The Bank of America® Premium Rewards® credit card continues to fly under the radar, despite having the potential to offer the highest base cash-back rate of any rewards credit card.

If you hold $100,000 or more in assets with Bank of America and/or Merrill, you qualify for Platinum Honors in Bank of America’s Preferred Rewards® program. This gives you a 75% bonus on all rewards, equating to a minimum of 2.625 points per dollar on all purchases and 3.5 points per dollar on all dining and travel purchases.

The card is also currently offering 60,000 points after you spend $4,000 on the card in the first 90 days of account opening, and it carries a $95 annual fee.

How the Bank of America airline fee credit works

Bank of America’s airline fee credit (up to $100 statement credit each calendar year) works a little differently from the airline incidental fee statement credit you get with Amex cards such as The Platinum Card® from American Express. Rather than have to designate an airline at the beginning of the year, Bank of America allows you to earn the credit across any eligible airline throughout the year. Enrollment is required for select benefits.

For example, you could use your Bank of America airline fee credit for checked bags on Delta one month and then inflight drinks on American the next. This gives you more flexibility to use your credit where you need it, rather than forcing you to guess which single airline you’ll be able to use it on.

It can potentially take anywhere from two to three weeks for your credit to post to your card account. While there are plenty of instances where we’ve seen that take less, don’t be alarmed if it does take the whole timeframe.

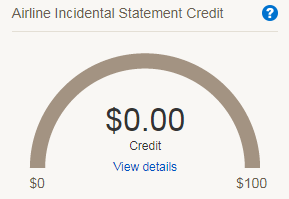

Another feature that Bank of America offers is the ability to check how much of your $100 airline credit you have used.

Which airlines qualify for the credit?

Bank of America does not have an official list published that outlines which airlines qualify for the incidental fee credit, though the terms and conditions do specify that only select U.S. carriers qualify. The Premium Rewards card terms and conditions mentioned specifically, Allegiant Air, Spirit Airlines and Sun Country Airlines are excluded. The following airlines are known to work:

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue

- Southwest Airlines

- United Airlines

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

That list is very similar to Amex’s list of qualifying airlines (with the exception of Spirit Airlines, which the Amex fee does cover).

What purchases trigger the credit?

According to the Premium Rewards Card terms and conditions, the following purchases will trigger your Bank of America airline fee credit:

The purchases must be paid in full with your Bank of America Premium Rewards card and made on a flight originating from a domestic airport on a qualifying U.S. airline carrier.

The terms and conditions do explicitly state that the following purchases will not qualify for the credit:

- Airline tickets

- Mileage point purchases

- Mileage point transfer fees

- Gift cards

- Duty-free purchases

- Award tickets and fees incurred with airline alliance partners

Also keep in mind that inflight Wi-Fi access processed through a third party like Gogo likely will not qualify.

Of course, there are sometimes exceptions to this rule. There have been data points presented by readers and in other online forums where charges outside the official list have counted. Occasionally award booking taxes, first-class upgrades and other fees will end up coding as an eligible purchase for the credit.

However, we don’t suggest counting on credit for fees that the credit isn’t intended to cover — it’s hit-or-miss at best and easier to just use the perk as intended. In the past, you could get away with buying gift cards on certain airlines with the credit, but issuers have cracked down to close that loophole.

Bottom Line

Airlines can change the merchant category code of a certain transaction, Bank of America can update what merchant codes and charges count, and airlines can change whether or not something is processed by a third party. This means what counts toward the credit will be a living list year-to-year based on what’s currently working.

If you’ve charged what you believe to be a qualifying airline fee and it’s not automatically reimbursed, you can call Bank of America and ask for the credit.

For more information, read our full review of the Bank of America Premium Rewards credit card.

Apply here: Bank of America Premium Rewards Card