the annual points bonus alone provides more value than the cost of the card’s $95 annual fee.

Other useful benefits

Earning points on the Wyndham Earner Business Card

When you use the Wyndham Earner Business Card for purchases, you’ll earn points as follows:

- 8 points per dollar at participating Wyndham properties (excluding Echo Suites Extended Stay properties) and on qualifying gas purchases

- 5 points per dollar on eligible marketing, advertising and utility purchases

- 1 point per dollar on other purchases, excluding Wyndham Timeshare resort down payments

You can add employee cards to your account for no additional cost. By doing so, you can earn points on purchases made by your employees on these cards.

Related: How to earn Wyndham points for your next redemption

Redeeming points on the Wyndham Earner Business Card

You’ll find many ways to redeem Wyndham points, but you’ll get the most value when you redeem the points you earn with the Wyndham Earner Business Card for stays.

As mentioned above, Wyndham Rewards uses a three-tier award chart that prices award nights at 7,500 points, 15,000 points or 30,000 points before the cardmember discount.

Due to the scaling, I usually get the most value when I find high-value award nights costing 7,500 points before the cardmember discount. For example, I redeemed 7,500 points each for several nights in South Korea, including on the beautiful island of Jeju, before I added the Wyndham Earner Business Card to my wallet.

However, you may also get high value on some 15,000-point award nights. For example, I’ve redeemed 15,000 points per night to stay at the Club Wyndham at Waikiki Beach Walk in Hawaii on two occasions.

You can also book Vacasa properties with an average cost of $250 or less per bedroom per night for 15,000 points per bedroom per night before the cardmember discount.

Related: Getting started with points, miles and credit cards to travel

Transferring points on the Wyndham Earner Business Card

Wyndham Rewards has nine airline transfer partners that you can send your Wyndham points to. I don’t recommend going with this method over redeeming your Wyndham points for stays, as the transfer rates are terrible. All airline partners have a transfer rate of 5 Wyndham points for one airline partner mile or point.

Which cards compete with the Wyndham Earner Business Card?

Depending on the primary reason you’re considering the Wyndham Earner Business Card, different cards — including some of the best cards for gas and hotel cards — will compete with it. But the following three cards are likely the closest competitors to the Wyndham Earner Business Card:

- If you want a consumer Wyndham card: With the Wyndham Rewards Earner® Card, cardmembers earn 5 points per dollar at Wyndham properties and on gas, 2 points per dollar on dining and at grocery stores, automatic Wyndham Gold status and discounts on Wyndham stays. This card carries no annual fee.

- If you want a consumer Wyndham card with more benefits: The Wyndham Rewards Earner® Plus Card earns 6 points per dollar at Wyndham properties and on gas, 4 points per dollar on dining and at grocery stores, automatic Wyndham Platinum status, discounts on Wyndham stays and 7,500 points each account anniversary. The card has a $75 annual fee.

- If you’re a fan of Chase: The Ink Business Preferred® Credit Card earns 3 points per dollar on the first $150,000 spent in combined purchases on travel and select business categories, including internet, cable and phone services. Cardholders will also receive travel protection, purchase protection and cellphone protection. The Ink Business Preferred has a $95 annual fee. To learn more, check out our full review of the Ink Business Preferred.

For additional options, check out our picks for the best hotel cards.

The information for the Wyndham Rewards Earner and Wyndham Rewards Earner Plus has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: How to choose a hotel credit card

Is the Wyndham Earner Business Card worth it?

The Wyndham Earner Business Card is worth it if you value earning Wyndham points on purchases and would benefit from getting automatic top-tier Wyndham Diamond status. The card offers 15,000 bonus points on each cardmember anniversary, which should provide significantly more value than the card’s annual fee and be a good incentive to keep the card long-term.

Bottom line

I love the benefits of the Wyndham Earner Business Card. The two benefits I enjoy the most are automatic Wyndham Diamond status and a 10% discount when booking award-night stays.

Assuming the card’s benefits don’t change for the worse, I plan to keep my Wyndham Earner Business Card for many years. After all, I’ll happily take 15,000 Wyndham points each year — and all of the card’s other perks — in exchange for paying the card’s $95 annual fee.

Related: How to get a business credit card